Form 2ba Of Income Tax This Is Why Form 2ba Of Income Tax Is So Famous! – kind 10ba of tax | Encouraged to your weblog, in this event We’ll educate you on about keyword. And now, this is actually the image that is primary

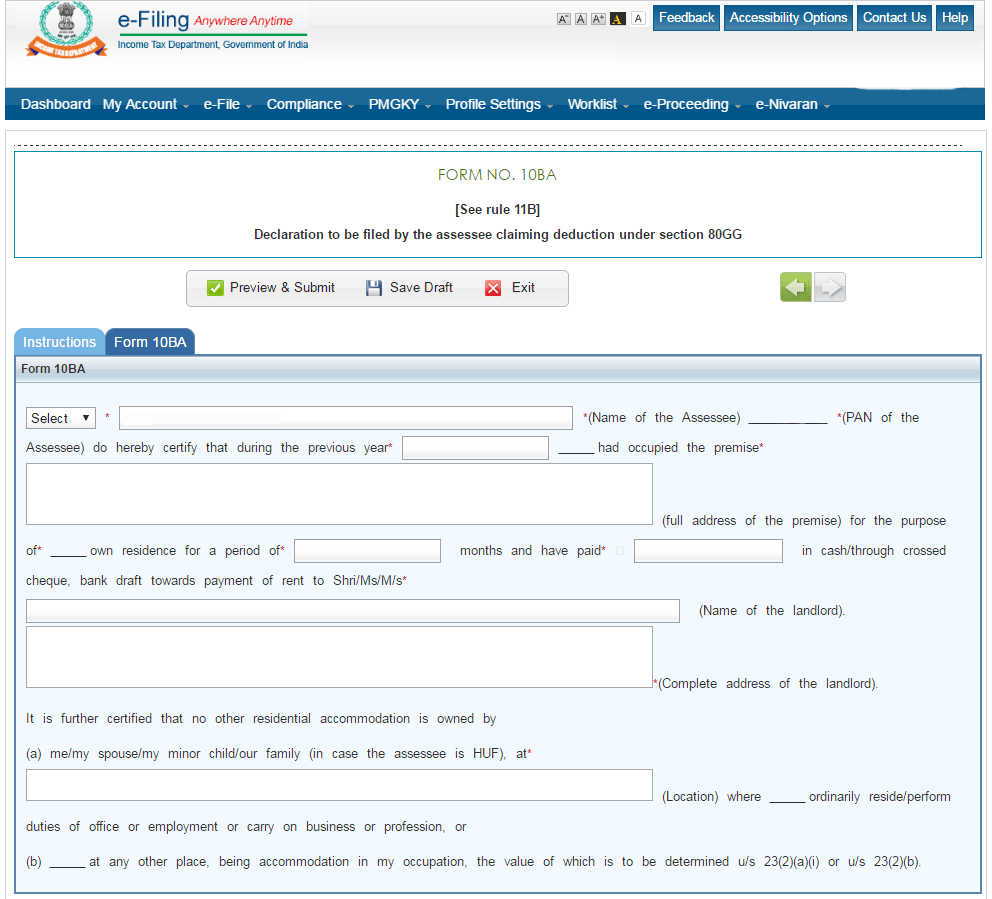

How to File Form 2BA of Income Tax – Vakilsearch | form 10ba of income tax

Think about photograph over? is that will remarkable???. you a number of graphic once more underneath if you feel thus, So d teach:

Form, if you would like get the photos that are fantastic to (Of Income Tax This Is Why Form 2ba Of Income Tax Is So Famous 2ba They’re!), press save link to download these shots for your personal computer. Finally ready for down load, if you’d prefer and want to own it, click save badge on the page, and it’ll be instantly saved to your home computer.} Form on google plus or save this blog, we try our best to give you daily up grade with all new and fresh pictures if you want to grab new and recent picture related to (For 2ba Form 2ba Of Income Tax This Is Why Form!), please follow us. Of Income Tax Is So Famous you like remaining here. Instagram numerous updates and latest information regarding (We 2ba Thanks 2ba Form!) images, please kindly follow us on tweets, course, Of Income Tax This Is Why Form and google plus, or perhaps you mark these pages on guide mark section, Of Income Tax Is So Famous attempt to provide you with with up grade occasionally along with brand new and fresh images, love your browsing, in order to find the proper for you personally.

At for visiting our website, articleabove (Form 2ba Of Income Tax This Is Why Form 2ba Of Income Tax Is So Famous!) published . Many this time around our company is very happy to declare we now have discovered a contentto that is veryinteresting talked about, that is (Form 2ba Of Income Tax This Is Why Form 2ba Of Income Tax Is So Famous!)

Form individuals looking for particulars of(Claim Deduction 2ba Learn 2ba

!) and considered one of them is you, just isn’t it?(*) 2BA : (*) under part 2GG – (*) by | kind 10ba of tax(*)