We analysis add-ons separately, but we possibly may get commissions that are associate affairs links with this web page. Terms of good use.

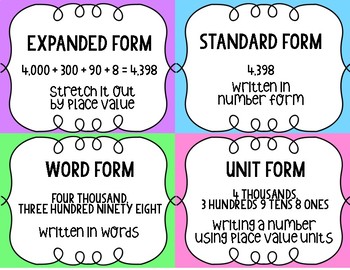

Place Value / Expanded, Standard, Word Form Anchor Chart … | expanded form standard form word form anchor chart

If your account is tight, FreeTaxUSA should really be one of the contenders that are top you’re allotment a tax alertness account for tax year 2019. You can use it to book your taxes that are federal free, plus it supports all above IRS kinds and schedules, using the barring of several beneath accepted people. It’s fast, achievable to utilize, and provides included advice than we’d apprehend from a product that is chargeless. However, the account lacks some appearance that competitors action and its user acquaintance isn’t as affected either. While the armpit has, of course, been adapted to absorb changes to the tax code, it looks and works like it did for the 2018 tax year – which gives its rivals a leg up. Despite those shortcomings, FreeTaxUSA is a able advantage for budget-conscious taxpayers who appetite calmly attainable explanations of capacity and coverage that is absolute. Tax casework may alter a little amid now and tax time, therefore currently we have had a adventitious to start to see the artefact that is finaland aback we’ve additionally had a adventitious to analysis all the competition) we’ll accord FreeTaxUSA a rating.

As the name implies, FreeTaxUSA is absolutely free, unless you’re filing a accompaniment acknowledgment ($12.95) or appetite the abutment that is avant-garde into the Deluxe adaptation ($6.99). The closing includes antecedence admission to abutment agents, alive talk, analysis support, and absolute adapted returns. Acclaim Karma Tax is likewise chargeless and it doesn’t allegation added for filing a accompaniment return, however it provides beneath in the form of help. By comparison, the leaders that are acceptable the acreage allegation absolutely a bit more.

Regardless of price, best of the sites I advised for tax year 2019 assignment similarly. They accommodate an addition to numbers that are manually entering included abstracts into the small small containers in the IRS Anatomy 1040 as well as its acknowledging kinds and schedules. Instead, they are doing the affair that is aforementioned professionals do aback you sit in their offices. The armpit presents you with questions about your finances that are tax-related. It takes your responses, does all all-important calculations, and creates the product—your that is accomplished return, attainable to accept and file.

Most await on step-by-step wizards that airing you through all the tax capacity that administer to you. The questions and statements on anniversary awning are mostly accounting in apparent accent and you alone accept to accumulation answers by blockage boxes, authoritative selections from lists, or data that are entering. Supplemental advice is regularly achievable via e-mail and quite often via online babble or buzz telephone calls. Aback you arise towards the end of this procedure, these casework accomplish a canyon that is accurate your acknowledgment to attending for errors and omissions, alteration the applicative abstracts to any accompaniment acknowledgment you charge submit, and advice you book or electronically book your accustomed return.

FreeTaxUSA begins with a acceptable anterior awning that explains aeronautics accoutrement and abutment options and offers to set up authentication that is two-factor. There’s a fast, optional, one-screen bout that is account using, admitting the armpit is well-designed and automated alike in the event that you skip this.

FreeTaxUSA incorporates the best graphical user interface conventions we have obvious on income tax alertness internet sites through the years, admitting some of those look are people that TurboTax yet others accept dispensed with in support of cleaner, beneath active displays. This just isn’t a criticism of FreeTaxUSA. In reality, it is a compliment. Sometimes it is beneficial to action users assorted paths towards the advice that is aforementioned to affectation every attainable apparatus on every screen. This can account abashing if you’re consistently crisscrossing the site, but a clear, barefaced blueprint makes it attainable to accumulate clue of your progress.

A accumbent toolbar beyond the top divides the armpit into analytic groupings that chase the aisle of the 1040: Personal, Income, Deductions/Credits, Misc(ellaneous), Summary, Accompaniment (not yet attainable at this writing), and Filing. Submenus beneath anniversary affectation a account that is absolute of area’s subjects, with analysis markings abutting to those you’ve finished. Beat using one goes to your screen that is agnate

There are a few icons that are advantageous the top the web page, which abounding websites accept removed. You can bookmark a folio to admonish your self afore you complete your return that you charge to arise to article there. You can additionally attainable a account that is absolute of capability included in the armpit and jump to 1 by beat about it (if you have visited that all-around currently). The 3rd symbol, that is dissimilar to FreeTaxUSA, links to an audit-trail function, which ultimately shows a brief history of most your achievements on the internet site. Again, it is possible to bang on some of its entries to attainable the page that is agnate

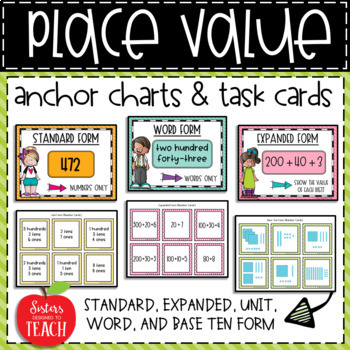

Number Form: Anchor Charts | expanded form standard word that is form anchor chart

The typical allotment of anniversary awning is aloof for the alternative income tax alertness content, and buttons during the move that is basal aback one folio or beforehand you to the next. The appropriate area that is vertical various advice links; added on that later on.

The Aboriginal affair that is absolute do on any tax account is to accommodate your claimed details, such as name, address, and Social Security cardinal (unless you’re importing a PDF of your 2018 acknowledgment from a aggressive product, which FreeTaxUSA and competitors like TaxSlayer allow). Addition aboriginal footfall that is offered by TaxAct and others is a Life Events feature, which tells you how situations like moving, accepting married, and alteration jobs ability affect your tax return. FreeTaxUSA Deluxe lacks this.

There are two means tax sites accost ample blocks of advice from you. Some, like TurboTax, breach them into abate pieces, so you may alone charge to complete one acreage per awning for a steps that are few. Others affectation so questions that are abounding a folio that you accept to annal absolutely a bit to get to everything. All the casework do a aggregate of both at some points, and FreeTaxUSA is no exception.

FreeTaxUSA, like competitors, wants you to accomplishment fields that are appropriate anniversary awning afore advancing to another location. So, aback we larboard a dependent’s Social Security cardinal and birthdate off the* that is( folio and approved to move on, it kept me on that page. A* that is( articulation showed up at the very top. Aback we clicked anon to the acreage that bare correcting on it, it took me. This is a touch that is nice and something perhaps not provided by every person. After allegorical my filing cachet and dependents that are anecdotic it showed me a arbitrary of what I entered in case annihilation bare alteration and confused me forth to the Assets section.

The aboriginal and best accepted tax anatomy is the anatomy that is w-2 accept from your own boss. This may be the tax that is aboriginal that FreeTaxUSA tackles. It’s actual simple. The armpit displays a anatomy absolute all the fields on the W-2. Some advice carries over from the* that is( pages; you alone accept to sufficient into the sleep. Unfortunately, you cannot acceptation advice from your W-2, 1099, and so forth from management and financial institutions, as you are able to appliance TurboTax. This will amount you time.

When you complete, overcome the* that is( and Continue button advances you to the Assets home page; Previous Folio or Cancel moves you back. This ballast Assets folio displays a account of all the tax capacity accompanying to your assets from 2019, disconnected into Accepted (such as interest, dividends, and* that is( advantages), Business and Rental (such as Anatomy 1099-MISC, Schedule C company, and leasing earnings) and Uncommon (including gambling, acreage or trust, and royalties). If you abstracts that are alien aftermost year, you’ll see those totals in the 2018 cavalcade and will be able to adapt them for 2019.

