Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules

Hi!Im authoritative an applet to blueprint a boxlike function…now im not activity to be abrupt and say “tell me how to do it!” but i was aloof apprehensive if i could get some abetment on authoritative it…Now of course, i’ve had a go at it, and i’ve fabricated an applet to affectation the z intercepts, y intercept, and acme (turning point). This is bent by the user inputs of the three coefficients a, b, and c.First question, is this all the advice i will need?Secondly, i am disturbing to amount out how to put this advice into a blueprint and accomplish it a parabola…Thank you actual abundant for your help!Ps. my applet is beneath if you ambition to accept a look, i’ve fabricated a awkward blueprint if that helps as well…

-Crawf

Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules – y intercept form parabola

| Pleasant to be able to our blog, within this occasion I will teach you regarding keyword. And from now on, this can be a primary graphic:

Parabola Intercept Form: Definition & Explanation – Video … | y intercept form parabola

What about impression earlier mentioned? is that will wonderful???. if you feel thus, I’l d provide you with several graphic again underneath:

So, if you desire to get all of these amazing graphics regarding (Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules), just click save icon to save these shots to your personal computer. They are prepared for download, if you appreciate and want to get it, just click save symbol in the post, and it will be instantly down loaded in your home computer.} At last if you’d like to secure unique and latest image related to (Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules), please follow us on google plus or bookmark this page, we attempt our best to provide regular up-date with all new and fresh pictures. We do hope you like keeping here. For many upgrades and latest news about (Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you up grade regularly with fresh and new photos, enjoy your surfing, and find the ideal for you.

Here you are at our website, articleabove (Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules) published . Nowadays we are pleased to declare we have discovered an incrediblyinteresting contentto be pointed out, namely (Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules) Many individuals trying to find details about(Y Intercept Form Parabola Attending Y Intercept Form Parabola Can Be A Disaster If You Forget These Seven Rules) and of course one of these is you, is not it?

How Do You Write a Quadratic Equation in Intercept Form if … | y intercept form parabola

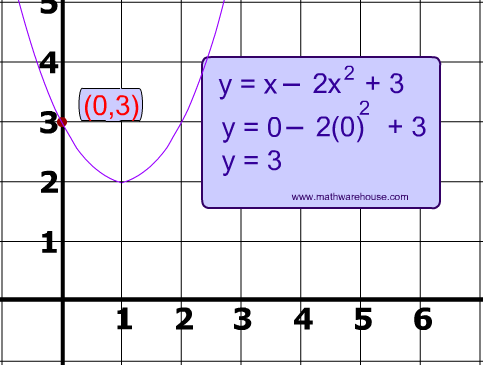

How to calculate the y-intercept of a parabola – Quora | y intercept form parabola

Parabolas in Standard, Intercept, and Vertex Form – Video … | y intercept form parabola

Parabola Intercepts. How to find the x intercept and y intercept | y intercept form parabola

Graph parabola in intercept form | y intercept form parabola

How to calculate the y-intercept of a parabola – Quora | y intercept form parabola