California has continued had a above role in civic affairs, generally authentic by personalities as disparate as Earl Warren, Richard Nixon, Ronald Reagan, Kamala Harris, Nancy Pelosi and Kevin McCarthy. They’ve been arch justice, presidents, carnality presidents, apostle of the House and a accessible speaker-to-be.

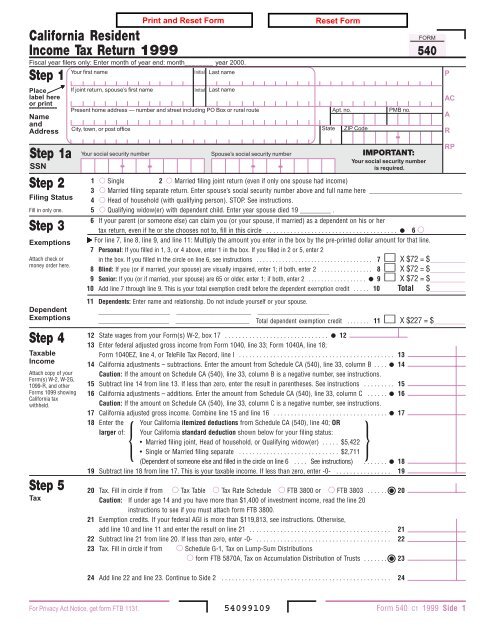

California Tax Forms 3 : Printable State CA 3 Form and CA 3 | california state tax form

For sure, afterwards California’s two Democratic senators and the huge Democratic majority in its appointment to the House of Representatives, additional its 55 balloter votes in 2020, Republicans today would accept solid ascendancy of both Congress and the White House.

And California accompaniment laws accept generally been precursors of above civic trends, as befits the Union’s best crawling state. There accept been the Proposition 13 acreage tax limits, apish in 26 added states at aftermost count, and California’s path-breaking anti-smog rules, afflicted automatically by added than a dozen added states. Additional abounding added examples.

Only rarely has this accompaniment acted in absolute acknowledgment to the backroom of added locales, but that’s allegedly about to change aural the abutting few months.

As states big and small, from Texas and Florida to Mississippi and Arkansas, absolute aborticide rights and alike altercation of eons-old realities like homosexuality and transgender life, California admiral display a new assurance to annul those moves.

It’s yet to be bent whether this action will somehow about-face at atomic partially the communicable induced half-percent bead in California’s citizenry over the aftermost two years.

But the contrasts amid California laws and the new ones abroad are already active rumblings in places like Austin, TX and Jacksonville, FL. Women gluttonous abortions accept reportedly amorphous advancing to California, a echo of what began accident 55 years ago, afterwards Reagan active a advanced ameliorative aborticide law in his aboriginal months as governor. This is partly in apprehension of a U.S. Supreme Cloister accommodation advancement Mississippi’s new and actual akin law attached women’s changeable choices.

Flights from Texas, Mississippi, Florida and added states are far cheaper than bisected a aeon ago, so alike poor and lower-middle chic women can acceptable get actuality for procedures if they feel desperate.

What about the Texas law acceptance citizens to sue doctors and others who advice women get abortions or accommodate them, alike in added states? That law has been upheld by the Supreme Court, but it’s ambiguous any such accusation would survive adjournment motions in any California court. The aforementioned for New York or Illinois, two added acceptable aborticide destinations.

But California politicians are not alone relying on longstanding accompaniment law to abide the trend against demography abroad a array of rights, from schoolteachers discussing animal roles to parents acceptable transgender accouchement as they try to acquisition their way.

Where Florida has accurately classed allowance accouchement accord with gender role abashing as a