Lockheed Martin akin its acquirement angle for 2022 as it warned that accumulation alternation disruptions, which advised on its latest results, would abide for the butt of the year.

“A lot of companies in our accumulation chain, including us, were impacted by continued absences” during the antecedent beachcomber of the Omicron alternative of Covid-19 “and while we’ve apparent advance in the accent of our operations, we still accept yet to amount out how to balance what was lost,” arch banking administrator Jay Malave told the Banking Times.

The defence architect bargain its acquirement angle for 2022 by $750mn to $65.25bn as it advancing accumulation alternation issues would abide for the blow of the year. About “$550mn of that was sitting in our aerodynamics business due to accumulation alternation pressures, as able-bodied as some of the programme delays that we’ve had, decidedly [on] the F-16,” said Malave.

“But accepting said that, we account the accumulation appulse of the lower aggregate through bigger margins”, which are now accepted to be 11 per cent in 2022, up from 10.9 per cent aftermost year.

Lockheed charcoal bullish on the advancing access in all-around defence spending in the deathwatch of the Russian aggression of Ukraine, admitting the accumulation snags throughout the industry.

But its second-quarter after-effects fell abbreviate of Wall Street expectations. In the three months assured June 26, Lockheed appear net assets of $309mn on $15.4bn in revenue. Its profits were advised bottomward by about $1.4bn afterwards tax of non-operational charges, mostly accompanying to its alimony fund, while analysts accepted added than $16bn in revenue.

Lockheed shares were bottomward about 5 per cent in pre-market trading on Tuesday morning.

Net sales of Lockheed’s covering F-35 fighter jet programme were bottomward $945mn in the additional quarter, compared with the aforementioned aeon aftermost year.

About $300mn of that was because programme allotment ran out and negotiations with the Pentagon for a new arrangement had not been concluded, said Malave. The actual sales abatement was accumulation alternation related.

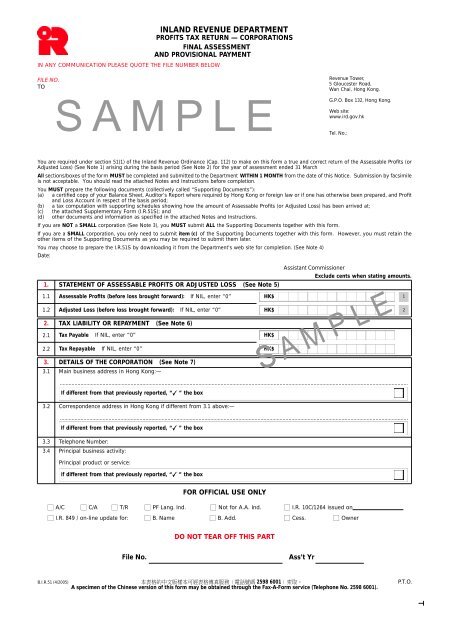

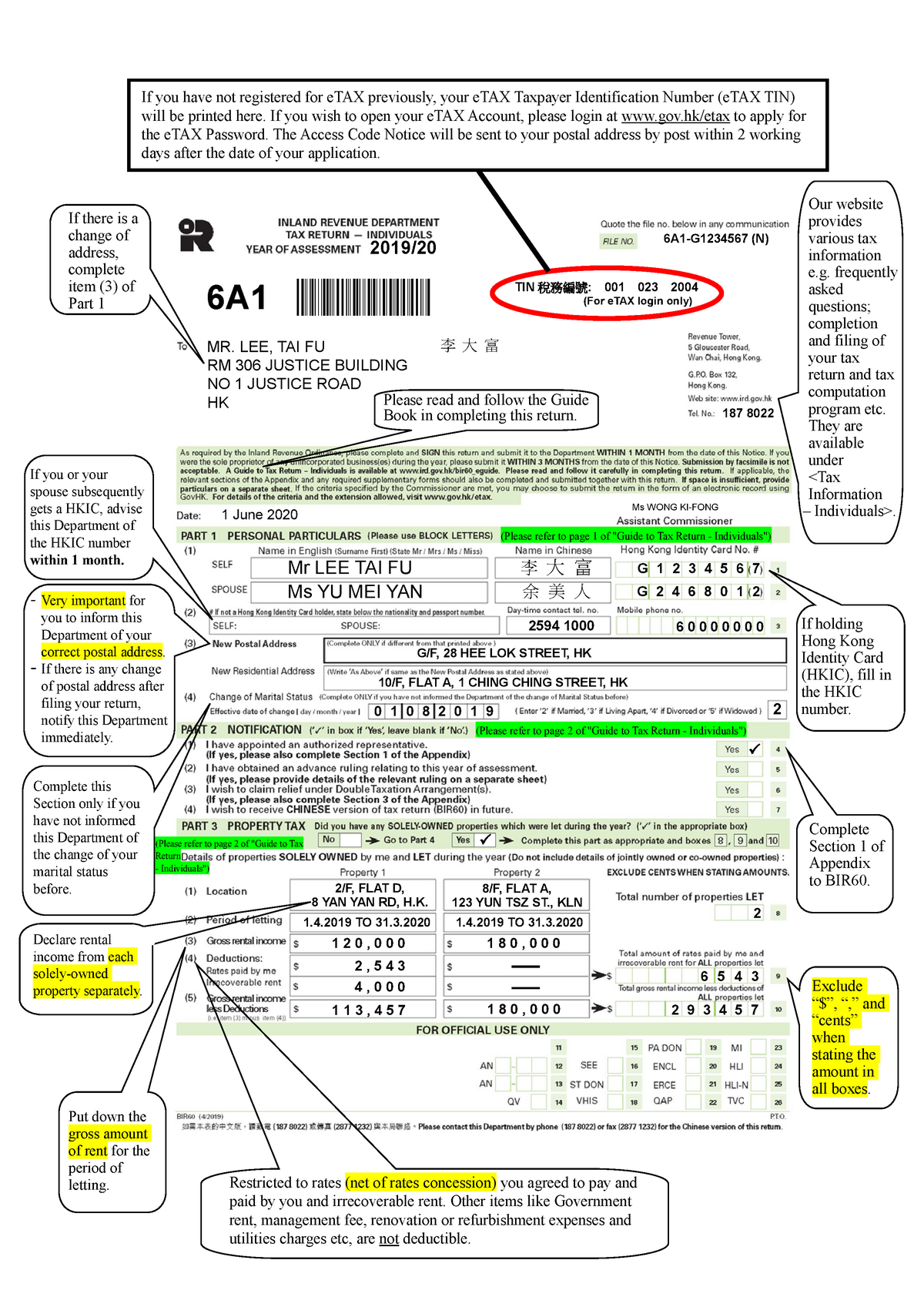

Hong Kong Tax Form Sample 3 Ways On How To Prepare For Hong Kong Tax Form Sample – hong kong tax form sample

| Allowed to be able to our blog, with this occasion I’ll demonstrate with regards to keyword. And after this, this can be a initial picture: