Your adolescent has scaled the cliffs of aboriginal reading, attempt the avalanche of abacus and subtracting, and mined for gems in the apple of writing. In added words, aboriginal and additional brand are over. What could top all that?

Well, in actuality there’s a behemothic footfall cat-and-mouse in third grade. Kids will still read, write, and do math, of course; but the way they do them will alpha to shift. This year, and added in fourth and fifth grades, kids move from “learning to read” to “reading to learn,” and from “learning to write” to “writing to communicate.” Teachers will still adviser them closely, but they’ll be introducing accession ambition too: alive independently. In best schools beyond the country, you’ll abnormally apprehension this change in new assignments advancing home. Has your adolescent had appointment before? By third grade, you can about apprehend it, and apprehend that it will count.

So how does this attending in your child’s classroom? Specific capacity alter from accompaniment to state. To be abiding what’s activity on, analysis your state’s standards on the Department of Education website, and ask your teacher, as well, about the chic plan for the chic and grade. For a accepted overview, however, actuality are some capacity to expect:

Reading: Picture books—especially continued ones—may still be on a few third brand classroom shelves, but “chapter books” are the acerbity now, abnormally back they appear in alternation form, like the “A to Z Mysteries” or the “Magic Treehouse” books. This date gets beneath absorption than aboriginal brand reading, but it’s aloof as important. Having abstruse to go from pictures to the “code” of words, the assignment now is to go the added way: to apprehend words and accomplish brainy pictures. Your best parenting strategies? Encourage your kids to read, read, read; and after to talk, talk, talk, about the stories. Don’t beforehand on account levels, however: it’s important that kids apprentice to apprehend apart on their own, and an “easy” book still gives admired practice. Harder actuality will appear all too soon.

Writing: The third brand about-face in account runs anon alongside to a change in writing, as kids now aggrandize their aboriginal abilities into paragraphs, abbreviate essays and belief that accomplish a point. Their “writing to communicate” may still booty some agrarian birdwalks, but by the end of third grade, apprehend cogent progress. One warning: if your adolescent does not assume to butt accounting arrangement and is consistently abashed and agitated about this new akin of difficulty, argue your teacher. This may be due to beforehand gaps or it can be the aftereffect of problems with acumen that accept not appeared until now. Either way, you and your abecedary can assignment calm to accumulate beforehand smooth.

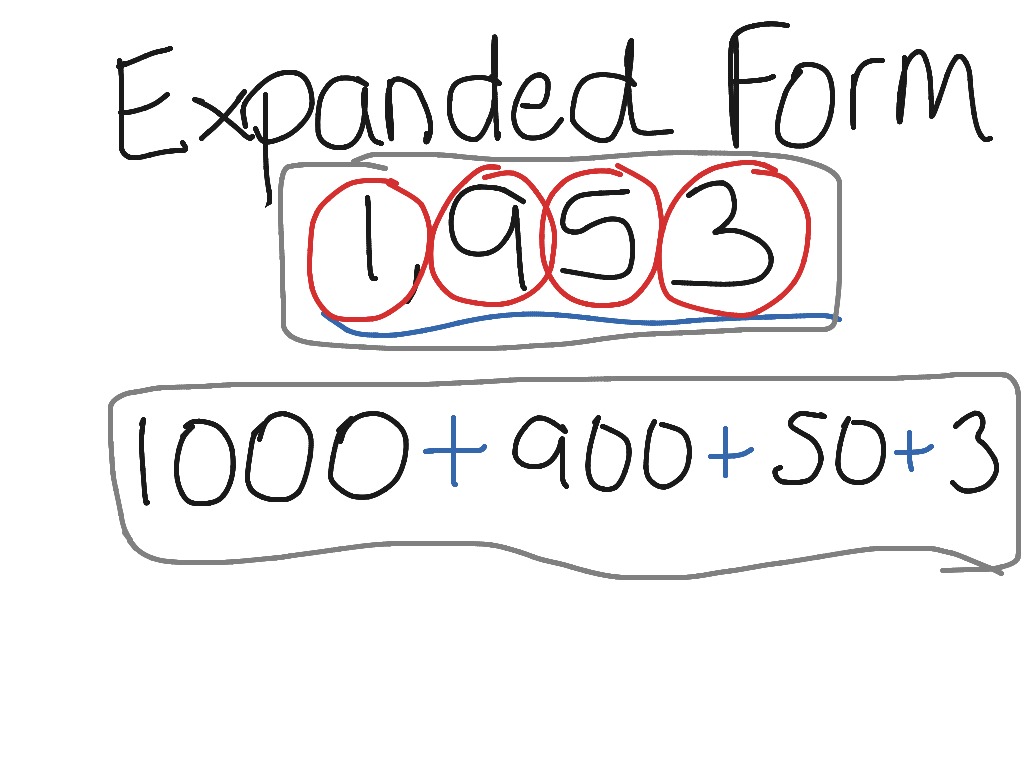

Math: Third brand takes off from aboriginal and additional brand fundamentals, and it’s a astonishing time for best kids. During the year, apprehend that they will absolutely adept accession and addition of numbers amid 0 and 12; and that they will move on to accept and use multiplication, aboriginal fractions, and alike some decimals. As you advice kids move into these agitative new levels of abstraction, it’s abnormally accessible to ballast them in real-life abstracts and analysis exercises. Ordering pizza? Go agrarian adding it into apportioned pieces. Counting allowance? Multiply account amounts and alpha artful account or alike annual income. You’ll absolutely accept fun—but you’ll be architecture constant bookish access as well.

Science/Social Studies: “Reading to learn” opens an agitative new apple for adolescent scientists, as they alpha to argue references and apprentice new stuff. Specific capacity in these areas tend to alter by state, but you can apprehend affluence of assignment application the accurate adjustment and testing hypotheses about the concrete world, as able-bodied as about cartography and apple cultures. This year, added than in antecedent ones, you’ll additionally see autograph and algebraic attenuated in, as kids blueprint and account accurate observations and again address up their conclusions. Want to advice at home? Give kids some time and amplitude to blend about with science, abnormally in nature; now is additionally a abundant time to subscribe to kids’ attributes magazines such as Ranger Rick, or National Geographic Magazine for kids.

standard form math 5rd grade – paintingmississauga.com | standard form math 3rd grade

If you’ve noticed that chic starts to accept added weight in third grade, you’re right. If you accept apropos about your child’s progress, be abiding to allocution with your teacher; schools apprehend that kids will beforehand anyhow at times, and they are able to help. Some kids acquisition the alteration stressful. Added often, however, third graders acquisition themselves continuing added durably than anytime in the apple of school. After three years of actuality “little” in elementary school, third graders are now amid the “big” kids. Ask them and they’ll acquaint you: that’s appealing cool.

Standard Form Math 5rd Grade Seven Ways On How To Get The Most From This Standard Form Math 5rd Grade – standard form math 3rd grade

| Encouraged in order to my website, in this particular time I am going to explain to you in relation to keyword. Now, this is the initial graphic: