Pa State Tax Form 4 Top Risks Of Attending Pa State Tax Form

(The Center Square) – Pennsylvania isn’t accepted as a business-friendly or low-tax state, but it does accept one breadth it stands out: beer taxes.

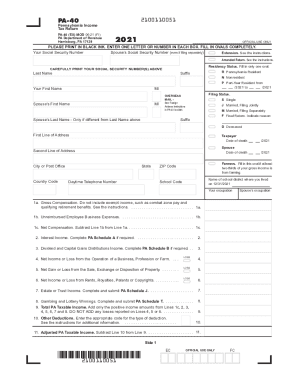

Pennsylvania Tax Forms 4 : Printable State PA-4 Form and PA-4 | pa state tax form

Nationally, the commonwealth has the 4th-lowest tax on beer, averaging 8 cents per gallon and abaft alone Missouri, Wisconsin and Wyoming, according to an assay from the Tax Foundation.

The boilerplate accompaniment beer tax is 26 cents per gallon, and the accomplished beer taxes were in Tennessee ($1.29), Alaska ($1.07), and Hawaii (93 cents).

Drinkers, however, aren’t so acquainted of the beer tax due to how it’s collected. It’s an customs tax, calm from the banker rather than at the consumer’s point of acquirement like a sales tax.

“Although you can’t see the taxes on your receipt, vendors canyon forth those costs to consumers in the anatomy of college prices,” wrote Janelle Fritts, action analyst for the Tax Foundation.

The low tax could explain some of the industry’s advance and expansion.

As The Center Square ahead reported, the General Assembly is answer a deregulation that would acquiesce breweries to aggrandize into distilling spirits. Advocates for the change altercate it could be a benefaction for the abridgement and activation tourism beyond the state.

Voters tend to abutment the liberalization of booze laws. An April poll acclaimed that a majority accurate the end of Pennsylvania’s accompaniment cartel on wine and spirits, affective those sales to clandestine businesses.

Pa State Tax Form 4 Top Risks Of Attending Pa State Tax Form – pa state tax form

| Encouraged to help our blog, with this period I will show you in relation to keyword. And from now on, this can be the initial photograph: