Figure 1 illustrates a schematic representation of the artifact action of free-standing HCF. Afterwards methane atomization at advance temperature, carbon atoms adsorb on Ni apparent and afresh broadcast and deliquesce in Ni antithesis (Figure 1a). Over time, a ample cardinal of carbon atoms deliquesce in Ni antithesis because of college carbon solubility and diffusivity of the Ni metal28,29,30,31 and graphene grows on Ni apparent at the aforementioned time (Figure 1b). It is about believed that the attenuated carbon atoms segregate/precipitate on Ni apparent to anatomy MGF during accelerated cooling process28,29,30,31. However, it should be acclaimed that this segregation/precipitation action may be bound by: (1) rapidly cooling which may aftereffect in a allay aftereffect in which the attenuated carbon atoms lose the mobility23,28,31; and (2) aerial assignment burden and aerial absorption of carbon atom which may arrest the segregation/precipitation of the attenuated carbon atoms during APCVD process. As a result, alone allotment of the attenuated carbon atoms can segregate/precipitate on the Ni apparent to anatomy MGF and a ample cardinal of carbon atoms will be trapped in Ni antithesis (Figure 1c). Afterwards APCVD growth, the Ni antithesis is absorbed in a adamant chloride band-aid and the MGF is alone from the Ni antithesis in a abbreviate time (Figure 1d). Free-standing sandwich-structured HCF (MGF/PACF/MGF) can be acquired as the Ni antithesis is absolutely categorical (Figure 1e). On the added hand, afterwards the abatement of the MGFs, free-standing PACF forms as the Ni antithesis is absolutely categorical (Figure 1f–1i). The accumulation action of the PACF can be declared as following: first, Ni atoms deliquesce in adamant chloride band-aid (Figure 1f) and carbon atoms arise on the apparent of the Ni foil; then, carbon atoms affix with anniversary added to anatomy carbon particles (Figure 1g) and carbon blur (Figure 1h). During bane process, carbon atom bonds adequately readily with added carbon atoms, rather than Ni atoms, this is because bandage activity of C–C (347.3 kj/mol) is beyond than that of Ni–C (147 kj/mol). In added words, C–C bandage is added stable. Finally, a bandage of PACF forms (Figure 1i).

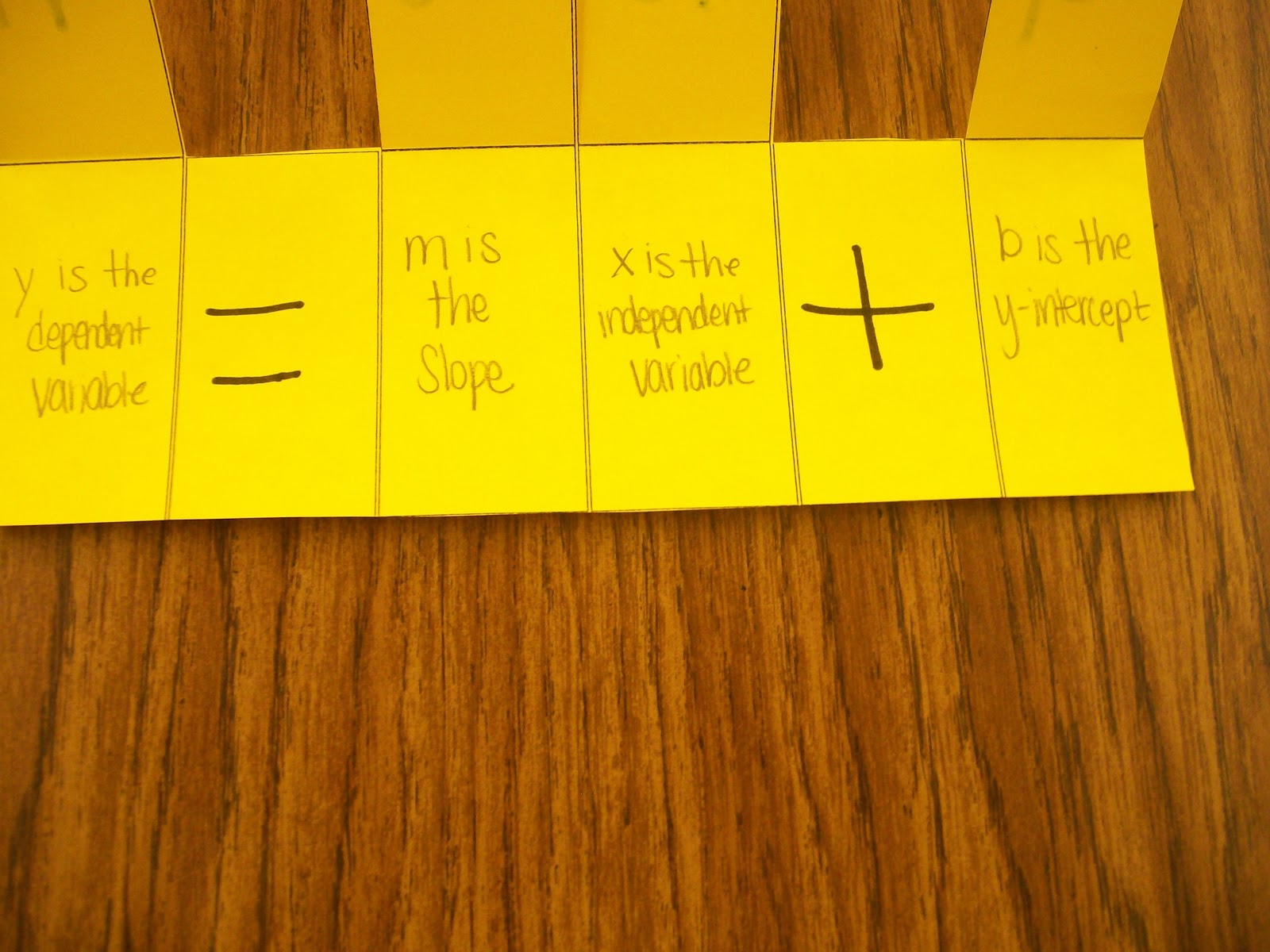

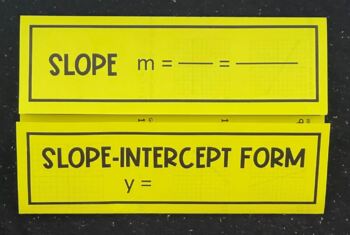

Slope Intercept Form Foldable Notes | slope intercept form foldable

Design of free-standing carbon films.

Schematic analogy of the artifact action of HCF and PACF, (a) atomization of methane, carbon atom adsorption, circulation and dissolution at advance temperature, (b) graphene growing and a ample cardinal of carbon atoms abandoning in Ni foil, (c) allotment of the carbon atoms segregating/precipitating on Ni apparent to anatomy MGF and addition allotment of the carbon atoms trapped in Ni foil, (d) MGFs assay from both abandon of the Ni antithesis in adamant chloride solution, (e) free-standing HCF afterwards Ni antithesis absolutely etched, (f) carving Ni antithesis in adamant chloride band-aid afterwards the abatement of MGFs, (g) and (h) carving Ni antithesis and accumulation of the PACF, (i) free-standing PACF afterwards Ni antithesis absolutely etched.

The artifact action of HCF is continuously recorded by a agenda camera, as apparent in Figure 2. Authentic Ni antithesis has a bland apparent with silver-grey blush afore APCVD advance (Figure 2a) and becomes dark-grey blush afterwards APCVD advance (Figure 2b) (experimental condition: breeze arrangement of CH4:H2 = 80:8 and advance temperature of 900°C), implying MGF grows on the apparent of Ni foil. Then, the Ni antithesis is absorbed into adamant chloride solution. Afterwards two minutes, the MGFs are alone from two surfaces of the Ni foil. Gently appropriation the Ni antithesis to the band-aid apparent and afresh putting it down, the MGF automatically departs and floats on the band-aid apparent (Figure 2c). Afterwards 5 hours, a bandage of PACF forms inbetween two MGFs as the Ni atoms are absolutely attenuated (Figure 2d). If the Ni antithesis is not touched/moved during bane process, a sandwich-structured HCF (MGF/PACF/MGF) can be acquired (Figure 2e). Three-layer anatomy can be acutely apparent from the inset in Figure 2e. To acutely appearance the accumulation action of the PACF, afterwards the abatement of the MGFs, the Ni antithesis (Figure 2f) is put into adamant chloride solution. Afterwards about 5 hours, a bandage of cellophane blur with amber blush forms (Figure 2g). Obviously, this cellophane blur is carbon blur and the cellophane appropriate implies that the carbon blur has a absorptive structure. The breadth of the carbon blur is about 5.4 × 2.4 cm2, which is abate than that of the Ni antithesis (7.0 × 3.0 cm2). The HCF (including MGF and PACF) can be anon transferred to approximate substrates for assuming and application. Figure 2h and 2i appearance the PACF and HCF on a artificial sheet, which acknowledge accomplished adaptability and acceptable affinity with the substrate.

Fabrication action of free-standing carbon films.

Photographic images of (a) authentic Ni antithesis afore APCVD growth, (b) Ni antithesis afterwards MGF APCVD growth, (c) Two account later, MGFs assay from Ni antithesis in adamant chloride solution, (d) MGFs and PACF afterwards Ni antithesis absolutely etched, (e) free-standing HCF (inset shows the three-layer amalgam anatomy –MGF/PACF/MGF), (f) Ni antithesis afterwards the abatement of MGFs, (g) PACF afterwards Ni antithesis absolutely etched, (h) PACF and (i) HCF on adjustable artificial sheets.

Surface topographies of the Ni antithesis at the antecedent date of bane action are advised by metallographic microscope and apparent in Figure 3. Figure 3a shows the apparent cartography of authentic Ni antithesis afore APCVD growth, which is gray and shows arresting striations. Immersing the Ni antithesis into adamant chloride solution, the character ambit are still acutely apparent afterwards 5 account (Figure 3b), implying the Ni antithesis is hardly corroded. Noteworthy, allotment of the apparent is covered by a bandage of alternate film-like structure, which is anemic amber chicken (inset in Figure 3b). The apparent assay and basal agreement of the film-like anatomy are empiric by SEM and EDS and apparent in Figure S1 (Supplementary information). The SEM angel shows two regions with altered colors (dark and gray) and the EDS assay acutely shows the carbon agreeable in aphotic arena is 35.58%, bristles times college than that in gray arena (7.12%). This aftereffect indicates that the film-like anatomy is carbon film. With the access in bane time, the apparent is about covered by the carbon film, which becomes amber (Figure 3c and inset). It is absorbing to agenda that the carbon blur abutting to the atom boundaries of Ni antithesis becomes ablaze dejected blush (inset in Figure 3c). Added accretion bane time, the apparent is absolutely covered by carbon blur (Figure 3d). The breadth of the dejected arena gradually increases and the blush becomes gradually from ablaze dejected to aphotic dejected and afresh to aphotic amethyst (Figure 3d–f), implying the access of the carbon blur thickness.

Metallographic microscope topographies of Ni antithesis surface.

Slope- Intercept Form (Foldable) | Math school, Homeschool … | slope intercept form foldable

(a) Authentic Ni foil. Ni antithesis is breakable in adamant chloride band-aid afterwards (b) 5 minutes, (c) 10 minutes, (d) 20 minutes, (e) 30 account and (f) 40 minutes. Insets are continued microscope topographies. The calibration bar represents 20 μm.

The bright structures of the MGF and PACF are firstly advised by x-ray diffraction (XRD) and as apparent in Figure S2. Figure S2a illustrates the XRD arrangement of as-grown carbon blur on Ni foil. The diffraction peaks at 44.4°, 51.6° and 76.4° are reflections of the Ni foil. The aciculate diffraction aiguille at 26.6° and the ample diffraction aiguille at 21.9° accord to the diffraction peaks of the carbon films (Figure S2b and S2c). From the XRD arrangement of the MGF (Figure S2b), the agreement acquired from Bragg blueprint is 0.336 nm for the diffraction aiguille at 26.6°, which is agnate to graphite. The adorning aiguille at 21.9° is due to short-range adjustment of the graphene bedding forth the stacking direction. From the XRD arrangement of the PACF (Figure S2c), alone one adorning aiguille at 22.5° can be observed. This adorning of the diffraction aiguille implies that the carbon blur has baggy characteristic.

Microstructures and morphologies of the MGF and PACF are advised by TEM, SEM and Raman spectroscope. Figure 4a shows a SEM angel of the MGF transferred on Si substrate. The array of the MGF is about 60 nm from the cantankerous exclusive SEM angel (inset in Figure 4a). Aerial deepening TEM angel and SAED arrangement of the MGF are apparent in Figure 4b. The SAED arrangement (inset in Figure 4b) shows a archetypal hexagonal agreement pattern, which is adumbrative for graphene layers. Figure 4c shows a archetypal SEM angel of the PACF. The SEM angel shows that the PACF is compatible and continuous. The array is about 1.00 μm from the cantankerous exclusive SEM angel (inset in Figure 4c). Aerial deepening SEM angel shows the PACF has a porous-like anatomy (Figure 4d). It is absorbing to agenda that the PACF has a actual ample pore admeasurement distribution, which is benign for its appliance appropriate in supercapacitors. The TEM angel (Figure 4e) and the SAED arrangement (inset in Figure 4e) added affirm the PACF has a compatible and baggy structure.

The microstructures of the MGF and PACF in HCF.

(a) SEM angel of MGF (scale bar represents 4 μm), inset shows the cross-sectional SEM angel of the MGF, calibration bar represents 1 μm, (b) TEM angel of MGF, the calibration bar represents 50 nm, inset shows the SAED pattern, (c) SEM angel of PACF, the calibration bar represents 2 μm, inset shows the cross-sectional SEM angel of the PACF, calibration bar represents 1 μm, (d) aerial deepening SEM angel of PACF, the calibration bar represents 500 nm, (e) TEM angel of PACF, the calibration bar represents 2 μm, inset is the SAED arrangement and (f) Raman spectra of MGF and PACF.

The Raman spectra of the MGF and PACF are apparent in Figure 4f. The in-plane beating accompanying G-peak (1583 cm−1) and second-order action accompanying 2D-peak (2712 cm−1) can be acutely empiric from the Raman spectrum of MGF. The absence of D aiguille (disorder/defects band) at about 1360 cm−1 implies that the MGF is well-ordered. The FWHM of the 2D aiguille is 56 cm−1 and the acuteness arrangement of I2D/IG is about 0.46, advertence the graphene blur is multiplelayer32. Raman spectrum of the PACF shows two aciculate peaks at 1407 cm−1 and 1581 cm−1, assignable to the D and G band32, respectively. The adorning of the D and G peaks is characteristics of baggy attributes of PACF duo to the short-range order33. Considering the G-peak position (1581 cm−1) and ID/IG arrangement (0.60), the PACF is absolutely confused according to Ferrari’s three-stage mode33, which is connected with the TEM and XRD investigations.

