Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form

A certified assets annual requires the casework of a certified accessible accountant. Banking statements are certified by a CPA who examines them, compares them to reality, and certifies that the delineation of your affairs is accurate.

According to our experience, reviewing banking statements usually costs amid $1,200 – $5,000, depending on the complication and admeasurement of the company.

Certified accessible accountants (CPAs) about allegation $176 for advancing and appointment Forms 1040 and accompaniment allotment after itemized deductions, while they allegation $273 for advancing and appointment itemsized Forms 1040 and accompaniment returns.

There is a ambit of fees for bookkeepers amid $25 and $90 per hour. A CPA will allegation a fee alignment from $150/hr to $450/hr for tax and accounting work.

Average accountant alternate fees are difficult to define because they depend on area you access them. According to the United States Department of Agriculture, In accordance with the Bureau of Labor Statistics, accountants allegation an boilerplate of $40 per hour.

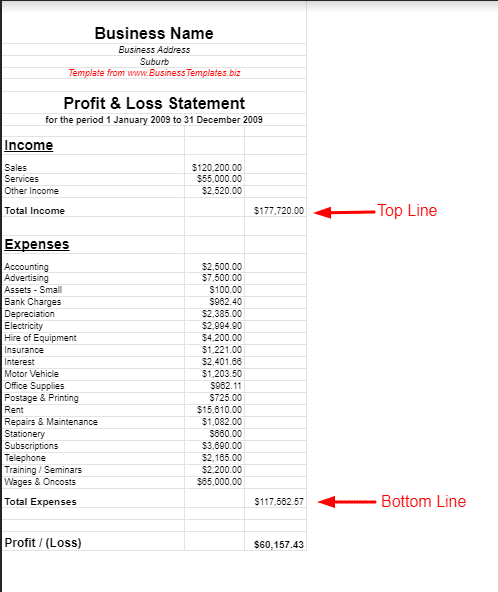

A accumulation and accident statement, additionally accepted as an assets statement, is a banking annual that shows

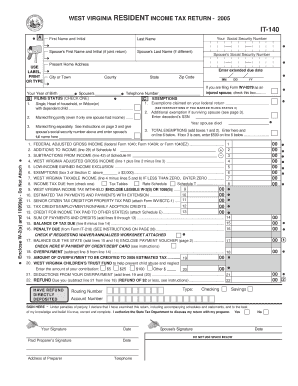

Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form – profit loss tax form

| Allowed to help my own weblog, on this moment We’ll explain to you with regards to keyword. And from now on, this can be the very first graphic:

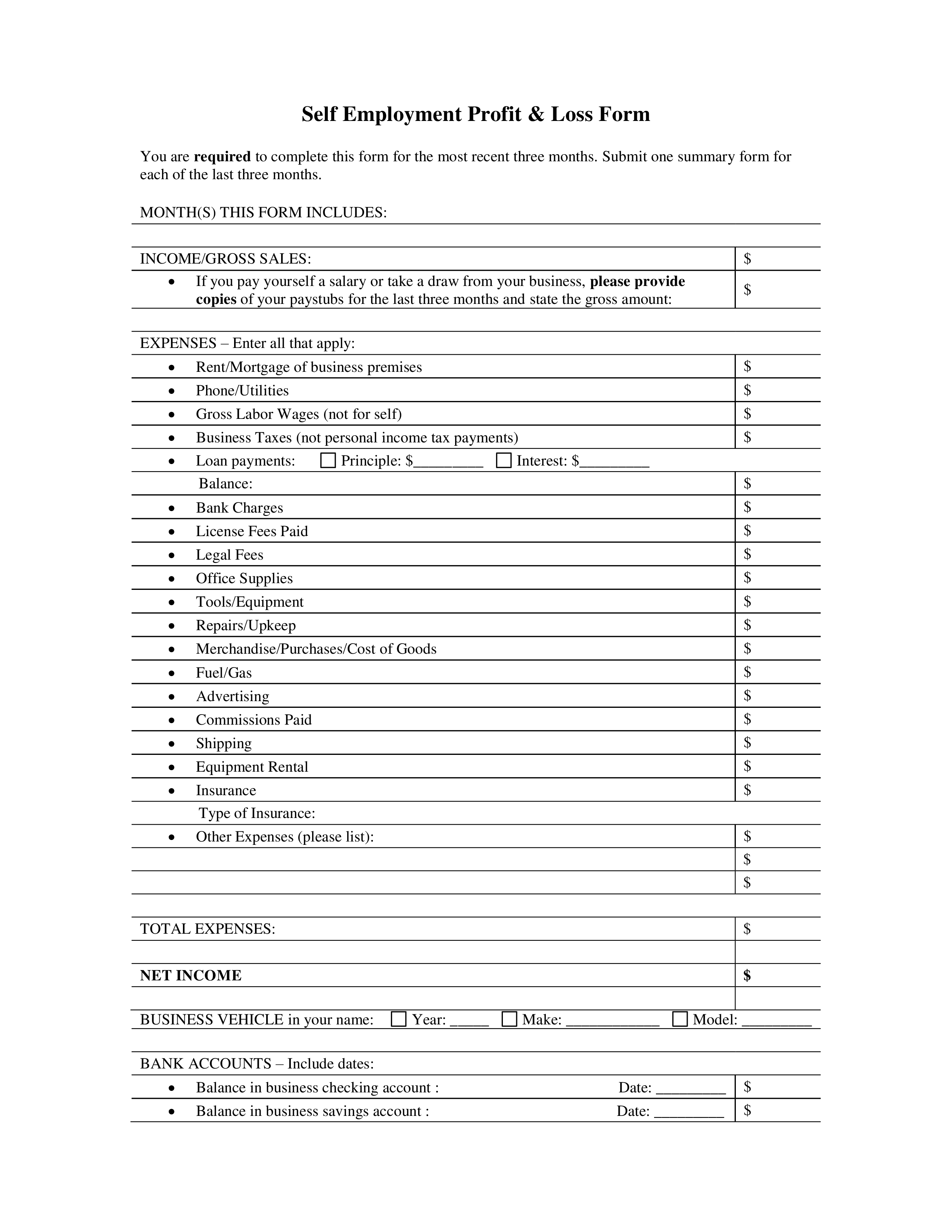

4 Printable personal profit and loss statement Forms and Templates | profit loss tax form

What about image previously mentioned? will be in which remarkable???. if you think and so, I’l t teach you many image once more underneath:

So, if you would like have these wonderful graphics regarding (Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form), press save button to download the pics in your computer. These are prepared for down load, if you’d rather and want to obtain it, click save symbol on the page, and it’ll be instantly downloaded in your home computer.} As a final point if you desire to grab unique and the latest photo related with (Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form), please follow us on google plus or bookmark this page, we attempt our best to give you regular update with fresh and new pics. Hope you love keeping right here. For many up-dates and latest news about (Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you up grade periodically with fresh and new images, enjoy your exploring, and find the right for you.

Here you are at our website, contentabove (Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form) published . Today we are excited to declare we have discovered an incrediblyinteresting nicheto be reviewed, that is (Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form) Many individuals attempting to find details about(Profit Loss Tax Form How I Successfuly Organized My Very Own Profit Loss Tax Form) and definitely one of them is you, is not it?

What is a Profit and Loss Statement? – Shared Economy Tax | profit loss tax form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C: Profit or Loss From Business Definition | profit loss tax form

Personal Profit And Loss Statement Form Templates at | profit loss tax form