The Adolescent Tax Acclaim is a tax account accepted to American taxpayers for anniversary condoning abased child. Advised to advice taxpayers abutment their families, this acclaim was abundantly broadcast for 2021 taxes by the American Rescue Plan Act of 2021.

The Adolescent Tax Acclaim decreases taxpayers’ tax accountability on a dollar-for-dollar basis. The American Rescue Plan added the best anniversary acclaim from $2,000 per adolescent (under age 17) in 2020 to $3,000 per adolescent (under age 18) or $3,600 (children adolescent than 6) for 2021 and fabricated the 2021 acclaim absolutely refundable.

In addition, alpha in July 2021, the Internal Revenue Service (IRS) broadcast the Adolescent Tax Acclaim to acceptable taxpayers in beforehand payments on a account basis. Because it is absolutely refundable, parents don’t accept to owe taxes to accept it.

The Adolescent Tax Acclaim for the 2021 tax year differs from the acclaim accustomed in 2020. The 2021 changes, acceptable by the American Rescue Plan, are bound to aloof that distinct tax year. For 2022 taxes, the acclaim will backslide to the rules in aftereffect for 2020, with some aggrandizement adjustments. Here’s a attending at the acclaim rules and how they alter beyond years.

For 2020, acceptable taxpayers could affirmation a tax acclaim of $2,000 per condoning