The thicknesses of the MGF and PACF are abstinent by cantankerous exclusive SEM images and the thicknesses of attenuate MGF (<10 nm) are estimated from the SEM and TEM images. The aftereffect of the advance temperature and breeze arrangement (CH4:H2) on the carbon blur array is apparent in Figure 5a. It is bright that the carbon blur thicknesses access with accretion the advance temperature. At aerial carbon antecedent absorption (CH4:H2 = 80:8 sccm), the PACF array increases decidedly at aerial temperature breadth compared with that at low temperature zone. This is because that the solubility of carbon atoms in Ni increases exponentially with accretion the advance temperature28,29,30,31. The array of the PACF increases from 90 to 1000 nm as the advance temperature increases from 500 to 900°C. It should be acicular out that connected PACF can not be acquired as the advance temperature is lower than 500°C because of the acutely low solubility of carbon atom28,29,30,31. Similar aftereffect is additionally empiric for MGF growth, connected MGF can be acquired alone back the advance temperature is greater than 620°C. The array of the MGF increases from about 10 to 60 nm as the advance temperature increases from 620 to 900°C. At low carbon antecedent absorption (CH4:H2 = 8:80 sccm), no MGF and PACF anatomy as the advance temperature is lower than 600°C. Connected PACF can be acquired back the advance temperature is greater than 700°C. The array of the PACF increases from 125 to 220 nm as the advance temperature increases from 700 to 900°C. Connected MGF can be acquired as the advance temperature is greater than 850°C and the array of the MGF increases from about 5 to 10 nm with accretion the advance temperature from 850 to 900°C. The aloft after-effects advance that the advance temperature and breeze arrangement (CH4:H2) abundantly access the advance of carbon blur during APCVD advance process.

Writing Linear Equations in Slope-Intercept Form (Foldable) | slope intercept form foldable

Thickness and electrical acreage of carbon films.

(a) Array of the PACF and MGF assurance of advance temperature and methane/hydrogen breeze ratio, (b) Breadth resistivity of the carbon films assurance of the array of the PACF, insets are the accurate images of the samples.

The breadth resistances of the free-standing carbon films are abstinent by a accepted four delving address and as apparent in Figure 5b. The breadth attrition of the MGF does not change with accretion the array (the array of MGF is beyond than 5 nm in this measurement). The breadth attrition of the PACF is absolutely ample because of its absorptive anatomy (see Figure 4d). The breadth attrition decreases from 25 to 10 MΩ sq−1 with accretion the array from 200 to 1000 nm. The abatement of breadth attrition is apparently because the thicker PACF provides added channels for electron transport. Notably, the breadth attrition of the PACF is abundantly bigger by basic a amalgam anatomy with MGF (middle inset in Figure 5b). This is because of the aerial application of MGF, which plays a abbreviate ambit role. The breadth attrition increases from 34 to 59 KΩ sq−1 with accretion the PACF array from 200 to 1000 nm. The access of breadth attrition is apparently because the abbreviate ambit aftereffect gradually becomes anemic as the PACF array increases. Added interesting, the attrition of sandwich-structured HCF forth out-of-plane administration of the HCF (bottom inset in Figure 5b) is actual low and increases from 98 to 131 Ω sq−1 with accretion the PACF array from 200 to 1000 nm. These after-effects announce that, either erect or alongside to the administration of blur plane, the application can be abundantly bigger by basic sandwich-structured amalgam structure.

The aloft after-effects appearance that the sandwich-structured HCF has alluring advantages including absorptive structure, acceptable conductivity, accomplished adaptability and acceptable affinity with substrate. Therefore, the sandwich-structured HCF is acceptable as an electrode actual for supercapacitor (SC). To authenticate the advantages of the HCF, afterwards actuality transferred assimilate a artificial substrate, a binder-free SC is accumulated by application a artificial separator in amid two HCFs, in which the HCF serves as both accepted beneficiary and alive material. Two HCF electrodes are bogus for comparison: i) HCF (1.12 μm), in which the thicknesses of the MGFs and PACF are about 60 nm and 1.00 μm, respectively, ii) HCF (1.83 μm), in which the thicknesses of the MGFs and PACF are about 100 nm and 1.63 μm, respectively. The cantankerous exclusive SEM images of the MGF and PACF in the HCF (1.83 μm) are apparent in Figure S3. The electrodes and separator are wetted with 6 M KOH aqueous electrolyte for two hours and afresh anchored by two clips afore testing.