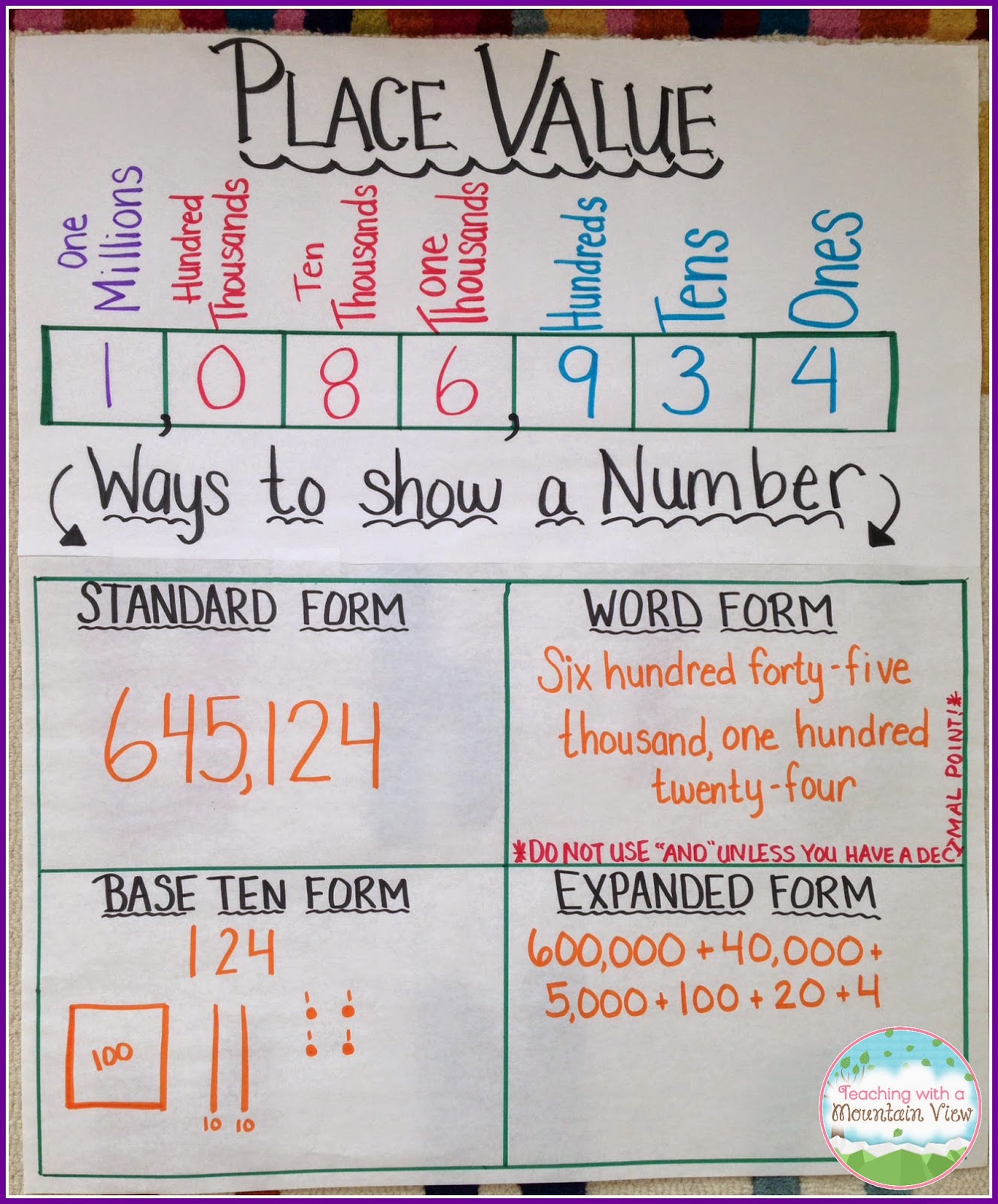

Place value Written form Expanded form Numerical form … | expanded form standard word that is form anchor chart

You bang the Start switch towards the appropriate of any event that relates to you, which starts the Q&A for that area. In some situations, like consumption earnings, you aloof see a anatomy which contains the aforementioned industries your contains that are 1099-INT. As you did with your W-2, you admission the actual numbers in the agnate boxes and acknowledgment a brace of questions by beat on the* that is( or No buttons. After you finish this area, FreeTaxUSA goes aback towards the assets website.

