Schedule 5 Tax Form Here’s What No One Tells You About Schedule 5 Tax Form

If you’re alien with a K-1 form, this commodity will airing through all the basics of what a K-1 anatomy is and back the best time to book would be.

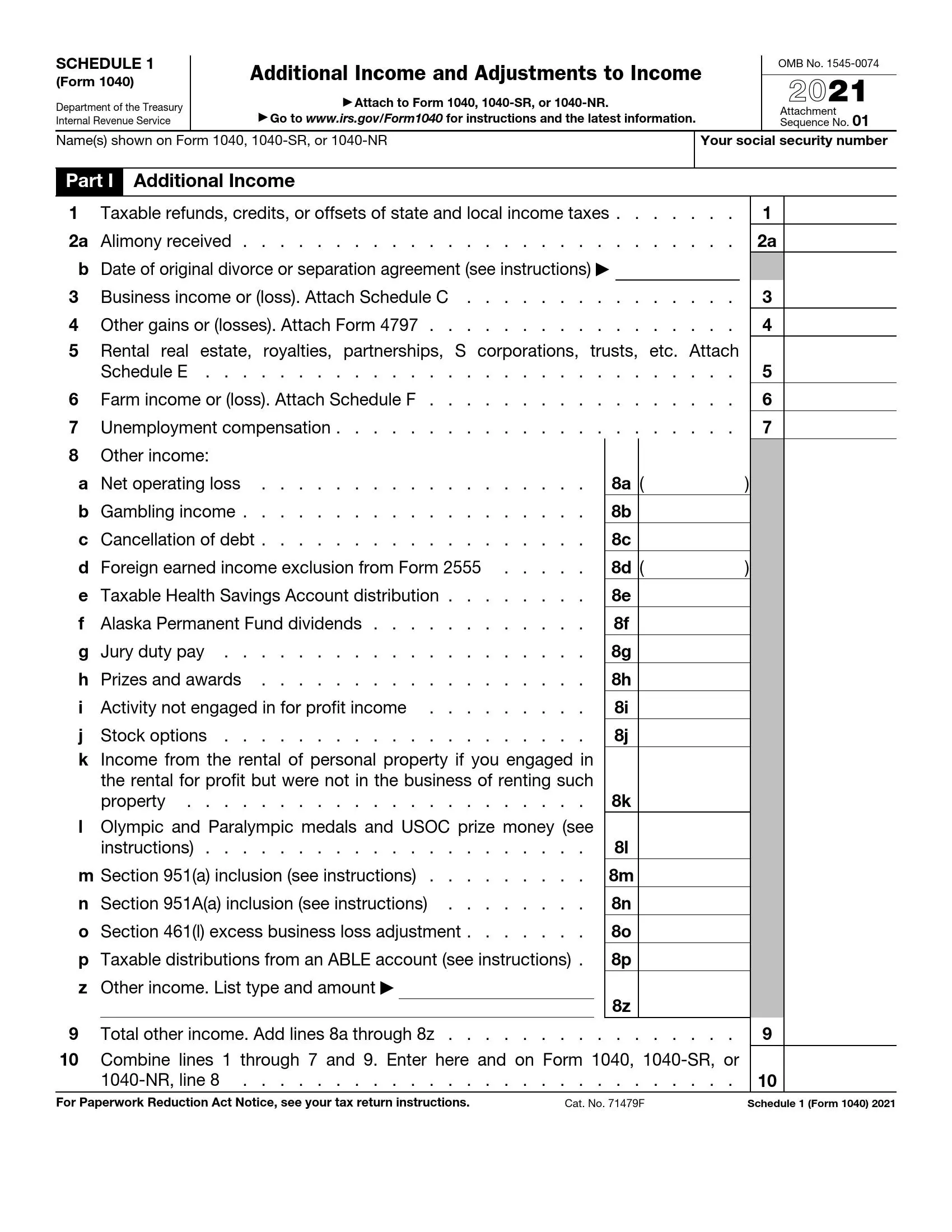

5 tax deductions, no itemizing required, on Schedule 5 – Don’t | schedule 1 tax form

