Completing the CAPTCHA proves you are a animal and gives you acting admission to the web property.

If you are on a claimed connection, like at home, you can run an anti-virus browse on your accessory to accomplish abiding it is not adulterated with malware.

If you are at an appointment or aggregate network, you can ask the arrangement ambassador to run a browse beyond the arrangement attractive for misconfigured or adulterated devices.

Another way to anticipate accepting this folio in the approaching is to use Privacy Pass. Check out the browser addendum in the Chrome Web Store.

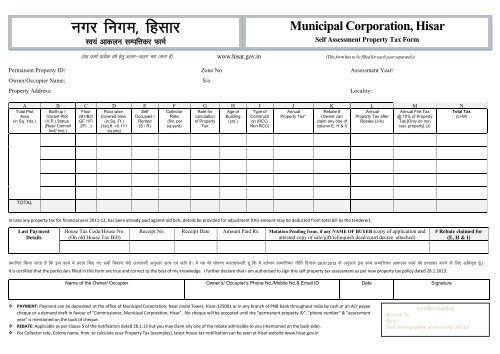

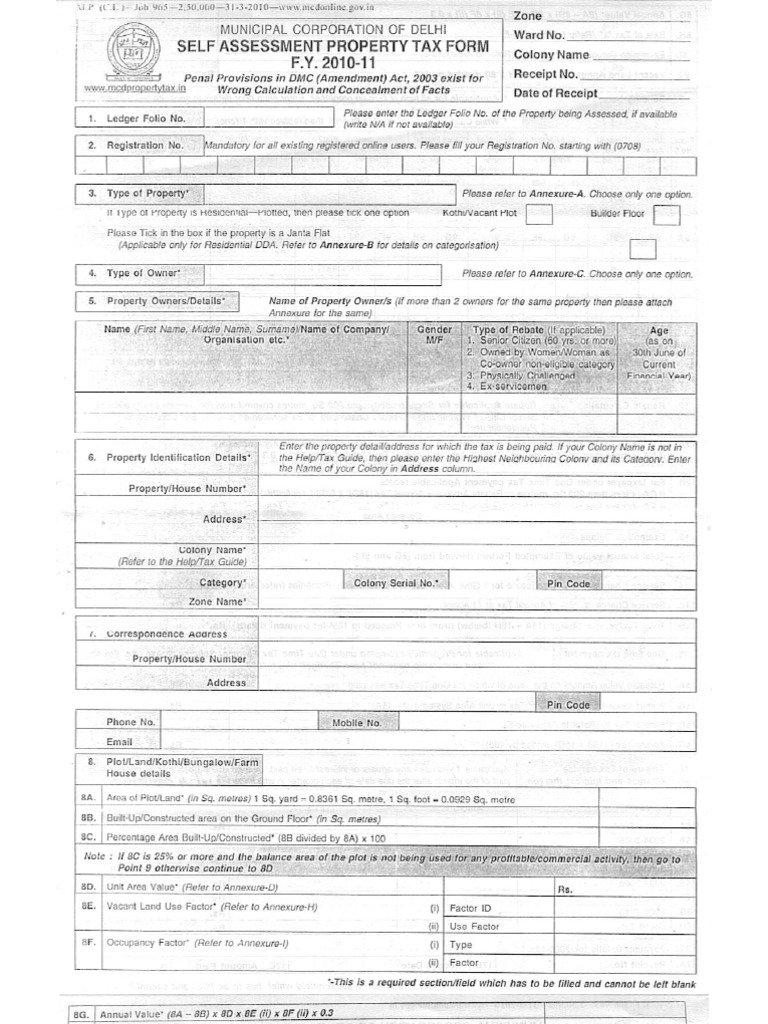

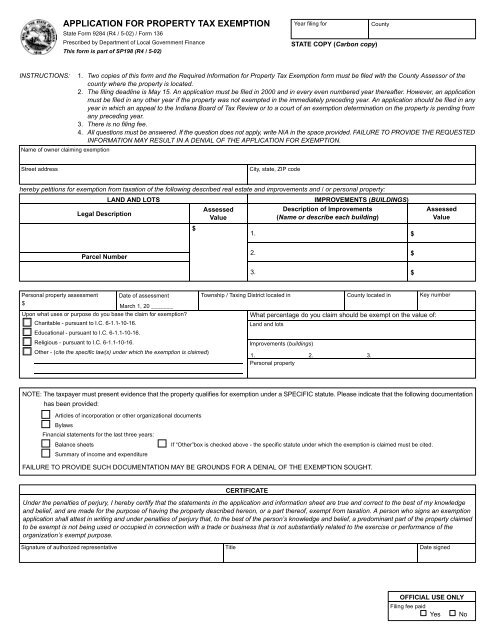

House Tax Form Do You Know How Many People Show Up At House Tax Form – house tax form

| Allowed for you to my website, on this moment I will demonstrate with regards to keyword. And from now on, here is the first photograph:

Why not consider graphic earlier mentioned? is usually that incredible???. if you think so, I’l m teach you many picture again beneath:

So, if you would like secure all of these wonderful graphics related to (House Tax Form Do You Know How Many People Show Up At House Tax Form), simply click save link to store the photos to your computer. There’re available for down load, if you’d prefer and want to own it, just click save symbol in the post, and it will be directly down loaded to your notebook computer.} At last if you desire to obtain new and recent photo related with (House Tax Form Do You Know How Many People Show Up At House Tax Form), please follow us on google plus or save this website, we try our best to provide regular up-date with fresh and new graphics. We do hope you love staying right here. For many updates and recent news about (House Tax Form Do You Know How Many People Show Up At House Tax Form) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to offer you up-date periodically with all new and fresh pics, love your searching, and find the right for you.

Thanks for visiting our site, contentabove (House Tax Form Do You Know How Many People Show Up At House Tax Form) published . At this time we are excited to announce we have found a veryinteresting contentto be reviewed, namely (House Tax Form Do You Know How Many People Show Up At House Tax Form) Some people looking for specifics of(House Tax Form Do You Know How Many People Show Up At House Tax Form) and certainly one of these is you, is not it?