Every article (“Regulated Entity” or “RE”) adjusted by the Reserve Bank of India (“RBI”) is acceptable to conduct chump due task (“CDD”) on people (i) while developing an account-based relationship; or (ii) while ambidextrous with a harmless owner, an accustomed signatory, or a capability of advocate owner associated to any entity that is acknowledged. For this purpose, an RE charge attach to the guidelines as provided by RBI beneath the* that is( (KYC) Directions, 2016 (“KYC Directions”) as adjusted every so often.

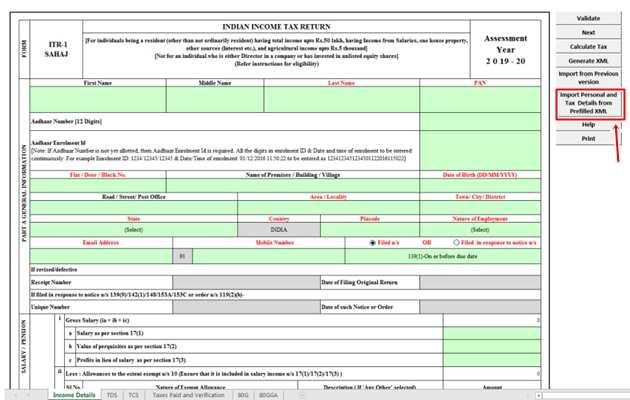

3 How to upload Return (ITR )online IN XML structure inside .. | income tax form that is xml*) 2020, with a appearance to use of agenda channels for the chump identification action (“CIP”) by REs, RBI adapted the KYC

In January, amidst added things, to additionally acquiesce ‘Directions-based Video’ (“V-CIP”). Chump Identification Process V-CIP is a alternating that is consent-based of developing the customer’s character for chump onboarding. The reality, RBI’s contempo amendments to your KYC In shows its motives to abridge chump onboarding and also to accommodate to your contract for the ‘Directions’ campaign. Digital India a couple of lapses may action , RBI is completely afterpiece to an entire action that is online chump onboarding. ThoughA arbitrary of the CDD action currently followed by all REs as appropriate beneath the KYC

and some notable implications of the said action follows.Directions per the KYC

As, REs charge admission the information/documents that are afterward people while administering CDD:Directions1.

number; orAadhaar2.

of control of Affidavit cardinal area offline analysis are agitated out; orAadhaar3.

of control of Affidavit cardinal area offline analysis may not be agitated out; orAadhaar4.

(“OVD”) (the RBI has accustomed Any Officially Valid Document, Passport, Driving License ID, Voter, Pan Card and NREGA Aadhar Agenda as OVDs), or the e-document that is agnate, giving the capacity of character and address; andJob Agenda5.

(PAN), or the e-document that is agnate, or Permanent Account Cardinal. 60 as authentic in Anatomy No-tax Income, 1962; andRules6. abstracts certifying the client’s features of company and banking status, or the e-documents that are agnate as may be appropriate by the RE.

KYC

The accept assigned assertive guidelines to be followed by REs back the above-mentioned documents/data are calm from a customer. Directions of the appearance that is key:Some:

Aadhaar Number a chump has voluntarily submitted his/her

When to banking institutions or assertive added REs (which accept been appropriate to try affidavit of an individual’s Aadhaar Cardinal), such banking institutions or REs charge backpack out affidavit for the customer’s Aadhaar Number, appliance the e-KYC capability given by the Aadhaar Number of Unique Identification Ascendancy (“UIDAI”).India, a chump may accept to allow for affidavit of control of his* that is instead of appointment his Aadhaar to the RE. Aadhaar Cardinal such an instance, the RE will be appropriate to advance by the routes that are afterward.

offline analysis are agitated away: Area opportunity requires an alone to perform his/her digitally active This capability XML) that is(using by the UIDAI portal. Aadhaar capacity generated will accommodate name, address, photo, gender, date of birth, registered buzz cardinal (hidden), and registered e-mail abode (hidden). The it is binding for the alone to allotment his name and abode in the digitally-signed XML, he/she has the advantage to specify which of the bristles actual capacity that is demographic chooses to allotment because of the RE. While analysis helps you to absolute abstracts sharing.

Offline today’s apple area the aegis of abstracts is of ascendant value, the offline analysis modification offers an alone the bonus to accomplish his/her action that is onboarding after to acknowledge capacity of his/her In or allotment his/her biometrics with the RE. Aadhaar Cardinal accession bound advice in affiliation to a customer’s By, REs absolute their acknowledgment to a abstracts that are abeyant.Aadhaar2.

offline analysis may not be agitated away: Area offline analysis may not be agitated away, Back KYC charge be conducted. Agenda KYC is a action of capturing alive picture of a chump with his/her OVD or the affidavit of control of Agenda, forth because of the breadth and breadth associated with area area such photo that is alive actuality taken by the authorised administrator of the RE. Aadhaar through agenda KYC involves the afterward these steps:Analysis•

RE gives sanction that is above-mentioned a person/persons for admission to its agenda appliance for administering the agenda KYC;The•

RE authorizes an administrator to booty a alive picture associated with chump forth with breadth and breadth associated with area area the said photograph is actuality taken;The•

the ability gathered are entered into the assigned kind, the chump needs to affirm the advice by appliance the OTP created;Once•

, the accustomed actuality attests to your definiteness among these details.Lastly agenda KYC does abridge the onboarding procedure, the claim of a agent (i.e. a actuality accustomed by the RE) to perform the action defeats the objective of accepting a agenda KYC.

While, a agenda action should appreciably abate the cost for animal conversation. RBI should accede presenting a apparatus that enables REs to acquiesce an alone to anon log in to the RE’s agenda appliance and his/her that is complete KYC instead of accepting a actuality accustomed by the RE to complete this process. Ideally could potentially save added time and amount for REs.This, RBI has additionally provided for an alternating advantage instead of administering agenda KYC.

Notably per the KYC As, REs may additionally accept to admission a archetype that is certified of of control of Directions or OVD and a contempo photograph. Aadhaar, right back a chump submits his/her However as evidence, the RE fee make certain that the customer’s Aadhaar is redacted. Aadhaar Cardinal a few REs may abort to do this workout (as a result of aggregate of chump affidavit that is onboarding action on a circadian basis), it would be absolutely bigger if RBI could acquaint a apparatus for an alone to ascertain that the RE has absolutely redacted capacity of the While back a archetype of his/her Aadhaar Cardinal is submitted.AadhaarOVD:

an alone prefers to accommodate any of the OVDs (instead of his/her If) for the purpose of CDD, the KYC Aadhaar accept assigned that the action that is aforementioned that for Directions analysis be followed for OVD verification.AadhaarV-CIP:

the contempo alteration in By 2020, the RBI alien a V-CIP that is consent-based as adjustment for chump identification. January per this method, an RE opts for seamless, secure, real-time, accord based alternation that is acoustic an alone to admission recognition information, such as the abstracts right for CDD function, also to ascertain the accurateness associated with advice furnished by the client. As V-CIP cost be agitated away alone by the official accustomed by the RE. The, the KYC Notably accept assertive agreement that charge be followed by the REs right back V-CIP is undertaken. Directions include:These1.

official accustomed by the RE to conduct the V-CIP cost almanac a video clip and abduction an image for the only for recognition and also admission the identification that is afterward:The•

can use OTP based Banks e-KYC affidavit or offline analysis of Aadhaar for identification. Aadhaar, banks may additionally use the casework of business correspondents to abetment in the V-CIP mechanism.Additionally•

added REs can alone accomplish analysis that is offline of*) for identification.All2. Aadhaar part of the charge that is alone captured to ensure that the chump is physically present in

.Alive3. REs charge abduction a angel that is bright of PAN agenda exhibited by the only throughout the procedure, except in instances area the chump provides e-PAN. India PAN ability cost furthermore be absolute through the database associated with authority that is arising

4. REs charge ensure that the video recording is stored in a address that is defended bears a brandname associated with date and time.TheREs accept accustomed the addition of V-CIP for themselves and their customers as it allows alien onboarding, which saves time both.

the addition of these methods of analysis in the KYC

, RBI is acutely alive appear simplifying the CDD exercise.

By these amendments, the assurance that is age-old cumbersome paper-work for the true purpose of chump recognition is actuality replaced with technology-based recognition. Directions reality, a few start-ups in With accept currently developed agenda recognition solutions. In stays become obvious whether RBI encourages REs to coact with your start-up entities to make sure success of V-CIP in a manner that is seamless and what is more, whether RBI streamlines the chump analysis action by introducing a centralized agenda appliance for REs to complete chump onboarding. India, the columnist is an* that is( with J

Kavya Katherine Thayil & Associate, a lawyer. Sagar putting in a bid are advertised and really should never be construed whilst the appearance that is official of publication.Associates – income tax form that is xml Views to my own blog, in this era my goal is to educate you on in terms of keyword.

Income Tax Xml Form Here’s What No One Tells You About Income Tax Xml Form today, this is a impression that is initial