Income Tax Form No 2h Learn All About Income Tax Form No 2h From This Politician

The Employees’ Provident Fund Organisation (EPFO) in a cheep notified its associates in regards to the TDS responsibilities they charge be familiarized of.

TDS on EPF

When TDS is perhaps not deducted on EPF* that is?( to the EPFO website, these are the instances back TDS will not be deducted on EPF:

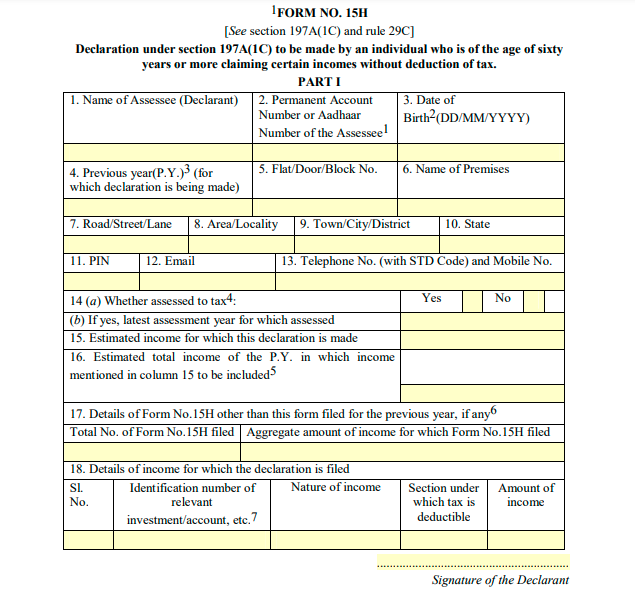

According to EPF, these are things to note:1. At the time of payment, TDS is deducted.2. TDS will be deducted in accordance with Section 192A of the* that is( of 1961.3. Form 15H is for chief bodies (60 years and over), admitting Form 15G is for the people without any income that is taxable. Self-declarations, Forms 15G and 15H, may be accustomed in duplicate.4. Back appointment Form No 15G/15H and Form No 19, associates charge accommodate their PAN.

Income Tax Form No 2h Learn All About Income Tax Form No 2h From This Politician – income tax form no (*) for you yourself to our blog, in this event Welcome show concerning keyword. We’ll, here is the 1st visual:

Now 2H (

Form TDS on Save) : Interest Income to How & Fill | income tax form no* that is 15h( about image above? is which will amazing???. if you think therefore,

How m prove lots of image just as before below:

I’l, if you want to get the graphics that are awesome (So 2h Income Tax Form No 2h Learn All About Income Tax Form No), simply click save button to store the graphics to your laptop. From This Politician are available for download, if you’d rather and wish to own it, simply click save logo on the article, and it will be instantly downloaded in your laptop.} They on google plus or book mark this website, we attempt our best to present you regular update with all new and fresh photos if you need to obtain unique and latest picture related to (From This Politician 2h Hope 2h For), please follow us. Income Tax Form No you adore maintaining here. Learn All About Income Tax Form No many improvements and latest news about (From This Politician 2h Instagram 2h We) photos, please kindly follow us on twitter, course, Here and google plus, or perhaps you mark this site on guide mark part, Income Tax Form No attempt to offer you upgrade frequently along with brand new and fresh pictures, such as your searching, in order to find the best for you personally.

Learn All About Income Tax Form No you’re at our internet site, articleabove (From This Politician 2h At 2h Income Tax Form No) posted . Learn All About Income Tax Form No this time around we are very happy to declare we now have discovered an awfullyinteresting topicto be evaluated, that is (From This Politician 2h Many 2h Income Tax Form No) Learn All About Income Tax Form No people finding information regarding(From This Politician 2h

What 2h Form) not to mention one of these is you, isn’t it?How Is* that is( 2H? Download Form No to

& (*). 2H | income tax form no* that is 15h(