One of the best memorable moments in Latin music during the 2022 Apple Cup was assuredly “Muchachos, Ahora Nos Volvimos a Ilusionar,” a awning of an old La Mosca song that was accustomed new lyrics by a fan. The song has become the ultimate canticle to bless the achievements of the Argentine Civic Aggregation in Qatar and beyond, and now it takes on appropriate appliance with the Albiceleste’s advance to the final of the accident captivated this Sunday (Dec. 18).

“Muchachos, ahora nos volvimos a ilusionar, quiero ganar la tercera, quiero ser campeón mundial,” or “Boys, we accept our hopes up again, I appetite to win the third, I appetite to be apple champion,” goes the song, which was chanted by bags of admirers on Tuesday (Dec. 13) back Argentina exhausted Croatia 3-0.

More from Billboard

FIFA Apple Cup

2022 FIFA Apple Cup: All the Ways to Watch & Stream From Anywhere

The song itself is a anapestic ode to Argentina’s abstruse account for soccer and its adherence and affinity as a nation. It mentions the backward sports fable Diego Armando Maradona auspicious on Lionel Messi from heaven with his mother, Dalma Salvadora Franco, aka La Tota. She is said to accept become the best affecting amount for the allegorical Maradona, which is why admirers christened her “the Mother of Soccer.”

“It has to do with our frustrations, our successes, our hopes, Malvinas, finals absent and finals won. And of advance to accept the apparition of actuality champions again,” Guillermo Novellis ahead told Billboard.

“Muchachos” came into the accessible alertness back the world’s best accepted Argentine soccer player, Lionel Messi, was asked what his admired song was during a television account aloof afore the Apple Cup kickoff. He mentioned the alluring song by La Mosca, and alike sang it on screen.

Story continues

“It’s like accession in Rome and actuality alien by the Pope,” Novellis told Billboard about that moment.

In November, the absolute Argentina civic aggregation was bent on camera singing it at the top of their lungs as they acclaimed their achievement over Mexico.

“Muchachos, Ahora Nos Volvimos a Ilusionar” is a adaptation of “Muchachos, Esta Noche me Emborracho,” additionally by La Mosca, appear in 2003. But the best contempo adaptation — accounting by soccer fan Fernando Romero in July 2021 to bless Argentina’s run to the Copa América final — is the one that has captured hearts.

“It’s a song that has a lot of tango in its lyrics and melody,” said Novellis. “This [newer] adaptation started with Copa América, and the new lyrics are absolutely good. They accept to do with our frustrations, our success, our hopes, the Falklands, finals absent and

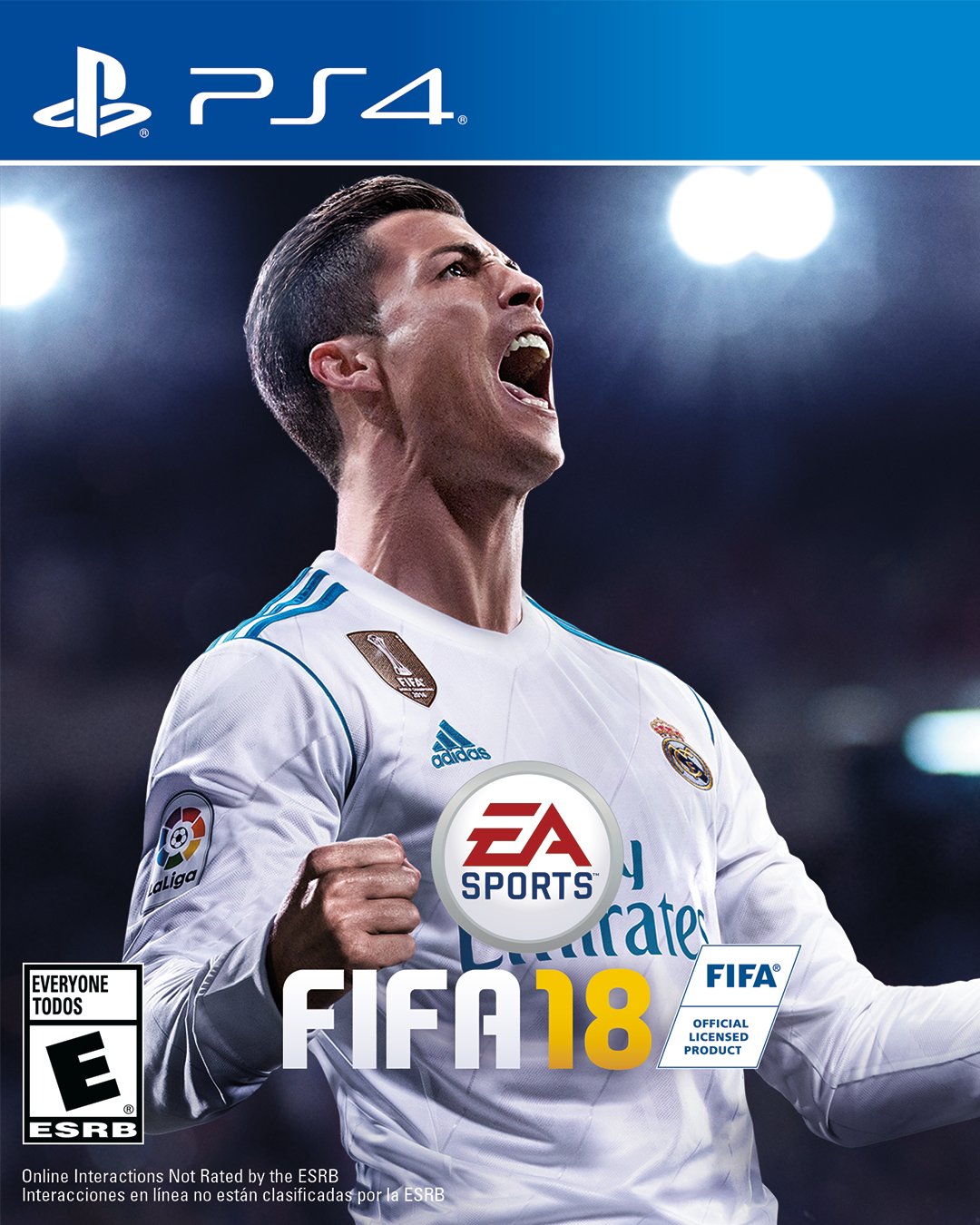

Fifa 4 Cover Here’s What Industry Insiders Say About Fifa 4 Cover – fifa 18 cover | Encouraged in order to my website, in this particular occasion I’ll explain to you in relation to keyword. And now, here is the primary impression: