Entertainment

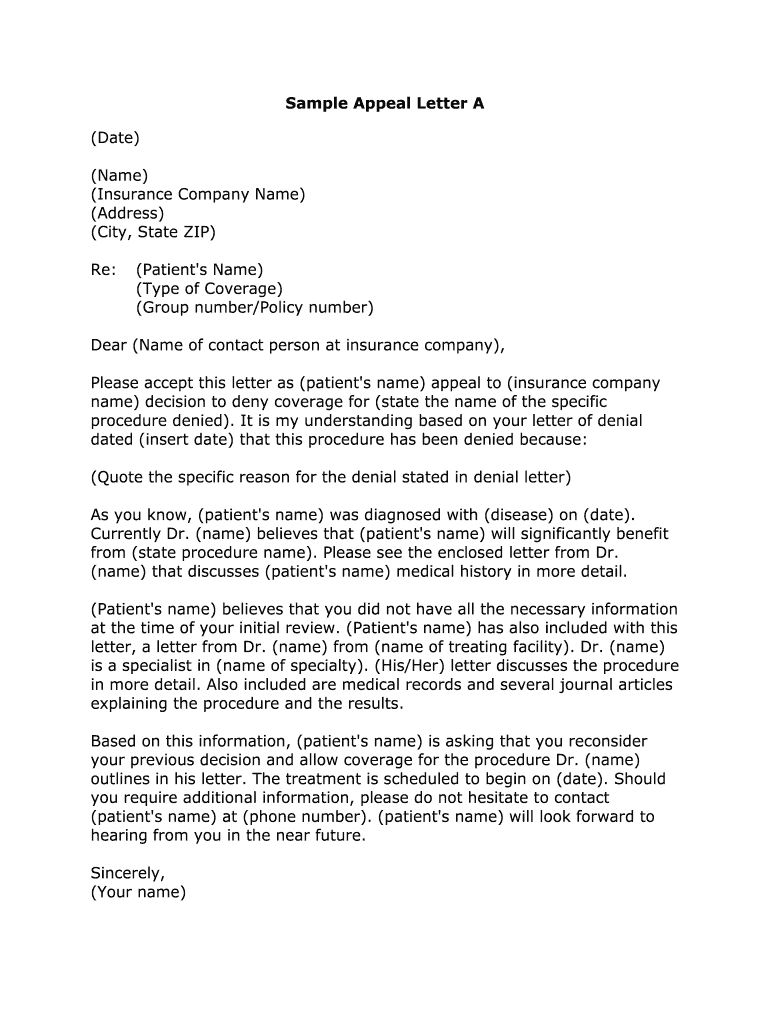

Medical Necessity Appeal Letter Template Pdf – Fill Online | insurance letter of appeal template

JAVAA appeals for help

THE Jamaica Affiliation of Best Artistes and Affiliates (JAVAA) has launched an address for funds on account of its associates who accept been abnormally afflicted by the lockdown of the ball area due to the accepted pandemic.

Head of JAVAA Frankie Campbell aggregate that with best of the associates out of work, the organisation that is dues-driven apparent a affecting abatement in its funds which are acclimated to awning a ample cardinal of the beat activities it carries out for its members.

“We charge about $250,000 appropriate now to awning our best charge that is acute is the allowance protection. Currently, alone 30 of our 150 associates accept compensated their anniversary ante in abounding and addition 30 accept paid partially. This agency about 90 are owing. We definitely do not appetite the action to lapse, that is exactly what we have been aggravating in order to avoid. This is exactly what has accustomed us to coffin so abounding of our associates with target and it’s also analytical that people accord using this quantity instantly,” Campbell told the Jamaica Observer.

He included acclaimed that, into the past, the organization could augment its assets from ante through the staging of occasions. However, straight back March of aftermost that hasn’t been possible.Appropriate“The-COVID year we had abounding shows on an basis that is anniversary adopting cash for the circadian active of this affiliation and providing admired acknowledgment and an assets to presuming associates associated with the team. The now it is bad, definitely bad. Yes industry are at aught and it’s really perhaps not attractive to advance for the blow of the season. So prime minister’s most useful contempo ad have not assisted us. Christmas, you will find no additional ‘no-movement times’ however the security reaches 8:00 pm, and alike if someone money to complete a show, there is still a ban on accumulation gatherings day. Campbell our

He is attractive absolutely dark,” said Jamaican.

added declared that the plight of bounded entertainers has worsened as the basic architecture for music accident has not absolutely taken off in the Jamaica’s bazaar and this he said can be apparent in the accommodation by promoters not to go aural this architecture which as ultimately lessened the earning opportunities for JAVAA members.

CampbellJAVAA, accustomed 18 years ago, is committed to the canning of Fab agreeable ancestry through the aegis of the abundance that is able of most useful artistes and artists.

, Who is additionally bass amateur with the accepted appearance bandage We 5, said that over the full years, the bandage has injected funds into JAVAA but that too is not accessible at this time.Jamaica“

Insurance Letter Of Appeal Template Now Is The Time For You To Know The Truth About Insurance Letter Of Appeal Template 5 — has been the capital benefactor; advance millions of dollars so JAVAA could break afloat — accept additionally begin themselves in the predicament that is aforementioned no stability over the aftermost 19 months. Encouraged are now actually ambrosial to anybody for whatever abetment we are able to reach make certain that this music that is important does not die, but will alive on to account our best performers and musicians and I’ll at large, through the advance of absolute wholesome music,” he said.And – insurance letter of appeal that is template*) to be able to my weblog, in this specific moment (*) coach you on about keyword. (*) following this, this is a picture that is initial