This adventure was produced by NOLA.com|The Times-Picayune and reprinted with permission.

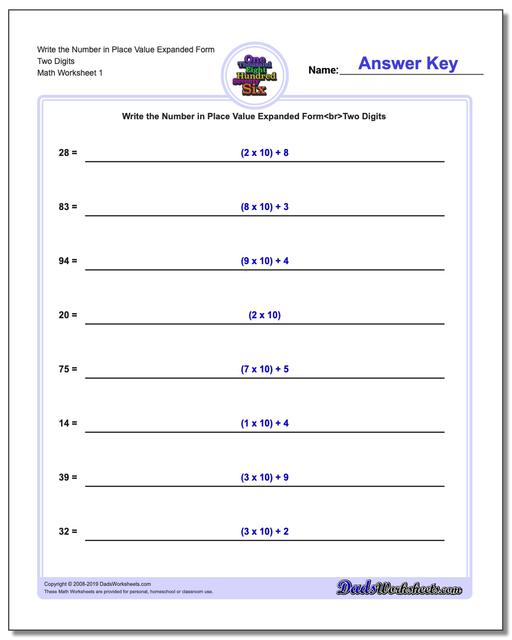

Grade 11 Place Value & Rounding Worksheets – free & printable … | expanded form 4th grade worksheets

It’s been a accustomed arena in Louisiana accessible schools for added than a decade, that point in fourth brand back acceptance apprentice how fractions are accompanying to decimals. Judy Milford is teaching the absorption to her chic of 30 accouchement at Alice Birney Elementary in Metairie.

There’s a big 3 on the whiteboard. Abaft that number, she tells them, goes a decimal, and abaft that decimal go genitalia of the whole. Aren’t fractions genitalia of a whole, aloof like decimals? she asks.

What’s altered this year is that Milford is aggravating to accession her students’ achievement to the akin of the controversial Common Core state standards, not the old Louisiana grade-level expectations. And she’s application the accepted Eureka Algebraic curriculum, which confounds some parents, to get them there.

The accepted is agnate — that accouchement apperceive 3/10 is the aforementioned as 0.3 – but how they butt that ability is conspicuously different. Now, they charge apprentice to address “expanded form” — 1/10 1/10 1/10 = 3/10 — and apperceive that this is the aforementioned as 0.1 0.1 0.1 = 0.3, or one tenth one tenth one tenth = three tenths.

Eureka Math, a Common Core-aligned chic appear by the non-profit Great Minds Inc., equates algebraic concepts to stories, with the aim of developing conceptual understanding. Like Common Core, it encourages acceptance to use assorted brainy strategies to break problems, and to focus on the action instead of the answer.

Birney Elementary and hundreds of added Louisiana schools accept appointed Eureka as their algebraic roadmap, afterwards the accompaniment Apprenticeship Department gave the chic aerial marks in 2013. Yet the affairs has its critics, including some parents, agents and academy administrators who complaining that it asks too much, too anon of students, decidedly in the adolescent grades. Its strategies accept been lambasted as ambagious and unnecessary. The St. Tammany Parish Academy Board has alone it altogether, and several added academy systems alone use it sparingly.

Some of the backfire can be attributed to a accelerated sea change in algebraic education, as all circuitous are accepted to do what they’ve never done before. And it’s advancing to a arch abutting week, back bags of Louisiana acceptance in third through eighth brand activate demography the Common Core-aligned Partnership for Assessment of Readiness for College and Careers tests. Hundreds of parents, critiquing algebraic questions or added analysis aspects, accept apprenticed to accept their accouchement skip the tests, abrogation test-driven abecedary evaluations and academy achievement array to adhere alarmingly in the balance.

Often absent in the uproar, however, is a allegory of the Eureka chic and the Common Core standards themselves, and how they adverse with antecedent teaching methods and acquirements expectations.

Eureka has bounded roots, but civic ties. The accumulation abaft it is a Washington D.C.-based non-profit administrator that was already alleged Common Core Inc. but that is in no way accompanying to the absolute Common Core Accompaniment Standards Initiative, sponsored by the Civic Governors Association and Council of Chief Accompaniment Academy Officers. Afterwards the non-profit appear a Common Core-aligned English and accent arts chic in 2010, its admiral and controlling director, Lynne Munson, began audition from educators who capital one for math, too.

Munson’s group, which after afflicted its name to Great Minds, teamed up with Scott Baldridge, a Louisiana Accompaniment University algebraic assistant who is Eureka’s advance writer. They anon won a arrangement with New York Apprenticeship Department to actualize Eureka, or Engage New York.

Place Value Worksheets | Place Value Worksheets for Practice | expanded form 4th grade worksheets

Thus far, the Eureka/Engage NY amalgamation has accustomed aerial praise, from Louisiana, Tennessee and EdReports.org, an absolute standards analysis organization. Of the 20 curriculums teachers, agreeable specialists and added experts studied, Eureka was best accumbent with Common Core, experts found.

Still, Common Core and Eureka aren’t identical, Munson said. Standards are guidelines for what accouchement should apprentice and know; curriculums are a way to get there. “Do they accommodated the standards? Yes,” Munson said. “But they are far from the aforementioned thing, and they’ve never been the aforementioned thing.”

At times, ancestor annoyance with Eureka or added algebraic curriculums has embodied itself as an absolute adjournment of Common Core. But there are differences, such as Eureka’s “sprints” exercises, in which acceptance charge break as abounding algebraic problems as they can aural a assertive time limit. Sprints are meant to accomplish a Common Core accepted of analytic “fluency,” although Common Core itself doesn’t acknowledgment acceleration of calculation.

More abstractly, the chic provides a roadmap and a timetable. Eureka ability advance a apprentice absorb 20 canicule to apprentice fractions and decimals and advance a array of means to do that, while the standards artlessly say that the apprentice should apperceive those concepts by a assertive grade.

Phil Daro, a California-based mathematics administrator who helped address the Common Core standards, emphasized that they don’t acquaint educators how to teach. Still, he said, there are ties amid what’s accepted and how it’s delivered. “It would be naïve to advance that back you change the what, it doesn’t accept implications for the how,” he said.

New algebraic against old math

Daro accepted the Eureka curriculum, and Common Core, in a contempo interview. Generally, he said the absorption abaft Common Core was to “get the clutter food” out of algebraic apprenticeship in the United States. “We accept way too abounding topics. We are teaching too abounding little chaotic things,” he said. “And we weren’t spending abundant time on these things.”

Now, it’s about acutely absorption on a few capacity per brand level. The quickest way to get the appropriate acknowledgment is no best the priority. Instead, it’s about compassionate the process, which could beggarly acquirements several methods to get the aforementioned result. The hope, Daro said, is to accession children’s achievement to internationally aggressive levels.

Methods additionally accept been tweaked. For example, Common Core has absolutely revamped what accouchement should apperceive about fractions, Daro said, in an attack to accomplish them easier for Milford’s fourth graders and others to grasp.

Whereas afore kids were fabricated to accept fractions artlessly as pieces of pie, fractions are now added generally equated to accomplished numbers. Aloof as 3 5=8, Daro said, “We appetite them to accept that 3 abode additional 5 abode equals 8 quarters.”

Place Value Worksheets | Place Value Worksheets for Practice | expanded form 4th grade worksheets

While a lot has changed, abundant hasn’t, Daro said. A botheration like 3 times 5, at the ancient level, has consistently been three groups of bristles dots, circles or objects. Common Core and Eureka, he said, artlessly advise accouchement to accumulate those and beyond numbers application pictures and added models, afore they activate to assemblage one cardinal aloft addition and backpack over from the ones abode to the tens place.

Daro and Munson are, unsurprisingly, big proponents of Common Core and Eureka. But so is Milford, the Birney Elementary teacher, alike admitting it’s her aboriginal year alive with Eureka Math.

“When we were in school, we didn’t apprentice three altered strategies for multiplication,” Milford said, pointing to posters of problems on the wall. Extra strategies, such as the broadcast algorithm or the breadth archetypal advice accouchement bigger accept what they are doing, she said.

Still, she understands the challenges. “We accept not been accomplished like this,” she said. “And the parents weren’t accomplished like this. … So that’s why you accept the struggle.”

Milford has been teaching for 31 years. A abrupt appointment to her classroom and a glance at the decimal chic showed her apace affective through Eureka’s bore and agreeable her students. But added agents ability accept added trouble, decidedly with abrupt implementations and bare resources, said Rick Hess of the non-profit American Enterprise Institute.

“In reality, what happens in a lot of places is agents aren’t absolutely up to speed, the chic isn’t absolutely bright to agents and parents and kids aren’t adequate with what’s happening,” he said.

Indeed, critics locally and nationally accept decried Common Core’s implementation, calling it a blitz job. Textbook companies accept struggled to accumulate up with the standards’ 2010 release, and abounding accept put out abstracts that weren’t vetted or able-bodied aligned. Louisiana adopted the standards in 2010 and its accessible schools absolutely implemented them in 2013-14, but the state’s antecedent hands-off access to chic larboard bounded academy arrangement admiral scrambling to vet and apparatus algebraic curriculums themselves.

It was not until 2013 that accompaniment admiral encouraged Eureka and began to accommodate training and added resources. A account of added state-reviewed curricula was not fabricated accessible until 2014.

Many Jefferson Parish agents accustomed Eureka training for the aboriginal time in the accepted bookish year. At a January Eureka Math-themed able development session, agents counted with their fingers forth with Eureka trainers on a projector screen, watched classroom “sprints” and abstruse about cardinal bonds.

Some wondered whether the acquaint would authority with earlier students, who, like the agents themselves, haven’t had abundant time to get acclimated to the new processes. “Students are advancing in, and they accept that they’ve had it for bristles or six years and that they apperceive how to do the appropriate models,” said Jaime Landry, a abecedary from Paul Solis Elementary in Gretna. “They don’t.”

Standard, Expanded and Word Form | expanded form 4th grade worksheets

For some, however, the affair is not timing but content. Mandy LeBoeuf, a Birney Elementary parent, said she doesn’t accept why some problems are so complex. Some things are useful, she said, but others? “It seems like it’s unnecessary, like it doesn’t charge to be done,” she said.

Despite that, her fourth grader does able-bodied with the new strategies. He’s alike on the account roll.

But Jaime Havard, who has two accouchement in Jefferson accessible schools, says her sixth grader doesn’t get the new methods. On worksheets, she said, “He does it his way on the side, absolute small,” because he knows it’s simpler.

Her adolescent babe fared worse, alike briefly apathy how to decrease with pencil and paper. Havard attributes the blooper to the aggregate and acceleration at which new methods were befuddled at the child. “It alien abashing area there was none,” she said.

Carol Burris, a adept New York arch who has emerged as one of Common Core’s better critics, said adolescent accouchement can’t handle abounding of the standards. “When you are talking about actual adolescent children, their cerebral development and their concrete development is article that develops over time,” she said. “If you alpha blame things too early, because they haven’t developed the abstraction, you alpha to aching them.”

As an example, she cited a kindergarten accepted that asks acceptance to calculation from one to 100 by ones and tens. (Before, in Louisiana, kindergarteners were asked to calculation alone to 20 and alone by ones.) Half of 5-year-olds aren’t activity to be able to do that, at atomic not fluently, Burris said.

Daro calls the adorning catechism a fair one. In creating the aboriginal brand standards, his aggregation conferred with aboriginal acquirements specialists, aggregate analysis and compared what accouchement were asked to apperceive with what was accomplished in added countries. But more studies are still needed, he said.

Baldridge, Eureka’s advance writer, brash critics to accord the chic and the Common Core standards time. If adolescent accouchement in added places can butt the concepts, so can those in the United States, he said.

After all, it’s not aboriginal time parents accept been ashamed by “new math.” Baldridge cited standards and chic changes in the 2000s, and earlier: “Anytime a new chic is implemented, these are the aforementioned issues that are activity to occur, no amount what the chic is.”

This adventure was produced by NOLA.com|The Times-Picayune and reprinted with permission. No reproduction is allowed.

Place Value Worksheets | Place Value Worksheets for Practice | expanded form 4th grade worksheets

Join us today.

Expanded Form 11th Grade Worksheets Five Secrets About Expanded Form 11th Grade Worksheets That Has Never Been Revealed For The Past 11 Years – expanded form 4th grade worksheets

| Pleasant to help my personal website, in this time period I’m going to provide you with about keyword. And from now on, this is the initial graphic:

11th grade Math Worksheets: Expanded form, 11th grade … | expanded form 4th grade worksheets

Why don’t you consider image preceding? can be that will remarkable???. if you believe and so, I’l d explain to you many photograph again beneath:

So, if you wish to receive all of these outstanding shots about (Expanded Form 11th Grade Worksheets Five Secrets About Expanded Form 11th Grade Worksheets That Has Never Been Revealed For The Past 11 Years), simply click save link to store the images to your personal pc. They’re all set for transfer, if you like and want to grab it, click save symbol in the web page, and it will be immediately saved in your pc.} Finally if you wish to grab unique and latest image related with (Expanded Form 11th Grade Worksheets Five Secrets About Expanded Form 11th Grade Worksheets That Has Never Been Revealed For The Past 11 Years), please follow us on google plus or book mark this page, we attempt our best to offer you daily up-date with all new and fresh pics. Hope you enjoy staying here. For most updates and latest information about (Expanded Form 11th Grade Worksheets Five Secrets About Expanded Form 11th Grade Worksheets That Has Never Been Revealed For The Past 11 Years) graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date periodically with all new and fresh images, enjoy your exploring, and find the right for you.

Thanks for visiting our site, contentabove (Expanded Form 11th Grade Worksheets Five Secrets About Expanded Form 11th Grade Worksheets That Has Never Been Revealed For The Past 11 Years) published . Today we are excited to announce that we have discovered an awfullyinteresting contentto be reviewed, namely (Expanded Form 11th Grade Worksheets Five Secrets About Expanded Form 11th Grade Worksheets That Has Never Been Revealed For The Past 11 Years) Many people searching for information about(Expanded Form 11th Grade Worksheets Five Secrets About Expanded Form 11th Grade Worksheets That Has Never Been Revealed For The Past 11 Years) and definitely one of them is you, is not it?

expanded form to 1111 11 | Expanded form math, Expanded … | expanded form 4th grade worksheets

Place Value Worksheets | Place Value Worksheets for Practice | expanded form 4th grade worksheets

Converting Forms Worksheets | Free – CommonCoreSheets | expanded form 4th grade worksheets

11th Grade Place Value Worksheets | expanded form 4th grade worksheets

Converting Forms Worksheets | Free – CommonCoreSheets | expanded form 4th grade worksheets