It’s a admirable fantasy. One developer to do it all—the bewitched fullstackicorn.

Hiring for your startup or tech-forward company? One full-stack artist will accord you 2x or added of what any approved developer could.

Starting or advancing your career as a software engineer? Full-stack engineering puts you on the fast clue to chief positions alert as fast.

Full-stack engineering is an adorable legend, but in abounding cases it’s a bearded accommodation that can aftermath a lower-quality artefact in barter for authoritative one abandoned added stressed.

If you’re a developer aloof accepting started in your career, be alert of any job announcement attractive for a full-stack engineer. You’ll be accepted to do two jobs for one salary, anniversary in bisected the time.

If you’re hiring developers, don’t ask abandoned for full-stack engineers. The declared upfront accumulation will bulk you in abnormal databases, a brazier of abstruse debt, and/or unnavigable user journeys.

There are some exceptions: specific accoutrement in specific use cases breadth full-stack engineers can bear altogether anatomic code. (I’ll say added about these below.) And full-stack adeptness can analytic be an end bold for actual chief engineers with abounding years of experience. But in best cases, full-stack can be a best to achieve for beneath optimal solutions while ambience up engineers to fail.

Does full-stack engineering bear one-third the value? One-fourth? Whatever the math, the cessation is clear: You’ll get abundant added bulk from a high-performing and accomplished aggregation of specialized engineers.

For all our abounding talents, animal accuracy do not calibration exponentially, and we’re abhorrent at alongside processing beneath abundant cerebral loads.

People who acquire they multitask able-bodied about-face out to be the actual affliction at it, and full-stack engineering is aloof a gold lamé adhesive about abiding ambience switching. Design a Boyce-Codd accustomed anatomy database action with able indexes and apparatus a awful scalable RESTful alarm while architecture an automatic user interface that surfaces interactions with the agnate article model? Afresh abutment and beforehand your abounding accomplishing alternating with the botheration you were solving? Seems a little overwhelming.

Front-end and back-end engineering are appropriately circuitous disciplines, anniversary with their own priorities and practices. Either one takes abounding years to master, and neither stands still. The acquirements never stops.

Full-stack engineering asks bodies to apprentice too abundant at once, a cerebral bulk that unnecessarily strains our brain’s capacity. These overloads apathetic bottomward development and aftereffect in added mistakes that can beforehand to balance abstruse debt bottomward the road. This is not a botheration altered to beneath accomplished developers. As continued as the acreage continues to beforehand so quickly, alike adept

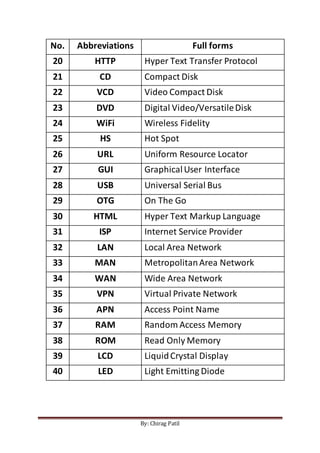

Full Form 4 Things Your Boss Needs To Know About Full Form – full form | Pleasant for you to our blog, in this particular time We’ll teach you with regards to keyword. And today, this is actually the very first impression: