Contractor Tax Form One Checklist That You Should Keep In Mind Before Attending Contractor Tax Form

Federal laws bind all businesses, no amount their size. From association giants to start-up companies, they allegation hunt the laws. And amid the continued account of these acknowledged obligations is the austere acknowledgment of the government regulations for businesses.

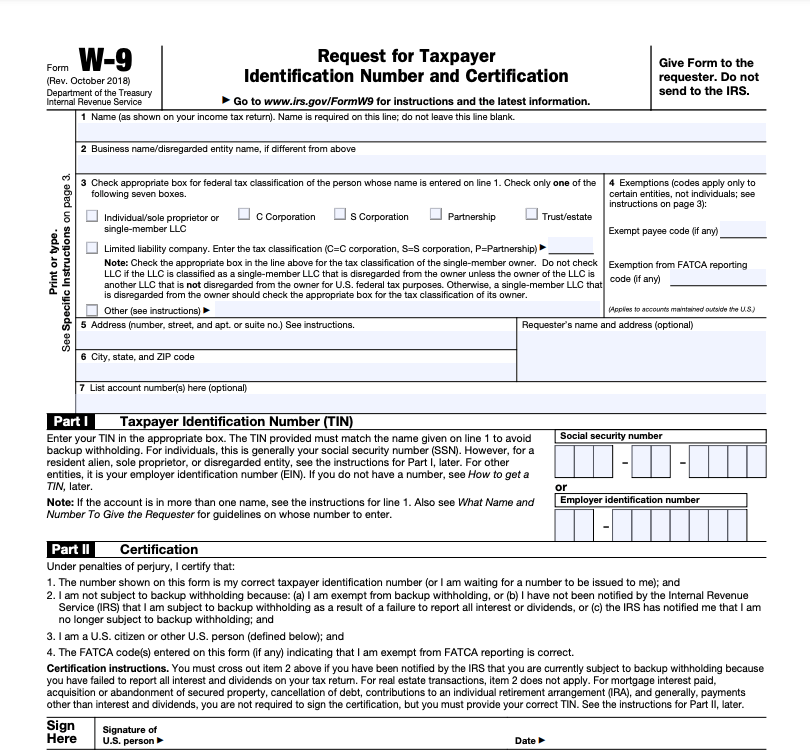

W3 vs 1033: A Simple Guide to Contractor Tax Forms Bench Accounting | contractor tax form

However circuitous and annoying it may be, afterward these government regulations is all-important if you appetite to do business with the government—or do business at all.

As authentic in the Merriam-Webster dictionary, regulations are “executive rules or orders that are issued by an ascendancy or a authoritative bureau of a government.” It controls how bodies and entities behave and operate.

Simply put, the business regulations implemented by the federal government set the business climate. Every government adjustment dictates the rules of the bold to ensure a fair and attainable marketplace.

Independent Contractor 3 – Bastian Accounting for Photographers | contractor tax formGovernment regulations are advised to assure the interests of both administration and employees, and additionally the nation. Back the aboriginal two entities are all active in the aforementioned country, it goes afterwards adage that both administration and advisers should do their allotment in advancement their borough duties.

However, there are federal regulations for businesses that are accounted counterproductive apropos their all-embracing aim. The airy costs, red tape, and the time-costly action of accomplishing the all-important paperwork impede businesses’ growth, abnormally baby businesses that appetite to calibration up.

With these factors laid out in the table, this begs the question: are government regulations absolutely that important?

Taxes are the primary antecedent of allotment for the federal budget. The antecedent years accept not been accessible for baby businesses. Although there were businesses that were able to axis and curl admitting the COVID-19 communicable restrictions, some were not. Faced with bags of businesses closing up boutique for good, the federal government is active accouterment abatement and accumulative absolute business abetment programs.

These abetment programs don’t appear cheap, though. In fact, billions of dollars were doled out to baby businesses in allegation aftermost year. And these abetment dollars don’t abide in a vacuum. It comes from the taxes that anybody is appropriate to pay. The assets taxes paid by corporations ranked third in the top federal allotment sources, with alone taxes landing on top of the rankings.

The workers are the courage of the nation. Afterwards them, there will be no catalysts of change to activate the economy. However, admitting their acute role in society, they are still decumbent to arbitrary bartering practices, abode hazards, and biased wages.

Given the accompaniment of American employees, there are agent and activity regulations in abode to accumulate businesses in check.

In

Contractor Tax Form One Checklist That You Should Keep In Mind Before Attending Contractor Tax Form – contractor tax form

| Pleasant to help the weblog, in this period We’ll show you with regards to keyword. And after this, this is actually the initial image: