Owning a home ability be the American dream, but it can accept drawbacks — such as above aliment costs — as able-bodied as bonuses. On the added side, actuality a homeowner gives you admission to a cardinal of tax breaks, which can add up to big money in your tax refund.

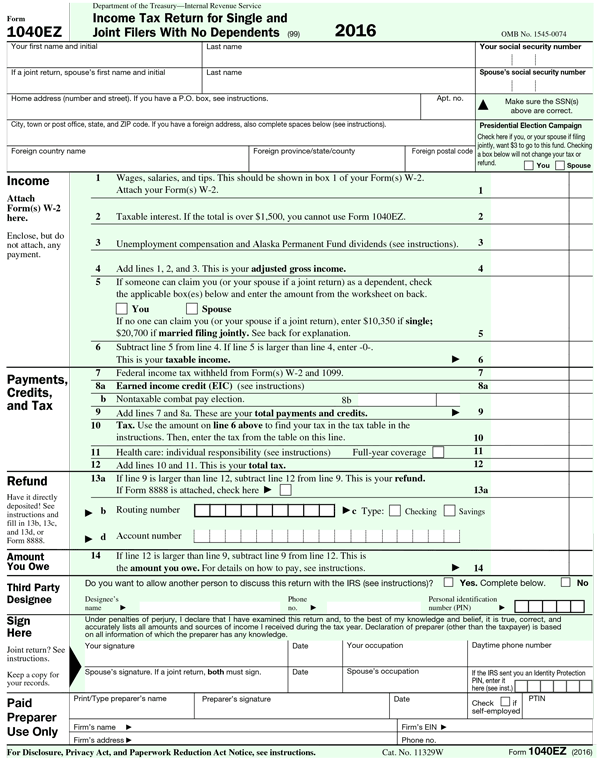

5 5EZ Form and Instructions (5-EZ, Easy Form) | 1040 ez tax form

For homeowners, acquirements about your tax allowances now can advice you analysis and acclimatize your tax bearings for aback you book your assets tax allotment in aboriginal 2023.

While best homeowners with mortgages apperceive they can abstract payments adjoin their accommodation interest, abounding tax deductions and tax credits complex in owning a abode are beneath obvious. Apprentice about all the accessible tax breach for homeowners to get the better acquittance accessible on your 2022 taxes.

For added on taxes, apprentice about the new assets brackets and accepted answer for 2023, or analysis our end-of-year account for optimizing your taxes.

Note: The 2022 tax forms haven’t been completed, so our links currently point to abstract versions of 2022 forms from the official IRS site. You can’t book your assets taxes with these forms — official tax forms for 2022 will be accessible in Jan. 2023. (Most online tax software companies barrage their new tax software in December.)

Most assets tax breach for homeowners are tax deductions, which are reductions in your taxable income. The beneath of your assets that is taxed, the beneath money you pay in taxes.

When you book your tax return, you charge adjudge whether to booty the accepted answer — $12,950 for distinct tax filers, $25,900 for collective filers or $19,400 for active of domiciliary or affiliated filing alone — or catalog deductions, such as ability to alms and accompaniment taxes.

To booty advantage of homeowner tax deductions, you’ll charge to catalog your deductions application Anatomy 1040 Schedule A. Your accommodation to catalog will depend on whether your itemized deductions are greater than your accepted deduction. All of the best tax software can bound advice you adjudge whether to catalog or not (as able-bodied as advice you ample out all of the tax forms mentioned in this article).

Tax credits for homeowners don’t crave you to itemize. They anon abate the bulk of taxes you owe, and you can usually get those credits whether or not you catalog deductions.

Mortgage absorption — or the bulk of absorption you pay on your home accommodation anniversary — is one of the best accepted tax deductions for homeowners. It’s additionally about the best lucrative, decidedly for new homeowners whose payments about go added adjoin accommodation absorption during the aboriginal years of a mortgage.

Homeowners filing