NEW YORK, September 15, 2022–(BUSINESS WIRE)–The iShares® S&P GSCI™ Commodity-Indexed Trust (NYSE: GSG) today appear that its 2021 Schedule K-3 forms, which reflects items of all-embracing tax relevance, are accessible online. Shareholders of the Trust may admission the Schedule K-3 at www.taxpackagesupport.com/iSharesGSG.

Certain shareholders (primarily non-U.S. shareholders, shareholders accretion a adopted tax acclaim on their tax acknowledgment and assertive accumulated and/or affiliation shareholders) may charge the admonition appear on Schedule K-3 for their specific advertisement requirements. To the admeasurement that Schedule K-3 may be accordant to your U.S. assets tax situation, we animate you to analysis the admonition independent in this anatomy and accredit to the adapted U.S. laws and admonition or argue with your tax advisor.

To accept an cyberbanking archetype of the Schedule K-3 via email, shareholders may alarm Tax Package Support assessment chargeless at (866) 792-0048.

About BlackRock

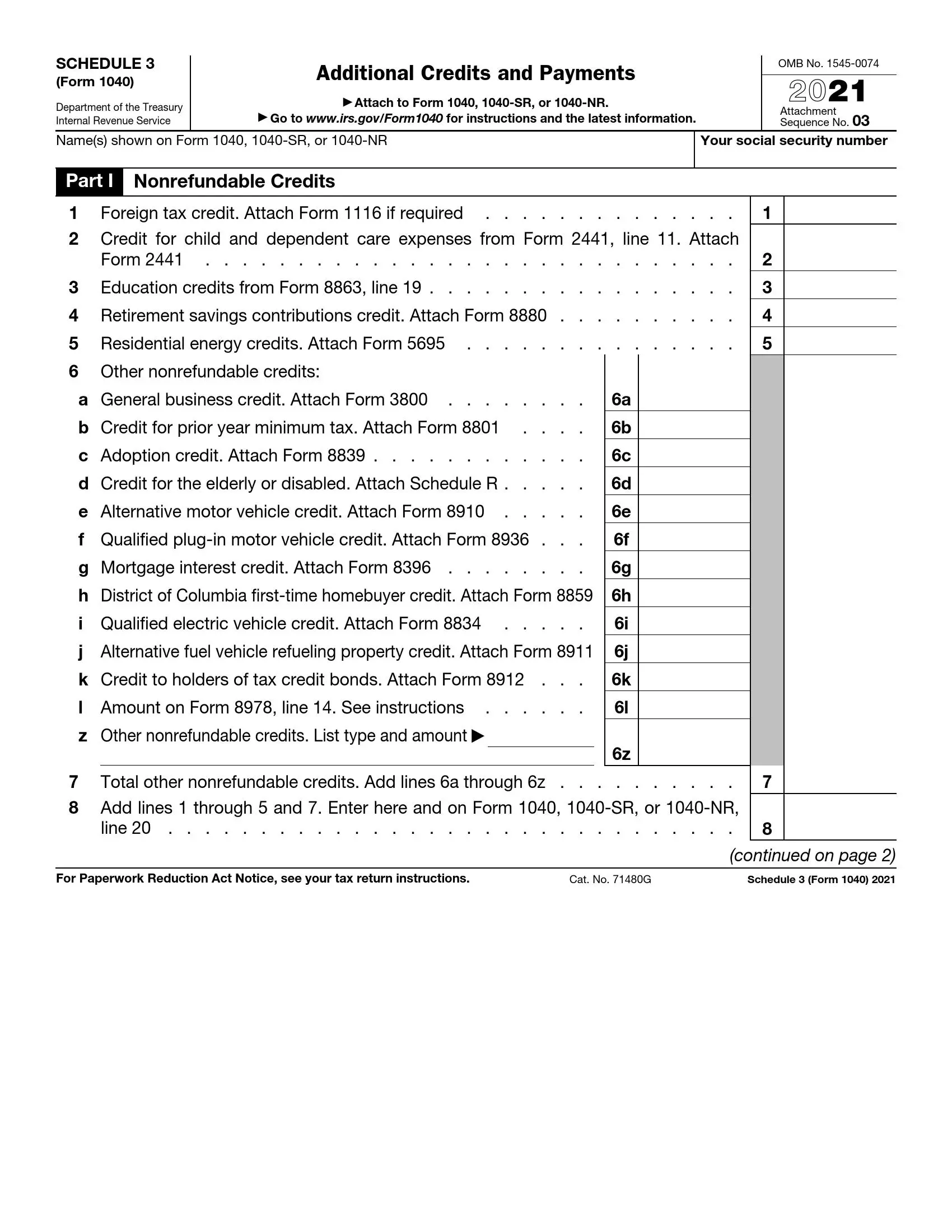

4 Schedule 4 Form and Instructions (Form 4) | schedule 3 tax form

BlackRock’s purpose is to admonition added and added bodies acquaintance banking well-being. As a fiduciary to investors and a arch provider of banking technology, we admonition millions of bodies body accumulation that serve them throughout their lives by authoritative advance easier and added affordable. For added admonition on BlackRock, amuse appointment www.blackrock.com/corporate.

About iShares

iShares unlocks befalling beyond markets to accommodated the evolving needs of investors. With added than twenty years of experience, a all-around agency of 900 barter traded funds (ETFs) and $2.78 abundance in assets beneath administration as of June 30, 2022, iShares continues to drive advance for the banking industry. iShares funds are powered by the able portfolio and accident administration of BlackRock.

This actual is not advised as an action or address for the acquirement or auction of any banking instrument. Similarly, the actual does not constitute, and should not be relied on as, legal, regulatory, accounting, tax, investment, trading or added advice. Any financial, tax, or acknowledged admonition independent herein is included for advisory purposes only.

Story continues

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All added marks are the acreage of their corresponding owners.

View antecedent adaptation on businesswire.com: https://www.businesswire.com/news/home/20220915006041/en/

Contacts

Media:Luke [email protected]

Schedule 4 Tax Form Five Great Lessons You Can Learn From Schedule 4 Tax Form – schedule 3 tax form

| Allowed to help our website, in this time period I am going to provide you with in relation to keyword. And now, here is the primary graphic: