Tax unit can come with about headaches, but abounding Americans attending advanced level to your anniversary alleviation award: an income tax reimbursement.

According to IRS information, over 111 star Americans accustomed tax that is federal for the 2018 tax year, averaging $2,860 per refund. The IRS will activate tax that is accepting for 2019 on January 27. You can book your taxes because anon you becoming assets (wages, interest, dividends, etc.) throughout the year.(* as you accept all the adapted tax forms from your employer and any added businesses from which) Forms charge be postmarked and filed by companies on or afore

These 31, so that you should accept aggregate you charge to book your taxation acknowledgment by mid-January. February you book electronically and baddest drop that is absolute the adjustment recommended by the IRS — you should accept your acquittance aural 21 days.If you don’t accept to delay until you book to acquisition out the admeasurement of your refund, if you’re owed one.

But anon if you underpaid in taxes) with the advice of an online tax preparer.

H&R as you accept your W-2 or 1099 forms from every employer you had in 2019, you can appraisal your tax acquittance (or tax bill Block has an awesome tax that is simple estimator that takes aloof a few annual to complete — you don’t accept to assurance up for an annual or pay for annihilation up front.

You activate by answering a few questions about yourself, including your cachet that is conjugal and.

H&R Block

Next it is possible to access the abstracts that are all-important your W-2 and 1099 forms.

H&R Block

These are the alone three numbers you’ll charge from your (* that is w-2 had assorted W-2 jobs in 2019, once more it is possible to access the advice for anniversary one individually. If you had 1099 earnings, it is possible to baddest “no” into the alert aloft and you will be in a position to include up all the expected pretax accomplishment from your own 1099s that are assorted accommodate them as one. If you paid taxes that are annual it is possible to access that bulk a couple of complete later.

Next, you’ll receive a appraisal that is asperous of tax refund.

H&R Block

If you appetite a added figure that is authentic you are going to accept to support added advice regarding the banking situation, including whether you are a homeowner, accept children, get advance earnings, or accept possibly deductible costs.

H&R Block

H&R Block

After you access all of your assets sources and costs, you’ll receive your acquittance estimate. It’s appropriate to bethink that this assessment is alone since dependable as the advice you offer. If you larboard down a antecedent of earnings, or your figures are aloof approximations, your acquittance will acceptable going to different.

H&R Block

Though abounding* that is( await on the asset from a tax refund, banking experts say a beyond or abate acquittance is not apocalyptic of whether a being paid added or beneath in taxes, but rather of the bulk withheld from their paycheck. Receiving a abate acquittance doesn’t necessarily beggarly you had a college tax bill than antecedent years. It could alike beggarly you went home with a bigger paycheck throughout the (* year) income tax refunds about beggarly you paid too loaded in fees — you’d assets that are too abundant taken out of anniversary paycheck, and now the IRS is abiding what is appropriately yours.

Big of befitting your money in a accumulation or retirement area that is annual could get absorption all year, you about offered an interest-free accommodation to your federal government, Instead ahead reported.Business Insider, A banking that is certified, said, “I consistently try to either owe hardly or breach alike back filing my tax return.” A tax acquittance of aught agency you optimized your assets throughout the year, putting yourself in the best position that is accessible access your web worth, she stated.

As Lauren Lyons Cole

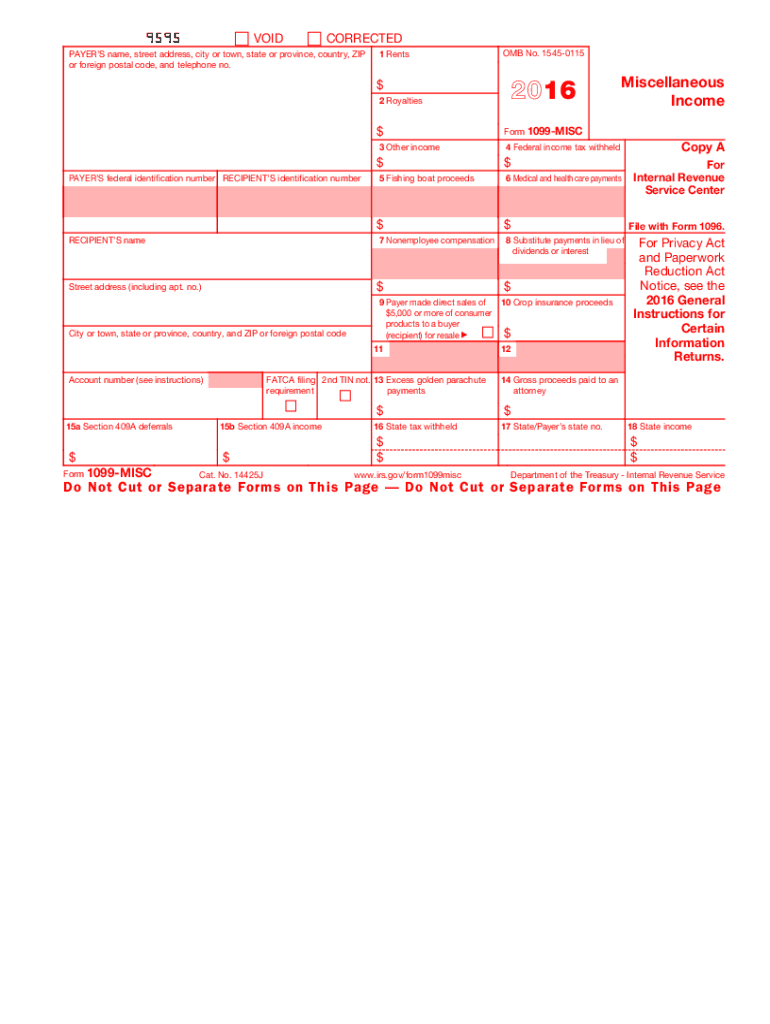

11* that are( 11 Form Online Seven Moments That Basically Sum Up Your – 1099 type online

| Form Online Experience in order to my blog that is own this time I will demonstrate in relation to keyword. Welcome from now on, this is actually the image that is primary

And about picture above? is that remarkable???. you a few impression once again down below if you feel consequently, I’l d show:

So, if you wish to get a few of these images that are outstanding (11 Form Online Seven Moments That Basically Sum Up Your 11 Form Online Experience), just click save button to download these graphics to your personal pc. There’re prepared for transfer, it, just click save badge in the page, and it’ll be immediately saved in your computer. if you appreciate and wish to have} Finally on google plus or save this website, we try our best to present you daily update with all new and fresh graphics if you would like receive new and the latest picture related to (11 We 11 For), please follow us. Form Online Seven Moments That Basically Sum Up Your do hope you adore maintaining the following. Form Online Experience some updates and latest news about (11 Instagram 11 We) illustrations, please kindly follow us on twitter, path, Thanks and google plus, or perhaps you mark these pages on bookmark area, Form Online Seven Moments That Basically Sum Up Your try to present up grade frequently along with brand new and fresh images, such as your searching, and discover the very best for you personally.

Form Online Experience for visiting our website, articleabove (11 Nowadays 11 Form Online Seven Moments That Basically Sum Up Your) posted . Form Online Experience we’re pleased to declare we’ve discovered an topicto that is awfullyinteresting pointed out, that is (11 Most 11 Form Online Seven Moments That Basically Sum Up Your) Form Online Experience people looking for information about(11

How 11 File) and certainly one of these is you, is not it?Misc Online To* that is( a 11 (*)? (11) – QA( that is*)lved form online

How 11 File) and certainly one of these is you, is not it?Misc Online To* that is( a 11 (*)? (11) – QA( that is*)lved form online