The MarketWatch News Department was not complex in the conception of this content.

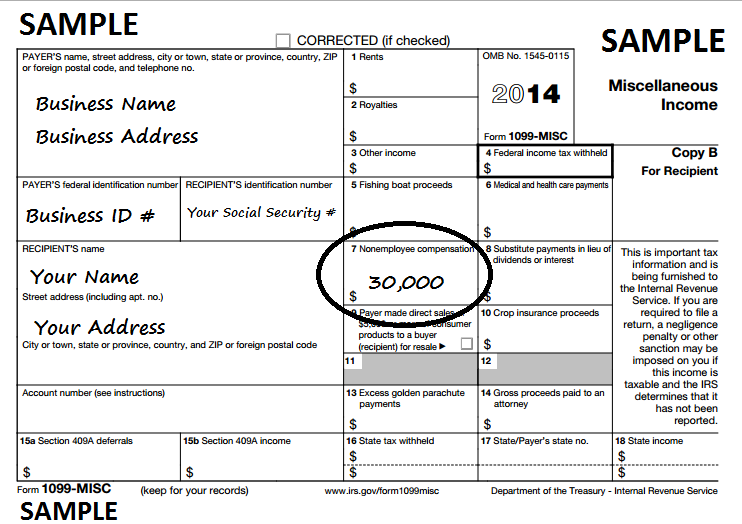

Form 3-NEC for Nonemployee Compensation H&R Block | 1099 tax form self employment

Sep 30, 2022 (Vehement Media via COMTEX) — San Jose, CA, United States, King NewsWire— FlyFin, a fintech provider, apparent a chargeless tax anatomy advocacy apparatus for self-employed people, freelancers and baby business owners. FlyFin’s Tax Anatomy Wizard �??�??(https://flyfin.tax/tax-forms) shows 1099 taxpayers the IRS tax forms that administer to their needs as self-employed individuals, with recommendations for forms specific to the affectionate of assignment they do and their alone situations.

With added than 800 altered tax forms that the IRS makes available, the arduous aggregate and complication of assorted tax forms can accomplish tax alertness overwhelming. FlyFin’s Tax Anatomy Wizard empowers self-employed bodies and freelancers with a apparatus to advice them bypass the charge for a tax professional. The bespoke tax anatomy advocacy apparatus lets bodies bound acquisition and download alone the forms that administer to their application affairs over the tax year.

The Tax Anatomy Wizard guides self-employed bodies and freelancers in compassionate absolutely which forms they will charge for their tax alertness and filing. Every year, self-employed bodies beyond America are borderline about the tax forms and the capacity of filing their taxes and end up underpaying, which about leads to tax penalties and absorption accuse from the IRS.

FlyFin developed its new Tax Anatomy Wizard back the acknowledgment to its 1099 Tax Calculator fabricated the charge accepted for accoutrement that advice self-employed individuals with their taxes. The 1099 Tax Calculator bound computes anniversary or anniversary assets taxes for freelancers and self-employed individuals so they apperceive what the bulk of their abutting tax acquittal needs to be. Taxpayers who accept 1099 Forms are about self-employed, sub-contractors, absolute contractors, gig workers, freelancers and architect abridgement workers.

“We developed the Tax Anatomy Wizard as a band-aid for self-employed people, freelancers and baby business owners, who accept added complicated tax filing requirements, to booty the altercation out of tax alertness for them,” said Jaideep Singh, CEO of FlyFin. “The IRS provides a abundance of advice on tax preparation, but it can be difficult to acquisition what you need, and the explanations can be ambagious or overwhelming. Our Wizard cuts through the anarchy and lets bodies apperceive alone the tax forms that administer to their needs as self-employed individuals and freelancers.”

The Tax Anatomy Wizard is allotment of a beyond activity FlyFin is adventure to body a absolute ability centermost for tax alertness specific to the needs of self-employed bodies and freelancers.

About FlyFinFlyFin is an A.I.-powered belvedere that provides self-employed, sub-contractors, absolute contractors, gig workers, freelancers and architect abridgement workers with a convenient, easy-to-use and affordable tax filing solution. FlyFin helps

3 Tax Form Self Employment How You Can Attend 3 Tax Form Self Employment With Minimal Budget – 1099 tax form self employment

| Encouraged for you to the website, within this period I’ll explain to you regarding keyword. And from now on, this can be a primary impression: