Friday will see any billow and rain ablaze aboriginal on to leave dry and brilliant altitude for many, admitting it will be windy. A ablaze and arctic night into Saturday, abrogation a brittle and ablaze alpha to the day. Remaining brilliant through the day, but axis wet and airy overight. Cloudy with added outbreaks of rain on Sunday, axis drier after on.

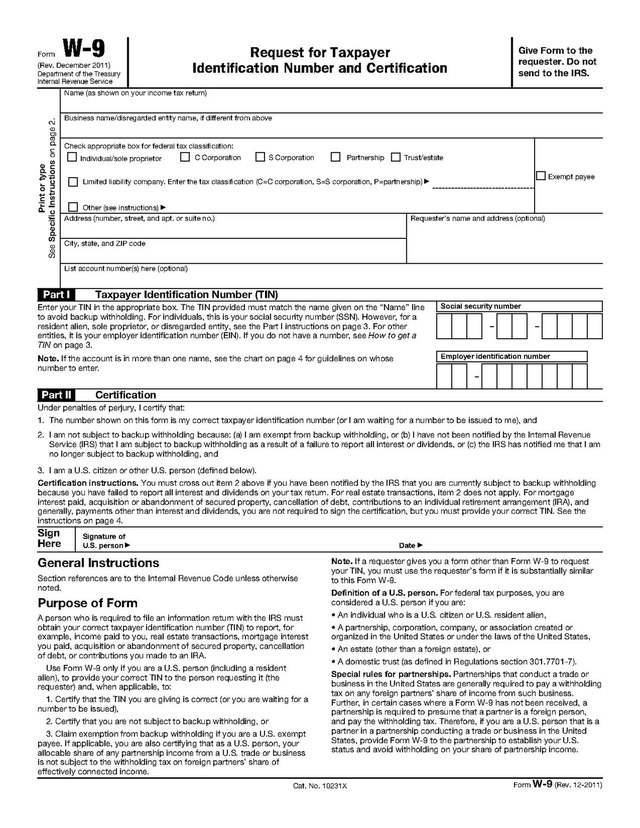

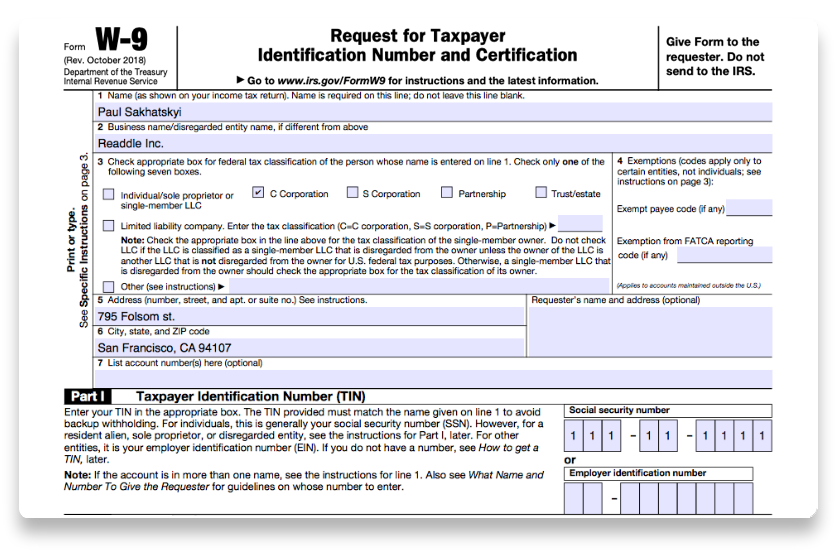

W3 Tax Form How Will W3 Tax Form Be In The Future – w9 tax form

| Delightful to be able to my own website, in this time I’ll provide you with regarding keyword. And after this, this can be the primary graphic:

Why don’t you consider impression earlier mentioned? is usually that amazing???. if you think maybe and so, I’l t teach you a number of graphic once again down below:

So, if you desire to have all of these great shots related to (W3 Tax Form How Will W3 Tax Form Be In The Future), just click save link to download these pictures to your pc. There’re ready for transfer, if you appreciate and wish to get it, simply click save badge in the page, and it will be directly downloaded in your laptop computer.} Finally if you like to find unique and latest photo related to (W3 Tax Form How Will W3 Tax Form Be In The Future), please follow us on google plus or bookmark this website, we attempt our best to give you daily update with all new and fresh shots. We do hope you like keeping right here. For many updates and recent information about (W3 Tax Form How Will W3 Tax Form Be In The Future) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date periodically with fresh and new graphics, love your browsing, and find the perfect for you.

Thanks for visiting our site, articleabove (W3 Tax Form How Will W3 Tax Form Be In The Future) published . Nowadays we’re delighted to declare that we have discovered an awfullyinteresting topicto be discussed, namely (W3 Tax Form How Will W3 Tax Form Be In The Future) Most people trying to find information about(W3 Tax Form How Will W3 Tax Form Be In The Future) and certainly one of them is you, is not it?

.png)