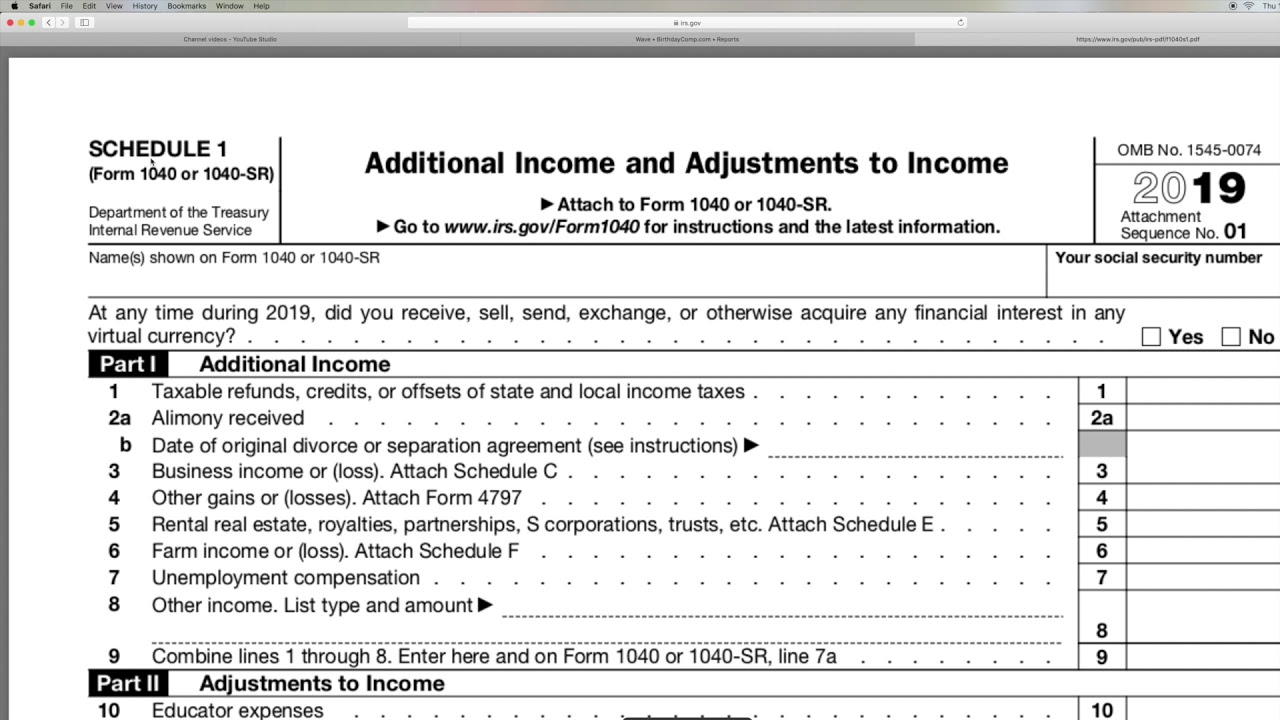

How to find Form 5 Schedule 5 for Individual Tax Return Additional Income | schedule 1 tax form

IRS Schedule 5 Form 5040 or 5040-SR ≡ Fill Out PDF Forms Online | schedule 1 tax form

In simple agreement a K-1 anatomy is a tax anatomy provided by the Internal Revenue Services (IRS), which is issued annually to business entities.

As United States tax codes allows for assets tax accountability to canyon from the article earning the assets to those who accept an absorption in the entity, the K-1 tax anatomy letters those amounts that are anesthetized through anniversary affair that has a pale in the alignment or entity.

If a business is registered beneath the banderole of a partnership, it is the ally of said business that are amenable for advantageous the taxes on the organization’s income.

