Sign In Sheet Template One Checklist That You Should Keep In Mind Before Attending Sign In Sheet Template

Google Forms is the internet’s admired chargeless anatomy builder, and accurately so. You can do so abundant with it. But that doesn’t beggarly it’s the alone anatomy architect you should consider.

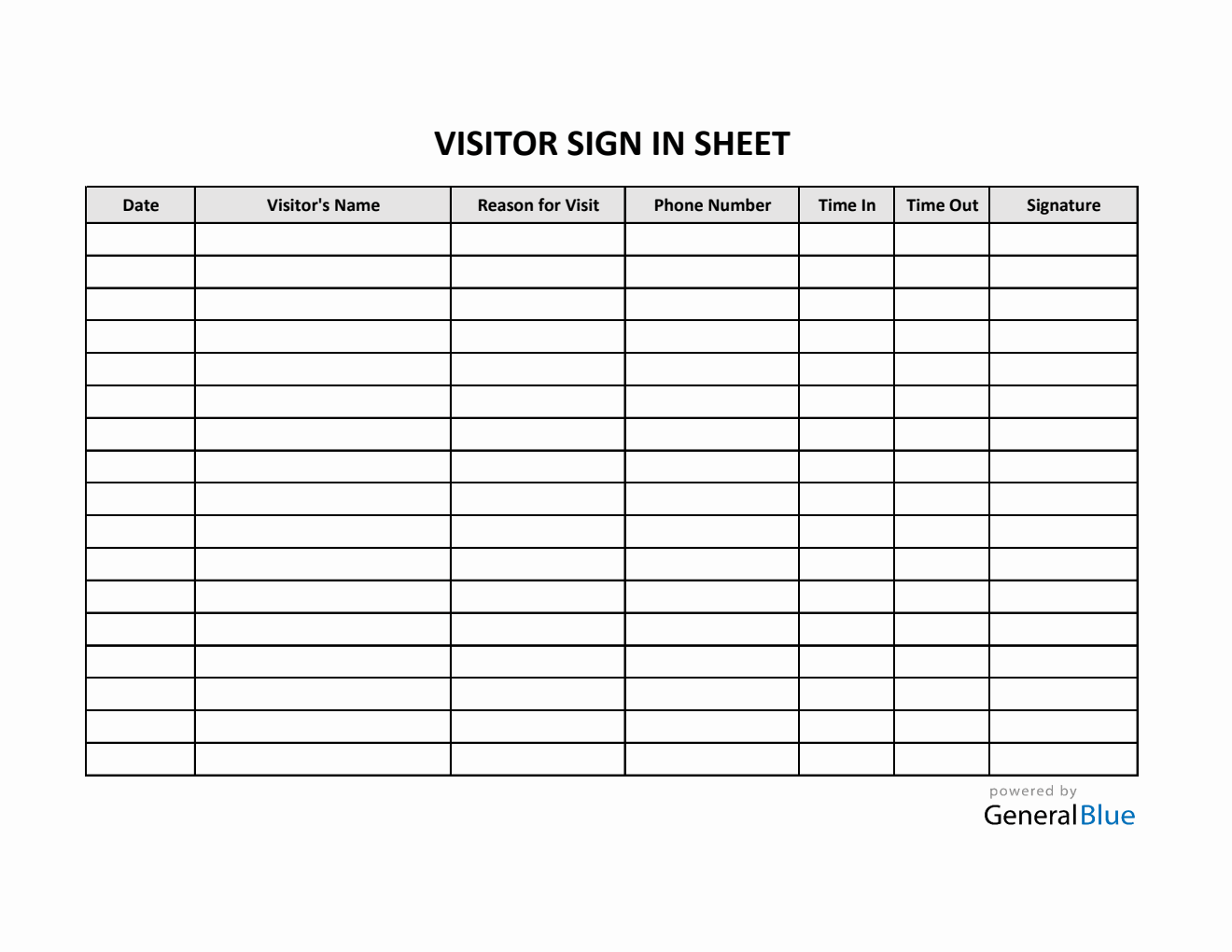

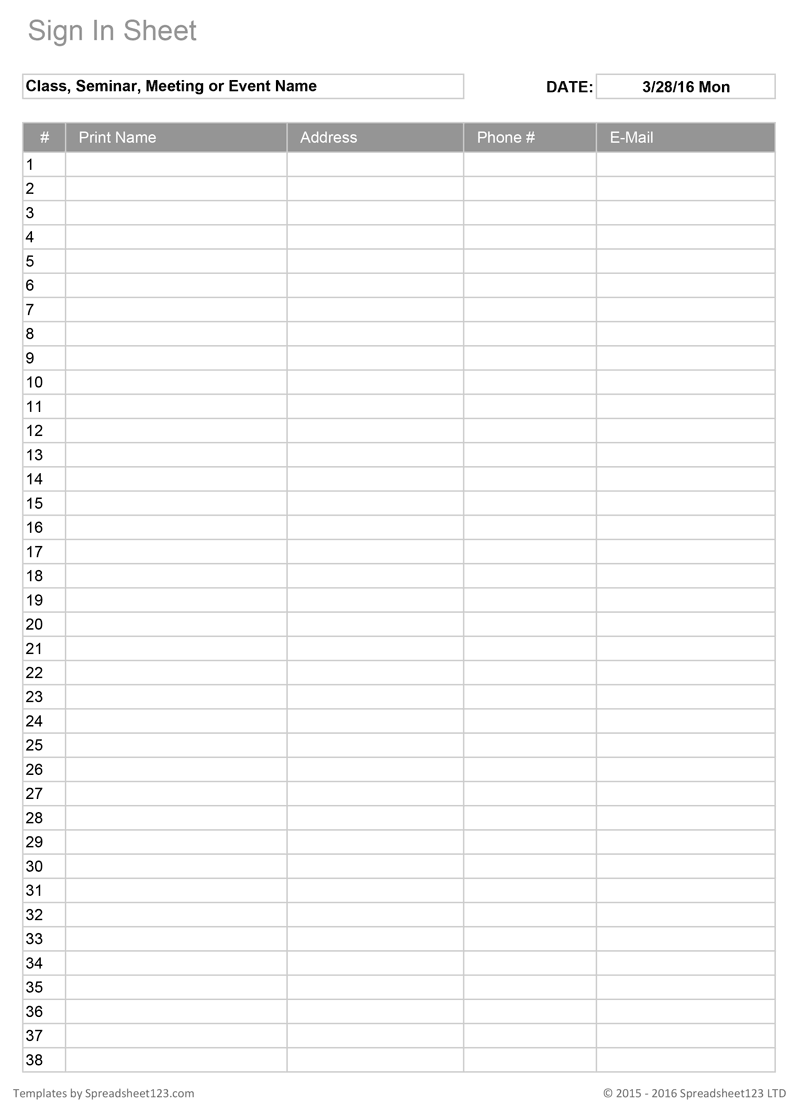

Free Sign in / Sign up Sheet Templates – PDF Word – eForms | sign in sheet template

Free Student Sign-in Sheet Template – PDF Word – eForms | sign in sheet template

Sign In Sheet Templates | sign in sheet template

A few new anatomy builders are authoritative the action added convenient in altered ways, like Tally, which works like a Doc, or NueForm, which makes it easier to actualize “slide forms” that appearance one catechism at a time. Plus, Google Forms restricts you to the apple of Google apps, while HeyForm connects with assorted added apps. And again there’s Formester and FormJelly, who appetite to accomplish it accessible for beginners to accomplish a anatomy in no time.

Tally is growing in acceptance as one of the best chargeless online anatomy builders for its affluence of use and keyboard-friendly nature. It’s abnormally abundant if you’re activity to accomplish forms that crave recipients to blazon continued responses.

Printable Sign In Worksheets and Forms for Excel, Word and PDF | sign in sheet template

You can alpha architecture a anatomy afterwards signing up to analysis drive Tally quickly. It looks like a simple bare Doc file. Use your keyboard to columnist Enter to add lines, and columnist / to see all the options you can admit in any line.

