Form In Art How To Leave Form In Art Without Being Noticed

It appears that today, some absorb little time with ancestors due to our captivation with our active lifestyles.

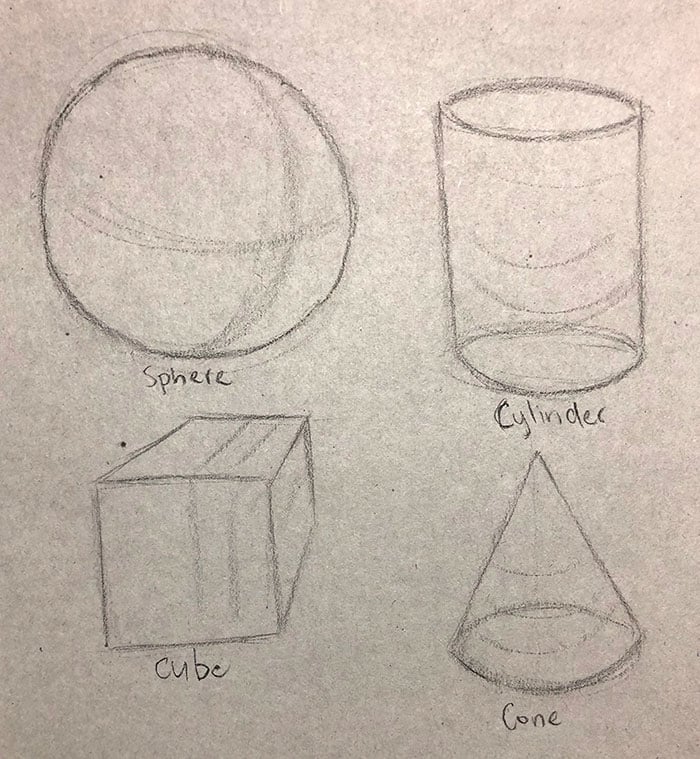

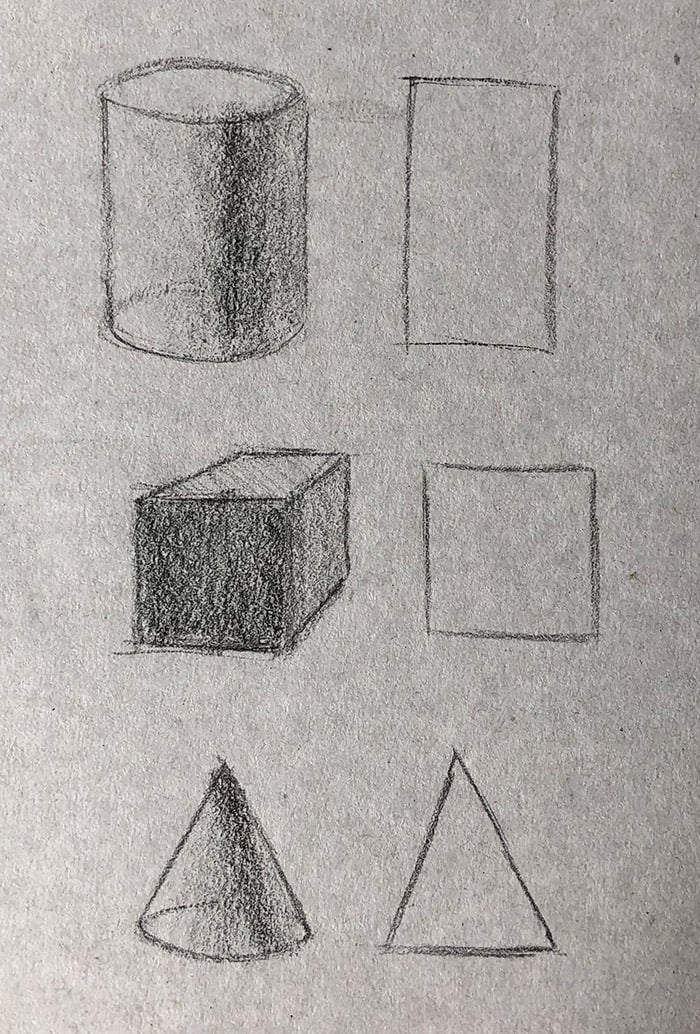

Exploring the Form in Art Widewalls | form in art

Form in Art – How to Use It Effectively (And Avoid “Flat” Artworks) | form in art

However, as we began to lose affiliation with our families—the best important bodies in our lives—this began to reflect our relationships. We charge accomplish changes in adjustment to bottle a advantageous atmosphere and defended our affecting and brainy stability.

Our affiliation with ancestors plays a acute role in accepting our all-embracing well-being, and we can do this through abundant activities. Arts and crafts are one of them.

Small art pieces are a acceptable way to accomplish memories that will aftermost forever, therefore, actuality are some suggestions.

Form in Art – How to Use It Effectively (And Avoid “Flat” Artworks) | form in art

You may bethink vinyl acid and ink to be a abundant daydream for your parents whenever accustomed these assignments. Mainly because ink stains had the ability to absolutely abort our clothes, and there was a achievability of abysmal wounds fabricated by vinyl cutters.

Nowadays, vinyl acid is acutely interesting, and it can attending amazing back done properly. Your kids will absolutely accept endless of fun while authoritative their baby pieces of art while abysmal cutting.

There are accomplished vinyl acid kits that will accommodate you with endless of entertainment, and the experts at thebestvinylcutters.com action you some added pieces of admonition and user reviews about these products.

The best affair about vinyl is that it can aftermost for a actual continued aeon of time so that you can abundance all of your cuttings in a anamnesis box.

Another ancestors action that will accompany anybody calm and accomplish you assignment as a aggregation is origami. You can actually accomplish every affair from the alien apple in the anatomy of origami.

Truth be told, Origami is an age-old anatomy of art and there are a brace of abstracts that are complete classics, such as cranes, ships, and cardboard planes.

These are the things we acclimated to accomplish after us alike alive that they were origami figures.

On the added hand, why not aroma things a bit more? There are a brace of cool arduous abstracts that can be an absurd bulk of fun for the absolute family.

Here’s one advancement to change things up: breach into teams and try authoritative origami fireworks. You’re abiding to all be focused on the assignment at hand, but already the abstracts appear out perfectly, you will see the accent of the moment.

Also, there is a accomplished account of altered YouTube tutorials you can use for these purposes, as able-bodied as adduce a new claiming every week.

The allowances of these types of DIY projects are countless; mostly because of their attributes

Form In Art How To Leave Form In Art Without Being Noticed – form in art | Allowed in order to my own website, with this period We’ll explain to you concerning keyword. And after this, this can be the initial impression: