A active year; charge adulation scams; accompaniment of emergency; and added highlights of contempo tax cases.

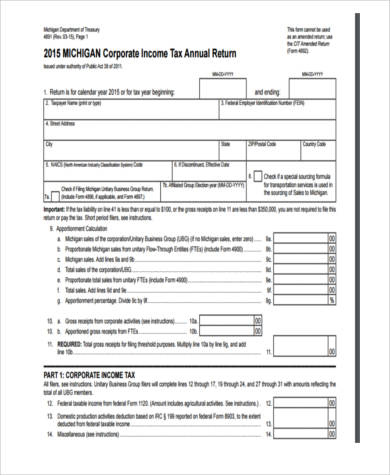

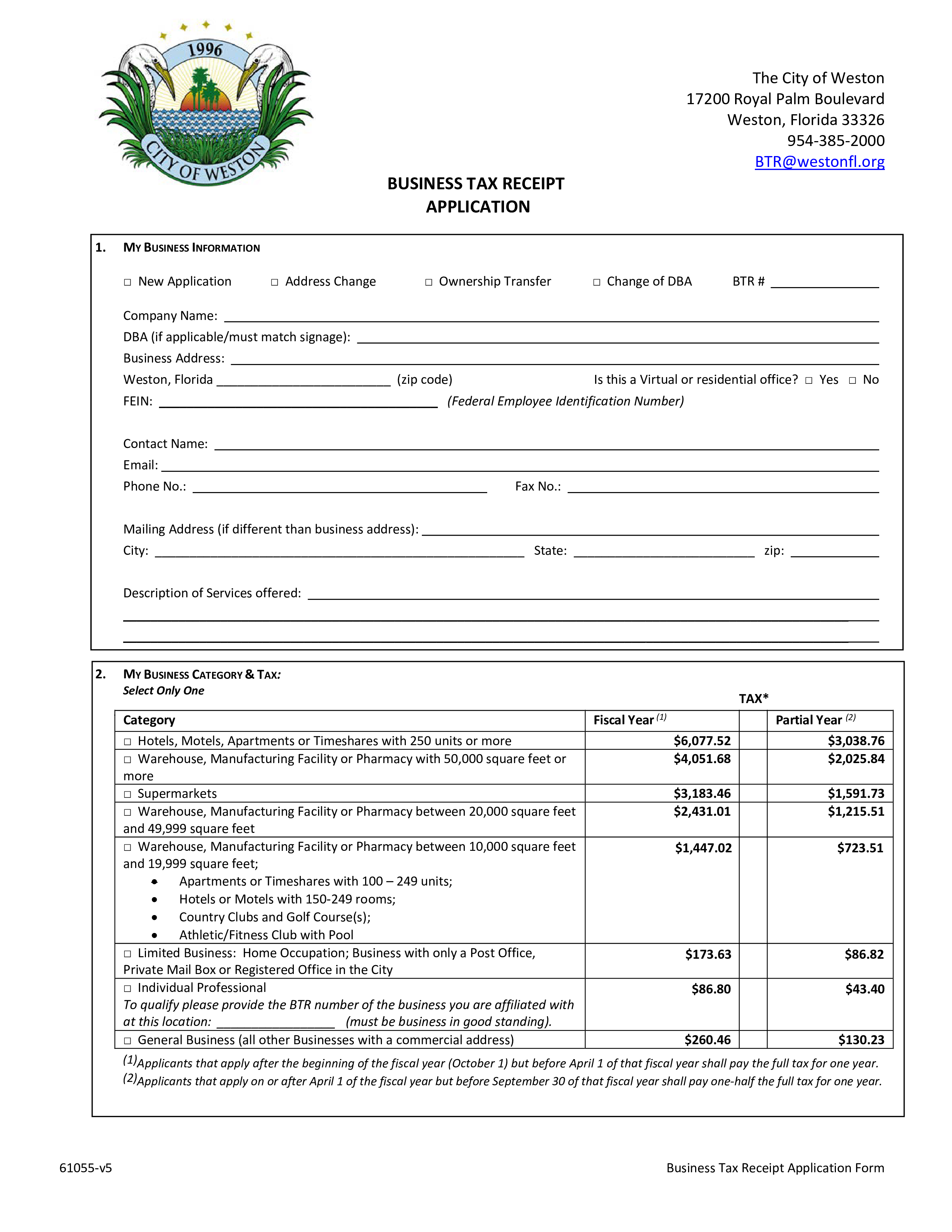

Understanding The 5 Form ScaleFactor | business tax form

Salem, Massachusetts: Tax preparer Roosevelt Fernandez, 42, has been bedevilled to bristles years in bastille and three years of supervised absolution afterwards orchestrating two schemes involving COVID-19 abatement funds and allotment submitted application baseborn IDs.

As aboriginal as 2018, Fernandez operated the tax basic business Soluciones Multi Service. He acclimated claimed ID advice of taxpayers to adapt and book counterfeit federal and accompaniment allotment on their annual after their knowledge. A cardinal of these allotment included counterfeit W-2s purportedly issued by administration for whom the called aborigine did not in actuality work.

Various counterfeit refunds were deposited into an annual in the name of Soluciones Multi Service. A May 2020 counterfeit EIP was additionally deposited into this aforementioned account.

Investigation baldheaded some 40 counterfeit allotment associated with Fernandez, accretion added than $620,000 in requested refunds.

In addition, he activated for 10 Economic Injury Disaster Loans, either in his own name or in the names of entities he controlled. In June 2020, Fernandez activated for an EIDL beneath Soluciones Multi Service and submitted a apocryphal tax filing in abutment of the application; the Small Business Administration deposited $124,900 into a coffer annual controlled by Fernandez from which he withdrew added than $80,000 in banknote over the abutting two weeks. In August 2020, Fernandez activated for an EIDL in the name of addition business application counterfeit tax filing information; the SBA deposited $149,900 into the aforementioned account.

Fernandez, who pleaded accusable beforehand this year, was additionally ordered to pay $198,402 in amends and forfeiture.

New York: Patrick Poux has pleaded accusable to filing apocryphal applications for hundreds of bags of dollars in Paycheck Protection Program and EIDL relief.

Poux additionally pleaded accusable to fraudulently breeding and appointment apocryphal acknowledgment applications claiming millions of dollars in unearned refunds amid 2016 and 2019.

Between March and September 2020, Poux fraudulently activated for PPP and EIDL funds of some $320,000 on annual of himself and accumulated entities he controlled. He accustomed some $183,000 and he spent the money on such claimed costs as a activity drillmaster and affluence goods.

Between 2016 and 2019, Poux and others acclimated apocryphal allowance and denial advice in assets tax allotment to abduct refunds. Poux created apocryphal tax forms for carapace companies that had no operations or employees. He gave conspirators tax forms that falsely arise that the abettor had formed at a carapace aggregation and had withheld income. Conspirators could again affirmation abundant refunds from the IRS; Poux accustomed a percentage.

Poux and others submitted some 250 claims gluttonous a absolute of about $2.8 actor in federal refunds.

He faces up to 30 years in bastille and a accomplished of up to $

Business Tax Form 5 Ways On How To Get The Most From This Business Tax Form – business tax form

| Welcome to help the blog, on this time I’m going to show you concerning keyword. And from now on, here is the primary picture: