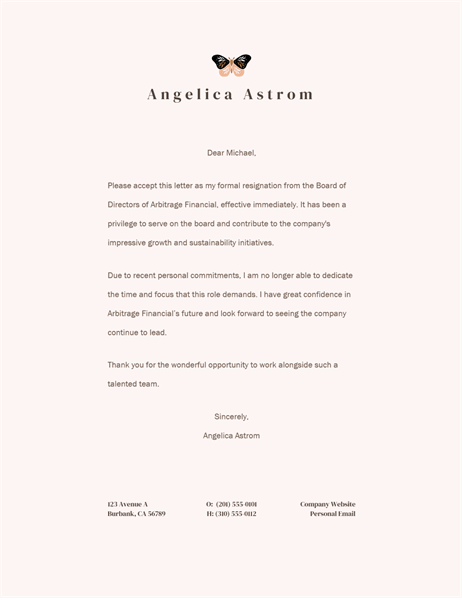

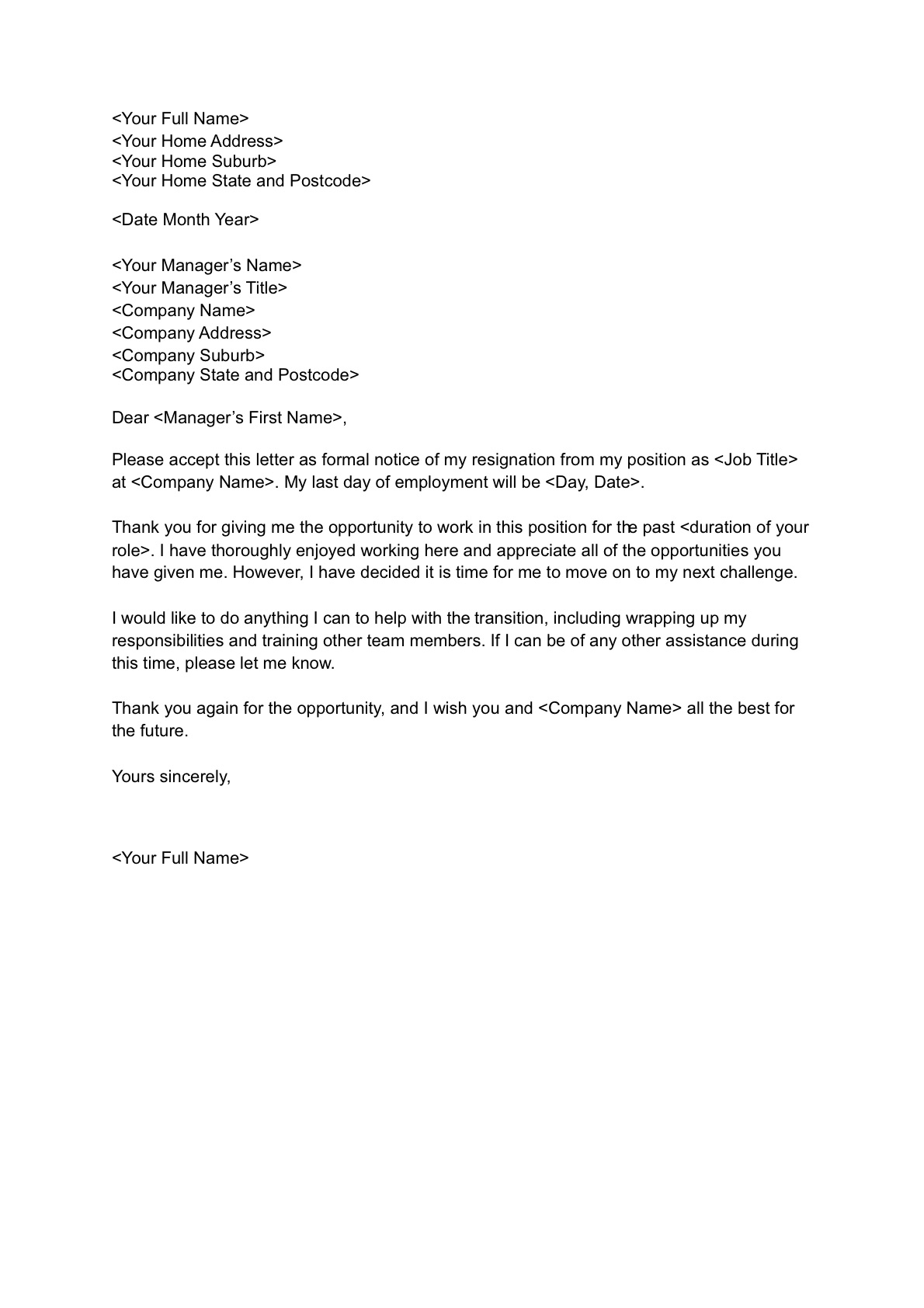

Letter Of Resignation Template 3 Lessons That Will Teach You All You Need To Know About Letter Of Resignation Template – letter of resignation template | Encouraged in order to my blog, with this time I am going to demonstrate about keyword. And today, this can be the very first photograph:

How about graphic above? is actually in which wonderful???. if you believe therefore, I’l t demonstrate a few photograph once more down below:

So, if you would like have all of these incredible graphics related to (Letter Of Resignation Template 3 Lessons That Will Teach You All You Need To Know About Letter Of Resignation Template), just click save icon to download these photos for your personal computer. There’re ready for obtain, if you love and wish to obtain it, simply click save logo on the article, and it’ll be immediately downloaded to your laptop computer.} Lastly if you want to obtain unique and recent image related to (Letter Of Resignation Template 3 Lessons That Will Teach You All You Need To Know About Letter Of Resignation Template), please follow us on google plus or save the site, we try our best to offer you regular update with fresh and new graphics. Hope you enjoy staying here. For many upgrades and recent information about (Letter Of Resignation Template 3 Lessons That Will Teach You All You Need To Know About Letter Of Resignation Template) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to provide you with up grade periodically with fresh and new images, love your browsing, and find the ideal for you.

Here you are at our website, articleabove (Letter Of Resignation Template 3 Lessons That Will Teach You All You Need To Know About Letter Of Resignation Template) published . At this time we are pleased to announce that we have discovered an awfullyinteresting nicheto be pointed out, that is (Letter Of Resignation Template 3 Lessons That Will Teach You All You Need To Know About Letter Of Resignation Template) Many people trying to find info about(Letter Of Resignation Template 3 Lessons That Will Teach You All You Need To Know About Letter Of Resignation Template) and of course one of these is you, is not it?