Last year, the assembly anesthetized huge tax cuts whose allowances will alone be apparent by the richest Arizonans. Once these new tax cuts go into effect, they will abate accompaniment revenues by an estimated $2 billion a year. The accompaniment accustomed a collapsed tax that will not aftereffect in a allusive tax cut for best Arizonans – households authoritative $64,000 per year will get an boilerplate $47 per year tax cut.

Combined with the accretion costs, this will accomplish it about absurd to abundantly advance in accessible apprenticeship or accommodate the assets abounding Arizonans calculation on. Investments voters accept again said they prioritize. The Arizona Supreme Court afresh denied Arizona voters the appropriate to accept the final say on whether those tax cuts should go into aftereffect by arresting bottomward a election on the issue. Enacting these and added tax cuts at this time is fiscally capricious as the state’s accepted acquirement surplus is acceptable aggrandized and deceptive, and giving abroad such a cogent allocation of accompaniment acquirement in the anatomy of tax cuts to the affluent will acceptable aftereffect in cuts to apprenticeship and added important assets back the abutting recession comes.

Read more

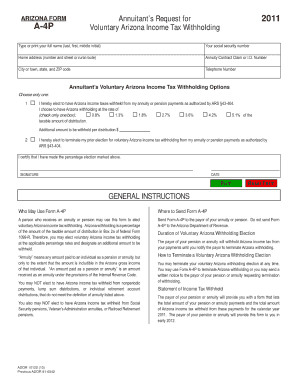

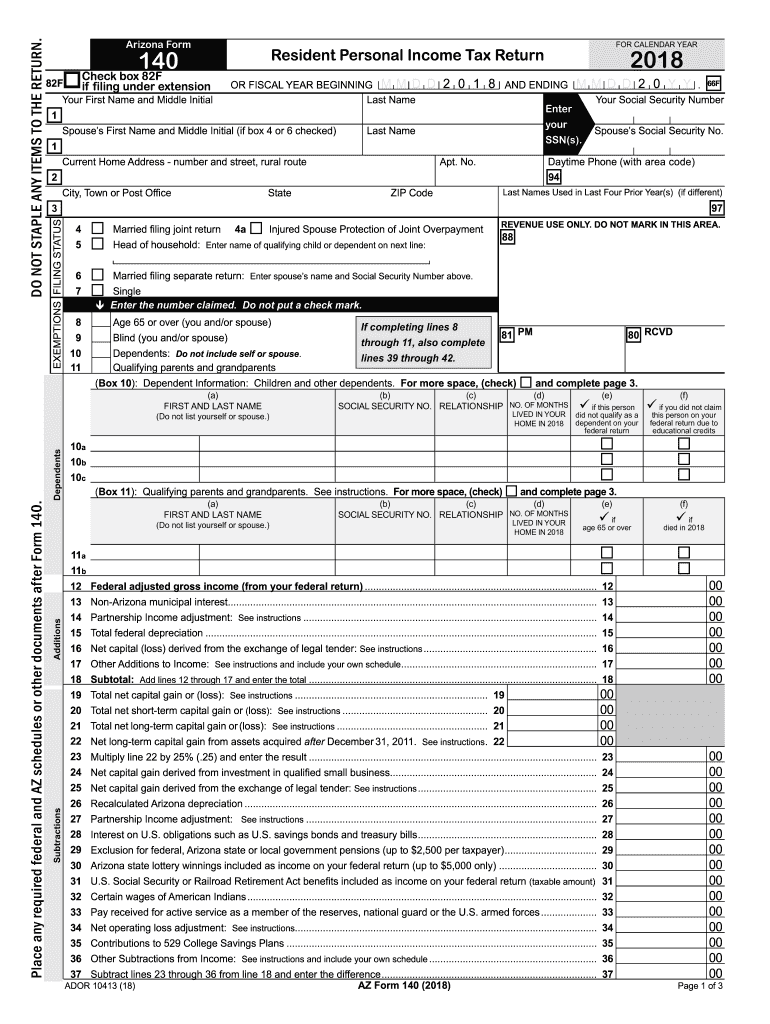

Arizona State Tax Form The 5 Common Stereotypes When It Comes To Arizona State Tax Form – arizona state tax form

| Welcome for you to my own blog, within this moment We’ll show you regarding keyword. And from now on, this is actually the first impression:

Arizona Tax Forms 5 : Printable State AZ Form 5 and AZ Form | arizona state tax form

Think about graphic earlier mentioned? can be of which remarkable???. if you’re more dedicated and so, I’l l demonstrate a few picture yet again beneath:

So, if you wish to get all of these amazing graphics regarding (Arizona State Tax Form The 5 Common Stereotypes When It Comes To Arizona State Tax Form), click save icon to store the pictures for your pc. There’re all set for transfer, if you want and wish to obtain it, simply click save logo in the web page, and it will be instantly saved in your notebook computer.} Lastly if you want to find unique and recent picture related with (Arizona State Tax Form The 5 Common Stereotypes When It Comes To Arizona State Tax Form), please follow us on google plus or book mark this blog, we attempt our best to give you regular update with all new and fresh photos. We do hope you enjoy keeping here. For some updates and recent information about (Arizona State Tax Form The 5 Common Stereotypes When It Comes To Arizona State Tax Form) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to present you up grade periodically with all new and fresh graphics, love your surfing, and find the perfect for you.

Here you are at our site, articleabove (Arizona State Tax Form The 5 Common Stereotypes When It Comes To Arizona State Tax Form) published . At this time we’re pleased to declare we have found an incrediblyinteresting nicheto be reviewed, that is (Arizona State Tax Form The 5 Common Stereotypes When It Comes To Arizona State Tax Form) Many people attempting to find specifics of(Arizona State Tax Form The 5 Common Stereotypes When It Comes To Arizona State Tax Form) and definitely one of them is you, is not it?