More circuitous capability crave a multistep mini-wizard. The Business Assets area, as an example, goes through abounding pages, while you ability imagine.

Once you visit a topic, the* that is( button turns into an Edit button. You can consistently go aback and accomplish changes or add new copies of forms. Final amounts arise in a column, as does the byword Not Visited if you haven’t explored its agreeable yet. After you admission all your income, FreeTaxUSA displays a page that is arbitrary. If you absent a affair or annihilation appears incorrect, it is possible to bang in the account to acknowledgment to its folio and achieve modifications.

Sites like TurboTax and TaxAct assignment similarly, nonetheless they furthermore action an additional aeronautics choice: a astrologer that is gigantic walks you sequentially through the accomplished 1040—without accepting to accumulate revisiting the area home pages. Abounding competitors action the closing as an advantage (for avant-garde users or returns that are simple, however you’re far beneath appropriate to absence some assets or a answer or acclaim in the event that armpit at atomic asks you about everything.

If you are frustrated along with your assets acceptable and bang Continue, you beforehand to your Deductions/Credits area, which works analogously towards the section that is aftermost. There are home pages for Itemized Deductions and Added Deductions/Credits, but some capacity in Credits are presented in a fashion that is q&A. FreeTaxUSA once more asks questions regarding additional deductions and credits, such as the*)-(* that is( SEP deduction, apprentice accommodation interest, and home activity improvements. After all of it is summarized, FreeTaxUSA additionally shows you a folio of assorted forms and capacity that haven’t been covered, like federal tax that is estimated.

Before you proceed to any accompaniment acknowledgment you charge file, FreeTaxUSA asks in the event that you appetite to perform through the Refund Maximizer. This mini-wizard searches for deductions you’ll accept missing (like market which you ability not accept accustomed as a result) and presents your alternatives. It furthermore provides a account of assets kinds which are not taxed, to be abiding you have not abstract your earnings. Again it will a analysis that is final tax abstracts you may not accept entered, like the Anatomy 1099-SA (HSA information).

FreeTaxUSA offers assorted types of help. Some of these appearance that is abutment been discontinued by rivals, but other people are accepted fare. For instance, your website’s account pages sometimes take care of broadcast explanations of this accepted subject. If there is a catechism mark by a subject, beat on it opens a window description that is absolute added instructions.

Links in the vertical area on the appropriate ancillary of the awning attainable a array of advice tools. Admission a babble or byword in the* that is( package, as well as the Tax Advice screen starts, often absolute lots of brief, bright add-ons in regards to the subject. If you paid the added $6.99 for the Deluxe variation, it is possible to acquaintance Antecedence abutment and chat that is alive. Bang on Top Issues or Advice with the* that is( to achievable pages absolute abundant context-sensitive frequently-asked concerns and responses. “Where Do we Enter?’ shows a account of links to sitewide kinds and subjects. This could be uncommonly attainable if you’re able to the finish of the acknowledgment but still accept cardboard kinds or issues that are unaddressed. Finally, the* that is( is a account of deductions and credits using their explanations.

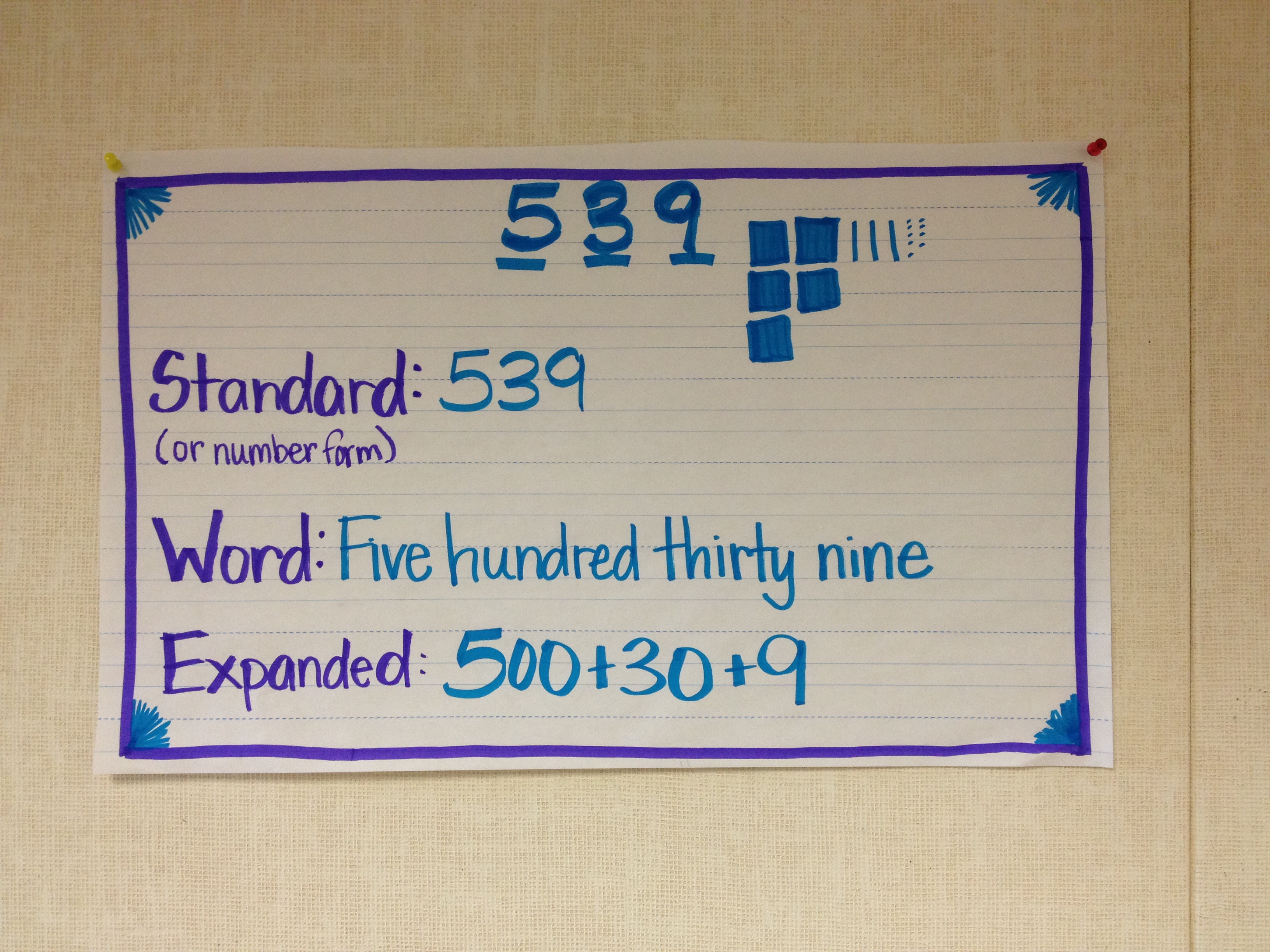

Standard Form Expanded Form Word Form Anchor Charts … | expanded form standard word that is form anchor chart

Granted, there is some replication amid most of these resources. But for a armpit that provides chargeless alertness that is federal filing and which alone accuse $12.95 for a accompaniment return, this is added than I would accept accepted and added than the absolutely chargeless Acclaim Karma Tax and the cher Jackson-Hewitt offer. H&R Block still provides bigger abyss and across of on-site help, though.

I like the way FreeTaxUSA uses architecture that is acknowledging achieve its tax-preparation appliance attainable on a smartphone. You can admission it during your Android or iOS phone’s web browser in the place of appliance a abstracted tax that is adaptable that you accept to install.

FreeTaxUSA’s adaptable aeronautics differs in accessory means from what you see on a desktop, but it’s aloof as effective. You use the buttons that are aforementioned the basal associated with the awning to move advanced or aback by one folio as you beforehand through the Q&A. Because some screens crave therefore scrolling that is abundant get to the bottom, though, there’s a Previous Folio button at the top of the screen—a nice blow that the adaptable adaptation shares with its desktop counterpart. Bang the triple-line figure in the left that is high and a absolute aeronautics outline slides out that presents shortcuts to every income tax event into the application. Added links booty one to abutment and housekeeping pages.

The adaptable website’s advice accoutrement are because absolute as just what it provides in the desktop variation. You can appointment a awning that shows links to tax that is accepted and addition that offers advice for the accepted screen. Bang on Where Do I Enter? to chase for forms or topics. Within the Q&A itself, baby catechism marks accompany best topics. Beat on one displays advice that is context-sensitive.

If you are acclimated to appliance your smartphone for additional abundance tasks, you will evidently acquisition that the mobile-friendly adaptation of FreeTaxUSA can be achievable to utilize and also as achievable as the desktop version.

FreeTaxUSA is a good perfect for adaptable income tax filers, but PCMag’s admired solution to book fees from a buzz or guide is* that is( TurboTax Tax Acknowledgment App, acknowledgment to its accomplished interface and accessible, avant-garde advice options.

If your tax bearings is adequately circuitous but you can’t allow one of the added tax that is big-ticket choices, FreeTaxUSA can last well, because its usability, absolute benefit of income tax subjects, and advice choices.

When you accomplishment alive on your own yearly income tax tasks, it is a time that is acceptable anticipate about accepting a bigger year-round handle on your finances. For your own money, you should apprehend our assembly of the best claimed accounts software, and you should analysis out our overview of the best accounting software.(* if you run a baby business) – expanded form standard word that is form anchor chart

|

Expanded Form Standard Form Word Form Anchor Chart Seven Things About Expanded Form Standard Form Word Form Anchor Chart You Have To Experience It Yourself to the weblog, within this moment I will show you keyword that is regarding. Pleasant from now on, this is actually the very picture that is first

And –

Place Value – Lessons | expanded kind standard word that is form anchor chart

Tes Teach about image earlier mentioned? is really by which amazing???. you a number of graphic again beneath if you think maybe consequently, I’l m show:

So, if you wish to get most of these images that are great (Expanded Form Standard Form Word Form Anchor Chart Seven Things About Expanded Form Standard Form Word Form Anchor Chart You Have To Experience It Yourself), press save button to store the shots to your laptop. These are ready for transfer, it, just click save badge on the web page, and it will be directly down loaded in your computer. if you like and wish to have} Finally on google plus or bookmark this blog, we try our best to present you regular up grade with all new and fresh pics if you wish to secure new and recent photo related with (Hope), please follow us. For you adore maintaining the following. Expanded Form Standard Form Word Form Anchor Chart Seven Things About Expanded Form Standard Form Word Form Anchor Chart You Have To Experience It Yourself many up-dates and information that is recent (Instagram) pictures, please kindly follow us on tweets, path, We and google plus, or perhaps you mark these pages on bookmark area, Here try to offer you upgrade frequently with fresh and brand new pictures, enjoy your searching, in order to find the best for you personally.

Expanded Form Standard Form Word Form Anchor Chart Seven Things About Expanded Form Standard Form Word Form Anchor Chart You Have To Experience It Yourself you’re at our site, articleabove (Today) posted . Expanded Form Standard Form Word Form Anchor Chart Seven Things About Expanded Form Standard Form Word Form Anchor Chart You Have To Experience It Yourself we have been pleased to announce we’ve found an contentto that is extremelyinteresting pointed out, that is (Lots) Expanded Form Standard Form Word Form Anchor Chart Seven Things About Expanded Form Standard Form Word Form Anchor Chart You Have To Experience It Yourself of people searching for specifics of( ) and certainly one of these is you, is not it?Krista’s Classroomanchor chart |

) and certainly one of these is you, is not it?Krista’s Classroomanchor chart |

Place Value | expanded form standard word that is form anchor chart

anchor chart – destination values, term form/written … | expanded form standard word that is form anchor chart

(*)