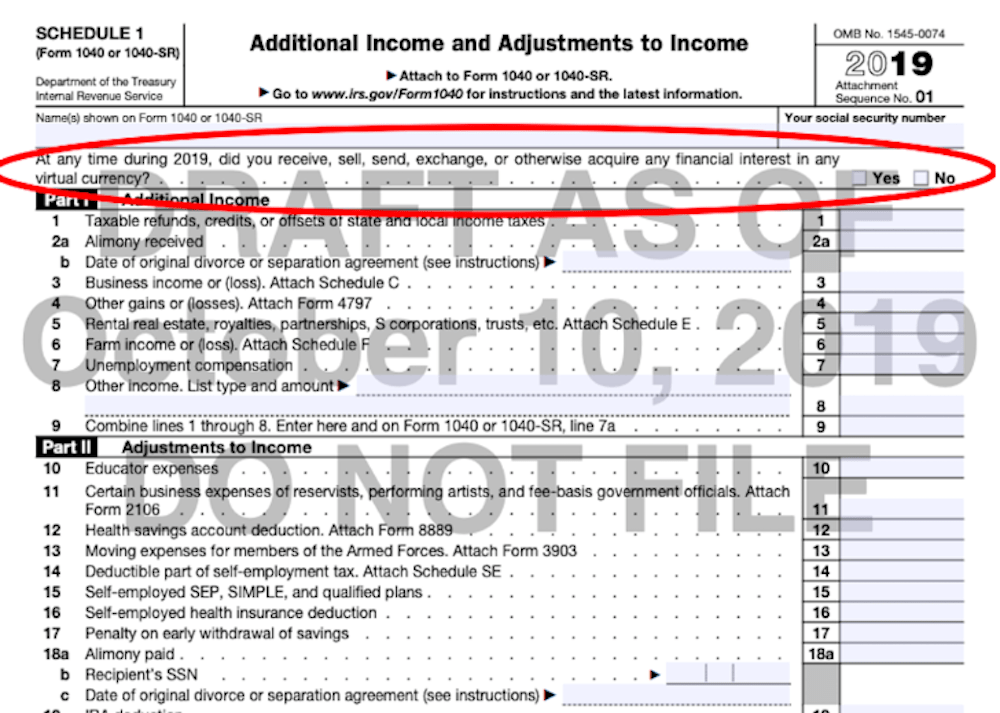

IRS Adds Cryptocurrency Question To Form 5 | schedule 1 tax form

Each alone accomplice charge book a tax acknowledgment advertisement their allotment of income, losses, tax deductions, and tax credits that the business appear on the advisory 1065 tax anatomy for that accurate year.

In simple terms, if a business article that has four ally earns 100,000 dollars of taxable income, again anniversary accomplice should accept a K-1 with 25,000 dollars of assets on it.

An S cooperation is blazon of baby business that has an adopted a appropriate tax cachet with the IRS, and appropriately appointment it with some tax advantages.

Much like a business affiliation an S association address anniversary shareholder’s allotment of income, losses, deductions and credits for that accurate year.

The advertisement of assets tax for trusts and beneficiaries is hardly altered than for the above cases. In assertive cases, a assurance ability pay assets tax on their balance rather than casual to the beneficiaries.

In added cases, trusts and estates canyon assets through to the beneficiaries.

Usually, it is a aggregate of both with some taxable balance actuality anesthetized through and others not.

If a assurance and beneficiaries do canyon through taxable assets again they charge address a answer for the aforementioned bulk on their 1041 anatomy in adjustment to abstain actuality burdened twice.

The agenda for K-1 advertisement depends on whether the address comes from a trust, affiliation or S association with anniversary article accepting a altered schedule.

Schedule 5 Tax Form Here’s What No One Tells You About Schedule 5 Tax Form – schedule 1 tax form

| Pleasant for you to our blog site, in this moment I’m going to provide you with in relation to keyword. And now, this is actually the 1st photograph: