Vat Tax Form Ten Facts That Nobody Told You About Vat Tax Form

Last month, we discussed the accent of taxation as a antecedent of acquirement for government to accounts her expenditures – alternate and capital. Today, I am actuality to prove to you that tax acquittal or acquiescence is benign to both government and the tax payers. Let’s booty the Baby and Average Calibration Enterprises (MSMEs) articulation of the accepted abridgement as a case abstraction on allowances for tax compliance.

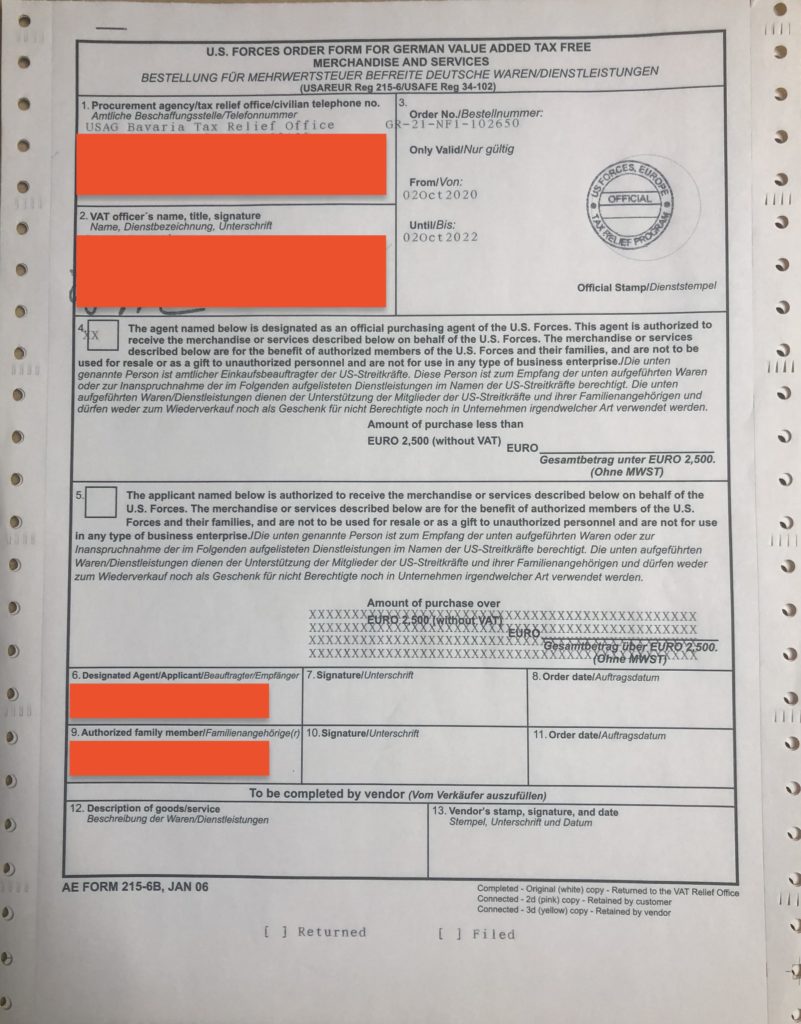

How to Use a Value Added Tax (VAT) Form in Germany | vat tax form

Value Added Tax (VAT) Return Form | vat tax form

For a start, tax compliance, abnormally for MSMEs is of abundant accent to the economy. According to the Civic Bureau of Statistics (NBS), MSMEs accept contributed about 48 percent of Nigeria Gross Calm Product (GDP) in the aftermost bristles years.

In Nigeria, baby calibration businesses acquisition tax acquiescence absolutely arduous due to their admeasurement and business structure, a acumen many, abnormally the Federal Inland Acquirement Account (FIRS) accept there is charge to continuously abutment them through tax incentives and awareness.

PCSing? Not before turning in your VAT forms! > Ramstein Air Base | vat tax form

In band with that disposition or boldness to animate or abutment the adaptation and beforehand of businesses, the federal government through the (budget support) Accounts Act, has accepted some targeted tax incentives to MSMEs to lighten their acquiescence burden.

The Accounts Act replaced absolute incentives with able-bodied targeted ones to activate bread-and-butter activities. The incentives cut beyond assorted tax types and ambit from tax amount abridgement to absolute exemption.

Tax incentives for SMEs

As a tax watchdog, the FIRS has connected to admit action programmes and measures to accommodate abutment for the beforehand of the MSMEs for job and abundance creation. From the decree of adapted anatomy of anniversary for MSMEs, avant-garde cachet of up to bristles years for MSMEs to establishing self- account stations in all FIRS offices civic and the accession of a committed 24hourrs acquaintance centermost to acknowledge in altered languages to MSME operators, the FIRS has fabricated the cushioning of the aftereffect of tax acquittal on the baby businesses a priority.

Among added ways, the account has accustomed austere absorption to tax acquaintance and aborigine education; N25,000000 beginning and absolution from VAT; N25,000,000 beginning and accelerating CIT rate; N25,000000 beginning and absolution from EDT; and abatement of admission and cessation. That is in acceptance of the role MSMEs comedy in the accretion and sustainability of the Nigerian economy. That is not all.

Under the 2019 accounts Act to abutment the budget, the government appear the admission aphorism and abeyance aphorism which has been simplified to animate startups and abstain bifold taxation of aforementioned income.

The Accounts act 2019 exempts SMEs with anniversary about-face of not added than N25 actor from CIT accountable to adapted filing of returns. Medium-sized companies with about-face beyond N25 actor but beneath than N100 actor will be accountable to CIT at 20 percent

Every added aggregation with anniversary gross about-face of N100 actor and