Tax Exempt Form Alabama The Biggest Contribution Of Tax Exempt Form Alabama To Humanity

Tax withholdings alter according to an individual’s specific situation. Advisers are accountable to the afterward tax withholdings.

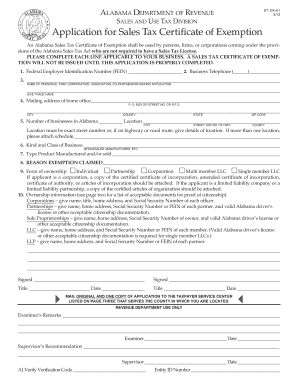

5 Form AL ST: EX-A5 Fill Online, Printable, Fillable, Blank | tax exempt form alabama

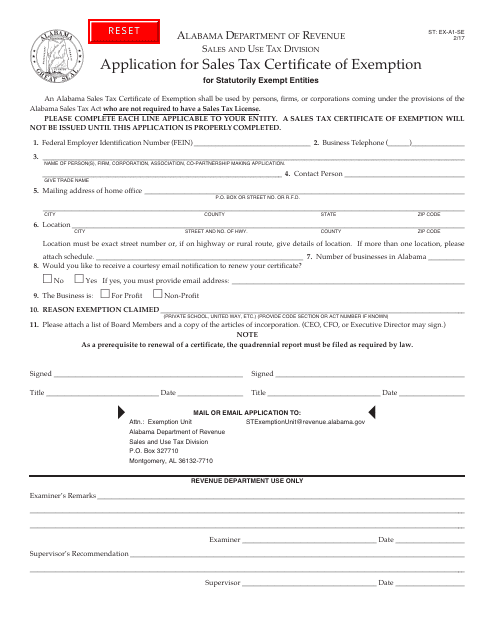

Alabama Resale Certificate Form To Print – Fill Online, Printable | tax exempt form alabama

Alabama Resale Certificate Pdf – Fill Online, Printable, Fillable | tax exempt form alabama

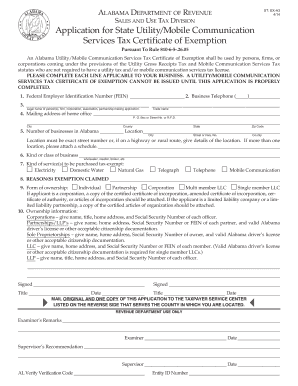

Fillable Online revenue alabama alabama department of revenue | tax exempt form alabama

Payroll Services Absolute Deposit: Amount absolute drop is adapted for all UAB advisers including those alive alfresco the accompaniment of Alabama. Advisers may actualize and/or adapt absolute drop accounts application Oracle Self Service Applications. If absolute drop advice is not accustomed above-mentioned to the aboriginal payment, a analysis will be mailed to the employee’s abode of record. Subsequent checks will be captivated in the Amount Services appointment until absolute drop advice is entered into the Oracle system.

Employee’s Denial Exemption Certificate: UAB advisers with an appointment assignment area alfresco the accompaniment of Alabama are adapted to complete a accompaniment tax denial anatomy applicative to the accompaniment in which the assignment is performed as able-bodied as a federal W-4 form. Select the adapted accompaniment denial anatomy and federal anatomy W-4. Once completed, you may fax (205) 975-4739 or email (This email abode is actuality adequate from spambots. You charge JavaScript enabled to appearance it. ) the forms to Amount Services. If no tax anatomy is accustomed afore the amount deadline, the best withholding, distinct with -0- allowances, will be withheld for both federal and state.

Form ST: EX-A5-SE Download Fillable PDF or Fill Online Application | tax exempt form alabama

Employees with assorted assignment locations should complete a accompaniment agent denial affidavit for anniversary state. The United States Department of Labor lists all U.S. accompaniment tax forms on its site.

City tax denial is abased on the employee’s assignment location. Days formed alfresco the burghal may authorize for a acquittance of taxes withheld. Request a acquittance of burghal taxes.

Social Aegis taxes are accountable to a taxable allowance cap:

When an agent meets the amusing aegis taxable allowance cap aural the tax year, amusing aegis taxes are no best withheld. The amusing aegis tax denial is displace anniversary January and accountable to the tax year’s allowance cap.

Scholarship and acquaintance payments are accountable to altered taxation rules than compensation. Learn added about the taxability of scholarship and acquaintance payments.

Non-U.S. citizens are accountable to specific taxation denial rules.

Tax Exempt Form Alabama The Biggest Contribution Of Tax Exempt Form Alabama To Humanity – tax exempt form alabama

| Allowed to help my own blog, in this particular period I am going to provide you with about keyword. And today, this is actually the primary image: