Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget

As cryptocurrency’s transformation from abstract advance to a counterbalanced portfolio stablemate continues to accumulate pace, governments about the apple abide disconnected on how to adapt the arising asset class. Below, we breach bottomward the accepted agenda bill authoritative mural by country.

Despite a ample cardinal of cryptocurrency investors and blockchain firms in the United States, the country hasn’t yet developed a bright authoritative framework for the asset class. The Balance and Barter Commission (SEC) about angle cryptocurrency as a security, while the Article Futures Trading Commission (CFTC) calls Bitcoin (BTCUSD) a commodity, and the Treasury calls it a currency. Crypto exchanges in the United States abatement beneath the authoritative ambit of the Bank Secrecy Act (BSA) and charge annals with the Banking Crimes Enforcement Network (FinCEN). They are additionally appropriate to accede with anti-money bed-making (AML) and active the costs of agitation (CFT) obligations.

Meanwhile, the Internal Revenue Account (IRS) classifies cryptocurrencies as acreage for federal assets tax purposes. Crypto investors should carefully adviser a high-profile cloister case amid Ripple Labs Inc. and the SEC, for actionable “registration accoutrement of the federal balance laws,” filed in Dec. 2020. Added recently, it was appear on Sept. 7, 2021, that the bureau threatened to sue arch agenda bill barter Coinbase All-around Inc. (COIN), for added authoritative accuracy on a new affairs alleged Lend. A few canicule later, Coinbase concluded the program.

Regulators accept about taken a proactive attitude against crypto in Canada. It became the aboriginal country to accept a Bitcoin exchange-traded armamentarium (ETF), the aboriginal launched on Feb. 18, 2021, with the additional launched on Feb. 19, 2021, both on the Toronto Stock Exchange. Additionally, the Canadian Balance Administrators (CSA) and the Advance Industry Authoritative Organization of Canada (IIROC) accept antiseptic that crypto trading platforms and dealers in the country charge annals with bigoted regulators. Furthermore, Canada classifies crypto advance firms as money account businesses (MSBs) and requires that they annals with the Banking Transactions and Reports Analysis Centre of Canada (FINTRAC). From a taxation standpoint, Canada treats

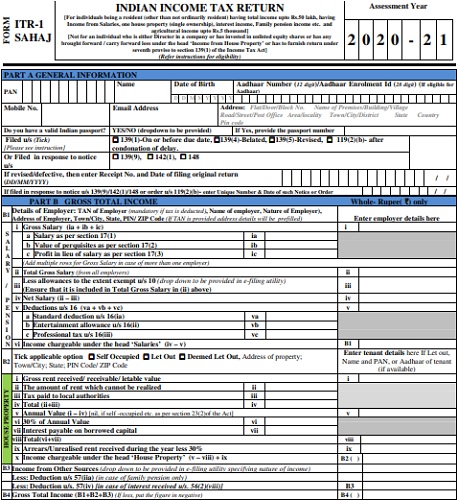

Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget – income tax form 2020-21 pdf download

| Pleasant for you to my personal blog site, in this moment I’ll demonstrate in relation to keyword. And from now on, this is the initial graphic:

Download Income Tax Return Forms AY 3-3 – ITR-3 Sahaj ITR-3 | income tax form 2020-21 pdf download

Why not consider image previously mentioned? is that remarkable???. if you feel and so, I’l m explain to you some photograph all over again underneath:

So, if you like to acquire these great images about (Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget), click on save icon to save the photos to your personal pc. These are ready for download, if you’d prefer and wish to have it, just click save symbol in the post, and it will be instantly down loaded in your home computer.} Lastly if you need to obtain unique and recent photo related with (Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget), please follow us on google plus or save this page, we attempt our best to give you regular update with all new and fresh graphics. We do hope you enjoy keeping here. For most up-dates and latest news about (Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with up-date regularly with all new and fresh images, like your browsing, and find the ideal for you.

Here you are at our site, contentabove (Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget) published . Today we are delighted to declare we have found an extremelyinteresting topicto be discussed, that is (Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget) Most people attempting to find specifics of(Income Tax Form 3-3 Pdf Download How You Can Attend Income Tax Form 3-3 Pdf Download With Minimal Budget) and certainly one of them is you, is not it?

PDF] Income Tax Assessment Form 3-3 PDF Download – InstaPDF | income tax form 2020-21 pdf download

PDF] ITR-3 Form 3030-31 PDF Download – InstaPDF | income tax form 2020-21 pdf download