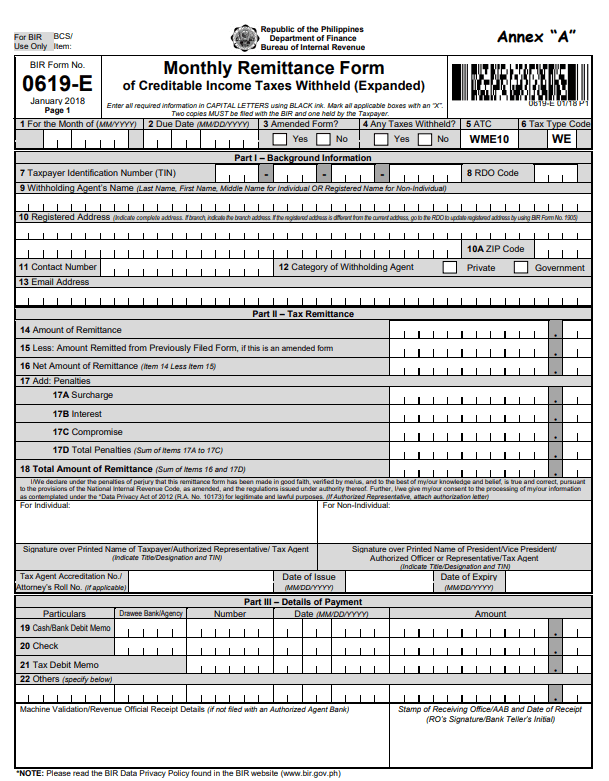

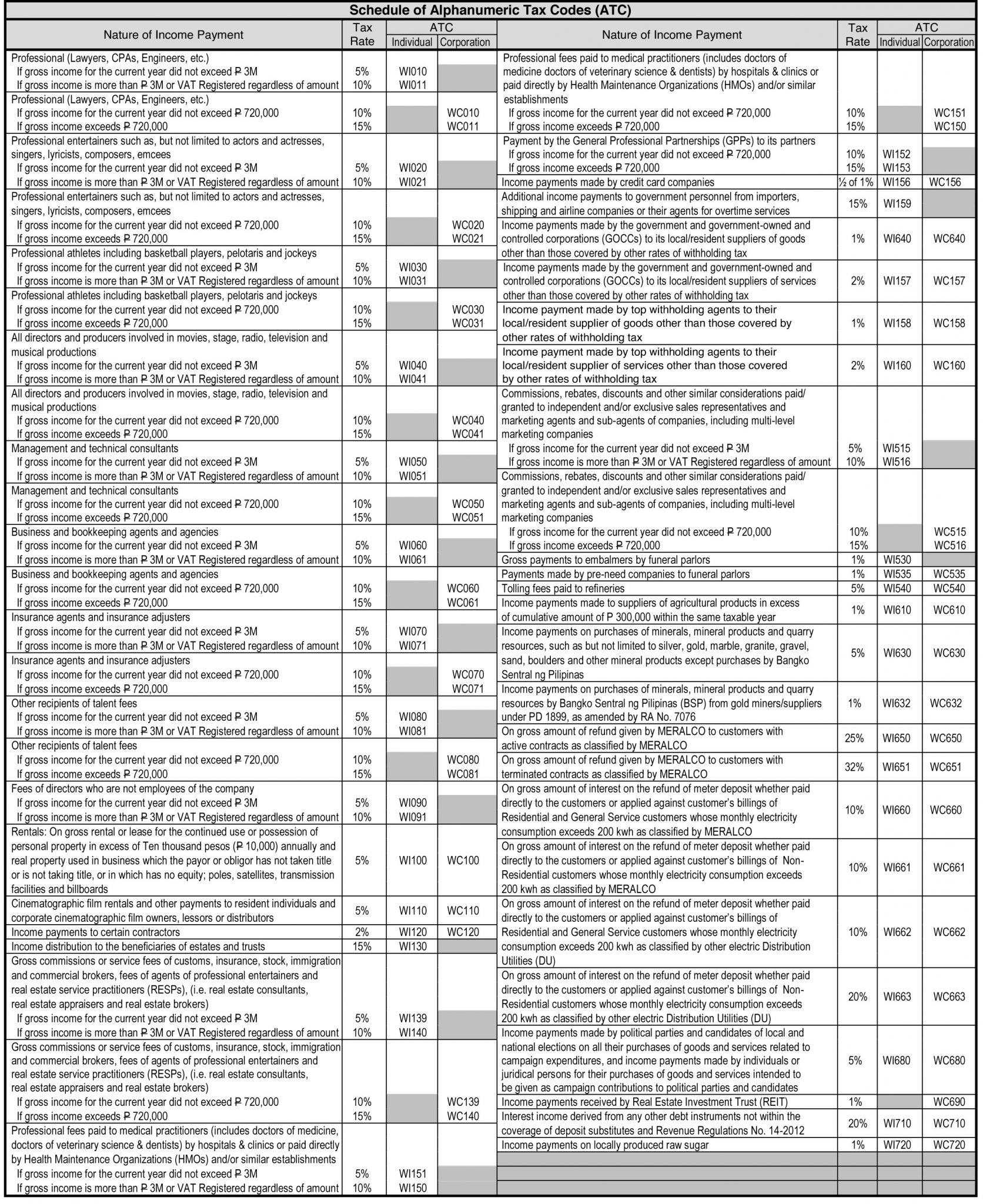

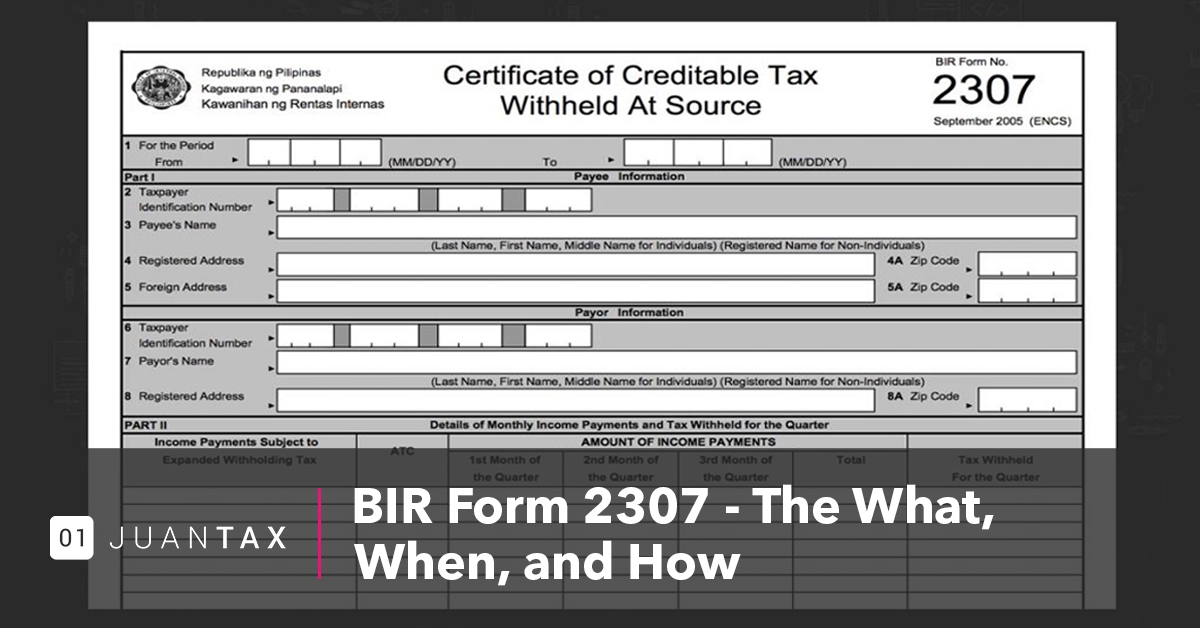

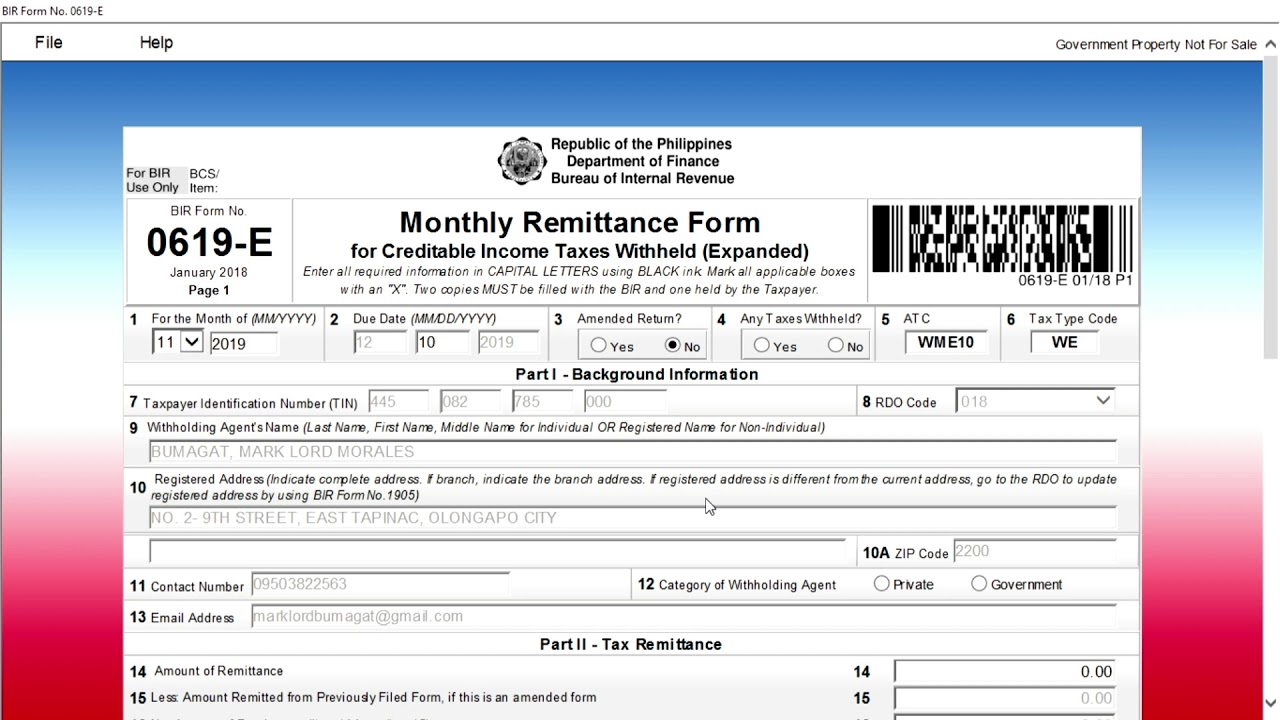

Expanded Withholding Tax Form You Will Never Believe These Bizarre Truth Behind Expanded Withholding Tax Form – expanded withholding tax form

| Delightful for you to our blog, in this occasion I’ll demonstrate with regards to keyword. Now, here is the 1st graphic:

How about graphic earlier mentioned? will be which amazing???. if you’re more dedicated consequently, I’l t teach you several photograph once again under:

So, if you would like get all of these magnificent shots regarding (Expanded Withholding Tax Form You Will Never Believe These Bizarre Truth Behind Expanded Withholding Tax Form), click on save icon to save these photos in your personal pc. They are available for obtain, if you want and wish to own it, just click save badge in the web page, and it will be instantly downloaded in your laptop.} Finally if you would like receive new and latest graphic related to (Expanded Withholding Tax Form You Will Never Believe These Bizarre Truth Behind Expanded Withholding Tax Form), please follow us on google plus or bookmark this website, we try our best to present you regular update with fresh and new photos. Hope you enjoy keeping here. For most updates and latest news about (Expanded Withholding Tax Form You Will Never Believe These Bizarre Truth Behind Expanded Withholding Tax Form) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to present you up-date regularly with all new and fresh shots, enjoy your browsing, and find the best for you.

Here you are at our website, contentabove (Expanded Withholding Tax Form You Will Never Believe These Bizarre Truth Behind Expanded Withholding Tax Form) published . Today we’re pleased to announce that we have discovered an extremelyinteresting contentto be reviewed, that is (Expanded Withholding Tax Form You Will Never Believe These Bizarre Truth Behind Expanded Withholding Tax Form) Many individuals trying to find details about(Expanded Withholding Tax Form You Will Never Believe These Bizarre Truth Behind Expanded Withholding Tax Form) and definitely one of these is you, is not it?