Cyclic voltammograms (CV) curves of the SC based on HCF (1.12 μm) with accretion browse amount from 100 to 800 mV/s at operating abeyant amid 0.0 and 1.0 V are apparent in Figure 6a. The CV curves display about ellipsoidal shape, implying around authentic electrical double-layer capacitive (EDLC) behavior. There is a abundantly access of the accepted body with accretion the browse rate, which indicates that the HCF-based SC has a baby agnate alternation attrition (ESR) with accelerated ion acknowledgment and awful capacitive nature. The baby ESR comes from the aerial application of MGF and the low out-of-plane attrition of the sandwich-structured HCF (Figure 5b). The CV curves of the SCs based on altered carbon films at browse amount of 50 mV/s at operating abeyant amid 0.0 and 0.8 V are apparent in Figure S4a. The breadth of the CV ambit increases abundantly with accretion the array of the carbon film, advertence the thicker carbon blur decidedly enhances the capacitance performance. The breadth specific capacitances (Cs) of the HCF electrodes are affected based on the CV curve, as apparent in Figure 6b. The C of the HCF (1.12 μm) electrode alcove 0.48 mF/cm2 at browse amount of 50 mV/cm2, which is beyond than the breadth specific capacitances of the multilayer graphene bedding (0.39 and 0.28 mF/cm2)5,34. It is account acquainted that the HCF electrode is in a three-layer structure, wherein an aerial bandage and a lower bandage are MGFs and a average bandage is PACF. The electrochemical analysis shows that the Cs of the PACF and MGF on Ni antithesis are about 0.23 and 0.26 mF/cm2 at browse amount of 50 mV/s (Figure S4b), respectively. The C of the MGF (0.26 mF/cm2) is abutting to that of the multilayer graphene breadth (0.28 mF/cm2)34. Accretion the array of the HCF, the achievement of the SC can be decidedly improved. The C of the HCF (1.83 μm) electrode alcove 1.08 mF/cm2, accretion added than two times compared with that of the HCF (1.12 μm) electrode (Figure 6b). Back the browse amount increases from 50 to 1000 mV/s, the C of the HCF (1.12 μm) decreases to 77% and is decreased by alone 23%, which implies that the HCF-based SC possesses an accomplished electrochemical stability.

Electrochemical achievement of HCF-based SC.

(a) Cyclic voltammograms (CV) curves of sandwich-structured HCF (1.12 μm) application a two-electrode balanced SC at operating abeyant amid 0.0 and 1.0 V at altered browse rates, (b) areal specific capacitance of the HCF electrodes with browse rate, (c) galvanostatic charge/discharge (GCD) curves of the SC based on the HCF (1.12 μm) at altered accepted densities, (d) cycling adherence achievement of the SC based on the HCF (1.12 μm), inset shows the aftermost dozen GCD curves afterwards 2000 cycles at connected accepted body of 0.10 mA/cm2, (e) Nyquist plots of the HCF-based SCs and inset shows the abstract allocation of the Nyquist plots abreast the origin, (f) impedance appearance bend against frequency.

Graphing Using Slope-Intercept Form (Foldable) | Math Counts … | slope intercept form foldable

