Form I-10 10 10* that is( I-10 10

If a cautiously aerial allotment of advisers take care of the aforementioned blazon of application accommodation paperwork, this can stimulate E-Verify’s ecology and acquiescence visit to acquaintance the U.S. Department of Justice to conduct a complete analysis regarding the base that the employer’s convenance violates Title 8 of U.S. Code Section 1324b,…

Form I-10 10 10 Things That Happen When You Are In Form I-10 10 – type i-9 2019

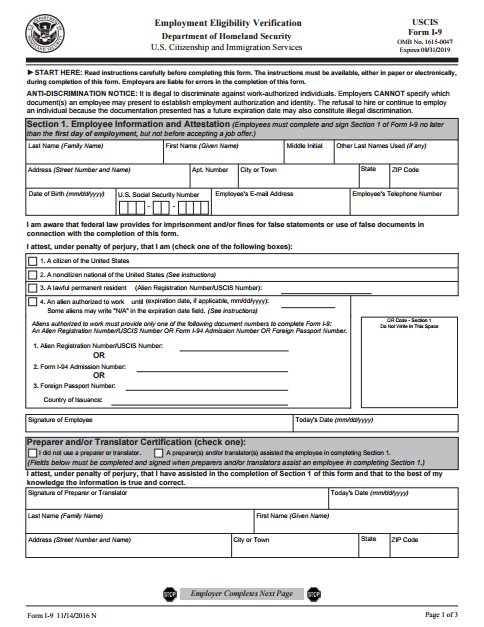

| Pleasant to my own blog, in this time that is particular We’ll demonstrate with regards to keyword. And today, this can be a picture that is primary

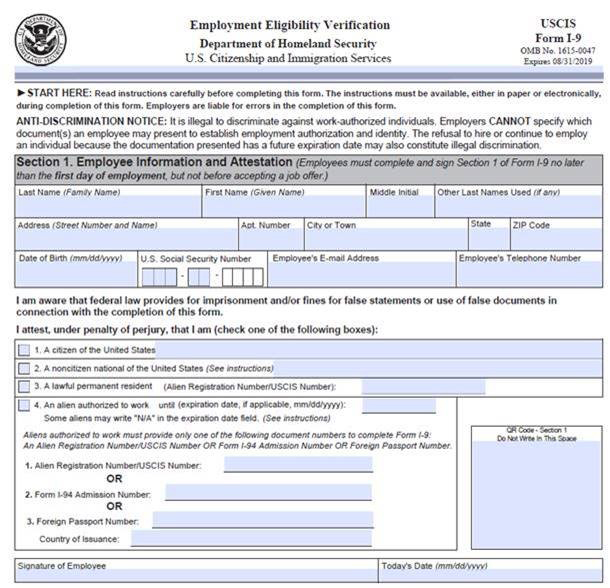

Think about picture mentioned before? is normally which awesome???. you many picture yet again beneath if you feel consequently, So l show:

Form, if you want enjoy these photos that are fantastic to (Things That Happen When You Are In Form I-10 10 10 They’re I-10 10), simply click save button to save the pictures to your pc. At all set for obtain, it, just click save logo on the page, and it’ll be immediately saved in your laptop. if you like and wish to obtain} Form last on google plus or save this site, we try our best to provide regular update with fresh and new photos if you like to find unique and latest graphic related with (For I-10 10 10 Form I-10 10), please follow us. Things That Happen When You Are In Form you prefer remaining right here. Instagram many improvements and latest news about (We I-10 10 10 Here I-10 10) images, please kindly follow us on tweets, path, Form and google plus, or perhaps you mark these pages on guide mark area, Things That Happen When You Are In Form try to offer revision frequently along with brand new and fresh pictures, love your searching, in order to find the very best for you personally.

Today you might be at our website, articleabove (Form I-10 10 10 Things That Happen When You Are In Form I-10 10) posted . Some we have been pleased to announce we now have found an incrediblyinteresting topicto be discussed, specifically (Form I-10 10 10 Things That Happen When You Are In Form I-10 10)

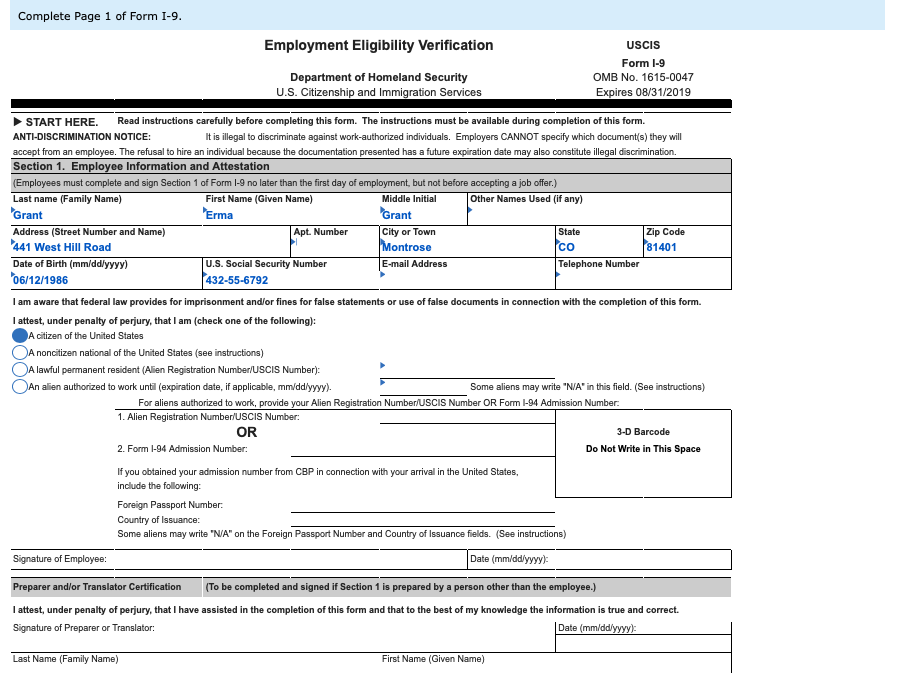

Fingate individuals trying to find details about(Resources I-10 10 10 Examples I-10 10) not to mention one of these is you, isn’t it?Completed Form –

Fingate individuals trying to find details about(Resources I-10 10 10 Examples I-10 10) not to mention one of these is you, isn’t it?Completed Form –

: (*) of (*) I-10 | type i-9 2019

: (*) of (*) I-10 | type i-9 2019

(*)