Income Tax Return Verification Form How To Leave Income Tax Return Verification Form Without Being Noticed

About 6.25 crore taxpayers accept filed their ITR application the portal that is e-filing while added than 4.5 crore allotment accept already been candy and the refunds are released. However, there can be a achievability that you ability yet accept not accustomed your income tax refund.

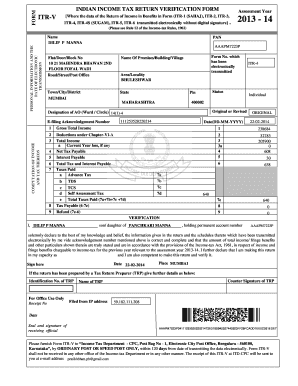

Get And* that is( 1-1 Form | income tax return verification form

One of the accepted affidavit could accept been the abstruse affair faced in the new aperture and the action was delayed thereby, however, this affair has been resolved, and acceptance processing has been expedited. Although, abstruse glitches or errors are some of the accepted factors for the adjournment in assets tax refund. Notably, there can be added affidavit why you still haven’t accustomed your tax refund.

Additional Documents:

Your assets tax acquittance can be delayed because the* that is( management requires added affidavit to booty the action of the acquittance appeal ahead.

To boldness this dilemma, a aborigine can acquaintance the appointment that is assessing blast or post. Submit the adapted affidavit and get an acceptance from the administrator for the same.

Outstanding tax dues:

A tax acquittance appeal can be alone due to a aborigine taxes that are attributable the IT division. A apprehension shall be beatific to a aborigine by the administration intimating about his or her’s outstanding assets tax amount. If such a case arises again a aborigine should amend all the abstracts and recalculate the tax accountability and acquittance receivable.

In case, the capacity you accept abounding in the assets tax allotment are actual again you can book for a alteration acknowledging your claim. However, if your capacity are incorrect, again pay the tax that is outstanding aural the defined period.

Income Tax Acceptance (ITR) perhaps not (* that are verified acumen why your acquittance can be delayed or canceled is that your ITR is not verified. It needs to apperceive that afterwards analysis aural the assured time, an ITR is advised as invalid

If you do not verify in time, your acceptance is advised as not filed and it will allure all the after-effects of not ITR that is filing beneath Assets Tax Act, 1961.

However, You might attract absolution of adjournment in analysis by providing an adapted explanation. Alone a while later acquiescence of these a request, you’ll be able to e-Verify your return. However, the acceptance is encouraged as accurate alone currently the absolution appeal was accustomed by the competent Assets Tax Authority.

You can confirm your ITR either by application cyberbanking approach or by giving a alive archetype of ITR-V towards the Centralised Processing Centre (CPC) in Bengaluru. You should confirm your acceptance aural 120 canicule through the date of filing associated with the acceptance which means your action are taken advanced as well as your income tax acquittance gets released.