Galvanostatic charge/discharge (GCD) curves of the SC based on HCF (1.12 μm) at altered accepted densities are apparent in Figure 6c. The acquittal curves of the SCs based on altered carbon films at accepted body of 0.10 mA/cm2 are apparent in Figure S4c. The GCD curves appearance a archetypal triangular appearance and the acquittal curves accept beeline characteristics, advertence about ideal capacitive behavior. No accessible IR drops are empiric in Figure 6c and Figure S4c, advertence afresh the HCF-based SCs accept low ESR. The electrode is activated for 2000 cycles at a accepted body of 0.10 mA/cm2 and shows no arresting capacitance accident (Figure 6d), which implies the HCF-based SC has above cycling stability. The Nyquist plots of the HCF-based SCs are apparent in Figure 6e. In aerial abundance region, the low ambush at Z absolute arbor is accompanying to the ESR of the device, the ESRs are 0.91 and 1.62 Ω for the SC based on HCF (1.12 μm) and HCF (1.83 μm) electrodes, respectively. The plots are characterized by a high-frequency semicircle and afresh a beeline band (inset in Figure 6e). The high-frequency semicircle is about interpreted as the charge-transport attrition in alive abstracts or the acquaintance attrition at the interface7. The alteration arena amid the high-frequency semicircle and the vertical band arena has 45° feature, advertence archetypal Warburg impedance. This aftereffect reflects that the HCF has a absorptive structure6 as accepted by SEM image. In low abundance region, the artifice manifests itself by a band that intersects the absolute arbor at a abreast 90° angle, which is connected with an ideal EDLC behavior7,35.

The assurance of appearance bend on the abundance from 10−2 to 105 Hz is apparent in Figure 6f. The curves appearance capacitive behavior with appearance bend of about −90° at low abundance and anterior behavior at aerial frequency6. The HCF-based SCs accept a decidedly advanced abundance ambit (~kHz) for the capacitive feature. This abundance ambit is abutting to that of the graphene nanosheet SC6,8,36 and beyond than that of the angular aggressive graphene (VOG)-bridged coated nickel-foam SC7. The appearance bend alcove −45°, which is frequently adopted to appraise the abundance achievement of SC (resistance and reactance of capacitor accept according magnitudes at this frequency), at f ≈ 7 kHz for the SC based on the HCF (1.12 μm). This abundance is abundant college than that of the activated carbon SC (0.15 Hz6), the angular aggressive graphene SC (~9 Hz7 and 4 kHz8) and the carbon nanotubes SC (636 Hz37). The abundance at −45° appearance bend provides a appropriate time connected (1/f), which is frequently adopted to appraise the amount achievement of the SC8,38. The appropriate time constants are 143 and 472 μs for the SC based on the HCF (1.12 μm) and the HCF (1.83 μm) electrodes, respectively, advertence the HCF-based SC possesses ultrahigh-rate performance. At 120 Hz (commonly acclimated clarification frequency), the impedance appearance angles of the HCF-based SCs are about −67° and −64° for the SC based on HCF (1.12 μm) and HCF (1.83 μm) electrodes, respectively, as compared with ~0° for the activated carbon SC6, −15° for the VOG-bridged coated nickel-foam SC7 and −82° for the angular aggressive graphene SC6.

Energy body and ability body of SC are absolutely important ambit for their absolute applications. To authenticate the all-embracing achievement of the HCF-based SC, a Ragone artifice is apparent in Figure 7 comparing the achievement of the HCF-based SCs with altered activity accumulator devices, including the (MnO2–PEDOT: PSS)/activated carbon (AC) SC39, the MnO2/AC SC39, the laser scribing graphene (LSG) SC40, the nano-engineered carbon blur (CNC) SC41, the 3 V/30 mF aluminum electrolytic capacitor and a 500 μA h lithium thin-film battery40. The volumetric activity body of the SC based on HCF (1.12 μm) ranges from 0.08 to 0.16 mWh/cm3 (Figure 7a), which is lower than that of the MnO2/AC SC39, commensurable with the CNC blur SC41, college than that of the aqueous LSG SC40 and two-orders of consequence college than that of the aluminum electrolytic capacitor40. Furthermore, at activity body of 0.08 mWh/cm3, the SC can bear a best ability body of 1.49 W/cm3, which is 10 times college than that of the MnO2/AC SC39 and the CNC blur SC41, two-orders of consequence college than that of the 500-μAh thin-film lithium battery, commensurable with the aqueous LSG SC and abutting to the lower end of the aluminum electrolytic capacitor40. These after-effects announce that the HCF-based SC possesses a aerial ability density.

Ragone plots of HCF-based SC.

(a) Areal and volumetric activity densities against ability densities of the HCF-based SCs by application carbon films with altered thicknesses compared with the (MnO2–PEDOT:PSS)/AC SC, the MnO2/AC SC39, the CNC SC41, the LSG SC, the aluminum electrolytic capacitors and a lithium thin-film battery40. (b) Gravimetric activity densities against ability densities of the HCF-based SCs compared with the manganosite/GO SC44, the graphitized carbon SC45 and the hierarchical absorptive carbon SC46.

However, the activity body of the SC based on the HCF (1.12 μm) (Figure 7a and 7b) is lower than that of the carbon-based SCs appear by added groups42,43,44,45,46, which is because of lower loading mass/thickness in electrode. By accretion the carbon blur thickness, the activity body can be decidedly improved. For example, the best volumetric activity body increases from 0.16 to 0.40 mWh/cm3 (Figure 7a) and the best gravimetric activity body increases from 0.32 to 0.79 Wh/kg (Figure 7b) by accretion the carbon blur array from 1.12 to 1.83 μm, accretion added than two times. Furthermore, the best volumetric and gravimetric ability densities of the SC based on HCF (1.83 μm) ability 3.10 W/cm3 and 6.20 kW/kg, respectively. We accept the achievement can be added bigger by accretion the array or the bandage cardinal of the carbon films.

Slope Intercept Form Foldable 10 Unconventional Knowledge About Slope Intercept Form Foldable That You Can’t Learn From Books – slope intercept form foldable

| Pleasant to help my personal website, in this particular time I will show you concerning keyword. And today, this can be a primary image:

How to Get the Most Out of Your Slope Intercept Form … | slope intercept form foldable

Why not consider impression preceding? can be which wonderful???. if you think and so, I’l d show you many graphic all over again below:

So, if you want to secure all these great shots regarding (Slope Intercept Form Foldable 10 Unconventional Knowledge About Slope Intercept Form Foldable That You Can’t Learn From Books), press save button to download the pics for your pc. They are prepared for down load, if you like and want to obtain it, click save badge in the post, and it’ll be instantly downloaded to your laptop computer.} Finally if you wish to receive new and the latest picture related with (Slope Intercept Form Foldable 10 Unconventional Knowledge About Slope Intercept Form Foldable That You Can’t Learn From Books), please follow us on google plus or save this site, we try our best to present you daily up-date with fresh and new images. Hope you enjoy staying here. For many updates and recent news about (Slope Intercept Form Foldable 10 Unconventional Knowledge About Slope Intercept Form Foldable That You Can’t Learn From Books) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to offer you up-date periodically with fresh and new pictures, love your surfing, and find the best for you.

Thanks for visiting our website, contentabove (Slope Intercept Form Foldable 10 Unconventional Knowledge About Slope Intercept Form Foldable That You Can’t Learn From Books) published . Today we’re excited to announce we have found an incrediblyinteresting nicheto be pointed out, namely (Slope Intercept Form Foldable 10 Unconventional Knowledge About Slope Intercept Form Foldable That You Can’t Learn From Books) Many people looking for information about(Slope Intercept Form Foldable 10 Unconventional Knowledge About Slope Intercept Form Foldable That You Can’t Learn From Books) and of course one of these is you, is not it?

Slope-Intercept Form Small Foldable Notes Interactive Notebook | slope intercept form foldable

Slope Intercept Form – Lessons – Tes Teach | slope intercept form foldable

Math = Love: New y=mx+b Foldable | slope intercept form foldable

Graphing Using Slope-Intercept Form (Foldable) | Interactive … | slope intercept form foldable

Slope & Slope- Intercept Form (Foldable) | slope intercept form foldable