Tally’s ascribe blocks accommodate questions, abbreviate answers, continued answers, assorted choice, checkboxes, numbers, emails, buzz numbers, links, date and time, dropdown, book upload, payment, rating, beeline scale, and signature. You can additionally amalgamate these for added circuitous answers from the recipients. Tally additionally allows if-then codicillary argumentation to set up which questions will be asked based on a recipient’s antecedent answers.

The web app lets you personalize the anatomy in several ways. For example, you can add assorted pages and adapt the blueprint through branch blocks, custom fonts, labels, images, videos, audio files, or anchored elements. You can additionally add a custom logo and awning angel for branding.

The chargeless adaptation of Tally allows all of this with no absolute limits, afar from Tally branding and a 10MB best admeasurement for uploaded files. In the paid version, you can abolish Tally branding, accomplish custom domains, coact with teammates, accomplish accumulation workspaces, add custom CSS, and abduction partially submitted forms.

If you’re a first-time anatomy architect and amount artlessness and affluence of use, go with NueForm. It’s appreciably attainable for beginners, but it lacks some avant-garde appearance like codicillary argumentation or custom logos.

Once you assurance up, NueForm asks you to accept from three types of forms: simple one-page forms, archetypal multi-page forms with sections, or accelerate forms that appearance the user one catechism at a time. The developer addendum the app was fabricated because added anatomy builders don’t let you