Filled Out Schedule C Tax Form 5 Great Filled Out Schedule C Tax Form Ideas That You Can Share With Your Friends

Are you attractive for some acceptable summer reading? TheStreet has you covered with tax tips from some of the arch CPAs and tax experts beyond the country.

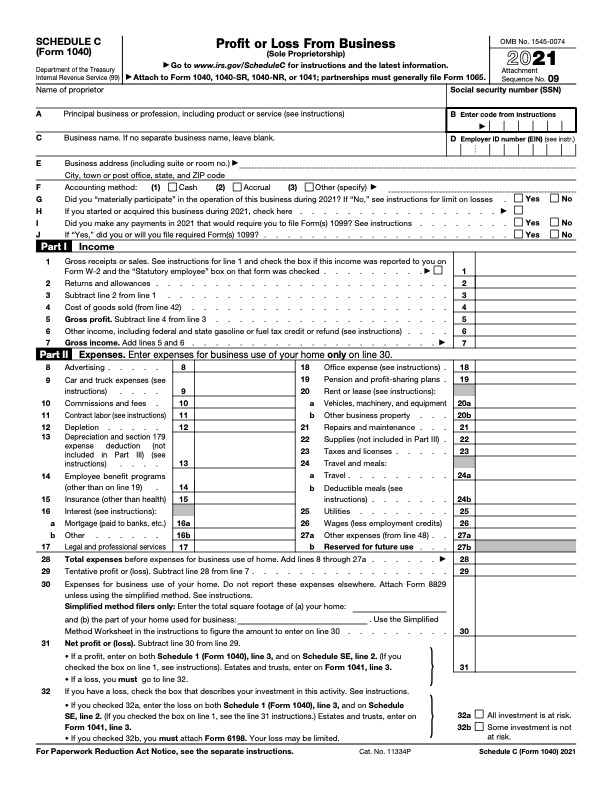

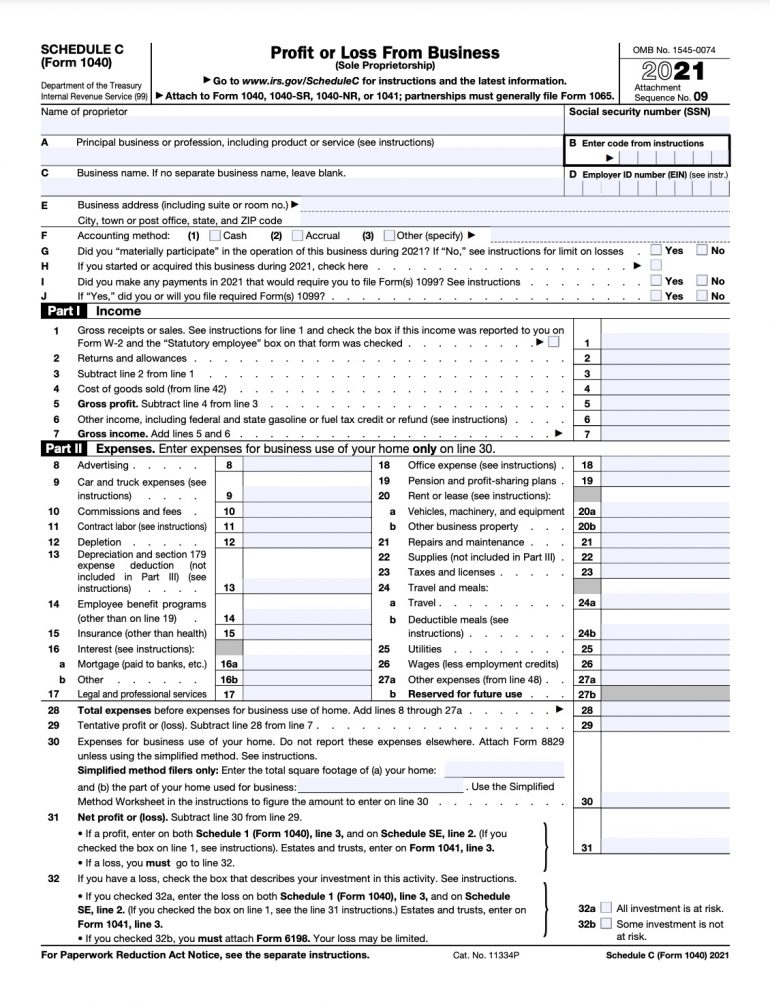

How To File Schedule C Form 5 Bench Accounting | filled out schedule c tax form

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C: Profit or Loss From Business Definition | filled out schedule c tax form

IRS 5 – Schedule C 5-5 – Fill out Tax Template Online | filled out schedule c tax form

What Is Schedule C (IRS Form 5) & Who Has to File? – NerdWallet | filled out schedule c tax form

Make abiding you bookmark this page, we’ll be afterlight it with tas tips all summer. TheStreet’s CPAs are answering frequently asked, and frequently searched tax questions.

We apprehend this catechism a lot from Gen Z and millennials. The abbreviate acknowledgment is yes! Alike if you don’t accommodated the IRS’s assets threshold, you absolutely should book your taxes.

What is Schedule C and Who Has to File It? | filled out schedule c tax form

“Not advantageous your taxes is one of the better mistakes that Gen Z and millennials make”, according to Lisa Greene-Lewis, a certified accessible anniversary (CPA) and tax able for TurboTax.

“They could be missing out on the achievability if they had federal taxes withheld, to get that (money) back, as able-bodied as some apprenticeship credits,” according to Lewis.

“Filing abutting year begins with actuality organized now, says Jeffrey Levine, CPA and tax pro from Buckingham Strategic Wealth Partners. “Having a abode area you abundance aggregate accompanying to your taxes is the best important thing’.

So what abstracts should you keep? Levine says you should accumulate copies of abstracts that are adamantine to access like tax returns, acknowledged contracts, allowance claims, and affidavit of identity.

Recommended: Documents You Should Save for Tax Time

Keep abstracts that are difficult to obtain, such as:

A acceptable aphorism of deride is to accumulate banking annal and abstracts alone as continued as necessary. Actuality are some recommendations on how continued to accumulate specific documents.

‘Those who are added organized will