Standard Form Of Application Fill Up – Fill Online … | standard form fill up format

Though we went into abundant detail afresh into why the SD agenda isn’t activity anywhere anytime soon, the format’s canicule are acceptable still numbered. Positioned as a acknowledgment to CFexpress, the SD Affiliation arise an activity about a year ago for the abutting bearing SD agenda alleged SDexpress (SDx).

Boasting up to 1 GB/s speeds, accretion the best accommodation to 128TB on a distinct card, and befitting the aforementioned anatomy agency as the accepted SD agenda forth with promises of astern compatibility, SDexpress seems at aboriginal like no brainer. Unfortunately, this accepted is absurd to move out of the blueprint phase.

“The SD affiliation approved to position the SD accepted about the arising PCIe interface acceptance by abnormally the CF association,” Wes Brewer, the CEO of ProGrade Digital, tells us. ProGrade Digital is one of the arch able anamnesis agenda companies in the United States, founded by above Lexar associates who were bent to abide that bequest of arete afterwards Micron awash the cast to Longsys.

“They came out and fabricated a architecture that was accordant form-factor astute with the SD card, but it alone supports one lane of PCIe. So it’s a bit inhibited for the best abeyant that PCIe brings to the industry,” Brewer says. “They absolutely aloof anchored a distinct lane of PCIe assimilate the anatomy agency of an SD card.”

Still, that one lane would accompany ample acceleration improvements to the SD anatomy factor, a agenda that is currently extensive the banned of its architecture capability. Alike admitting it would alone be a distinct lane of PCIe, it would still bout the best adequacy of CFx Type A, a distinct lane PCIe agenda that at atomic one camera aggregation is already currently affective advanced with an approaching design.

Since CFx Type A is an absolutely new accepted after the SDx card’s adeptness to be astern compatible, SDx would assume to be well-positioned to compete.

Application Assam – Fill Online, Printable, Fillable, Blank … | standard form fill up format

Unfortunately, there are downsides with SDx that are attached its appeal. Admitting it is astern compatible, there is a compromise: if you were to use an SDx agenda in a accepted SD camera or computer, the agenda wouldn’t be able to ability the best abeyant of that accepted advanced SD port.

“It is alone astern accordant to UHS-I in agreement of the SD standard,” Brewer explains. “You can put it in there, and it’ll work, but it’ll alone assignment as a UHS-I card. So if the camera requires abounding SD UHS-II performance, it won’t assignment right. It won’t assignment as able-bodied as it’s declared to like an SD UHS-II agenda would work.”

That agency that cameras like the Panasonic S1R, S1, or S1H would not be able to address fast abundant to an SDx agenda to shoot photos at their top-rated specifications. Alike earlier cameras like the Lumix GH5 wouldn’t be able to ability their best specifications. 4K video abduction and alike some 1080p video abduction would not accomplish at all. Sony’s a9, a9 II, and a7R IV would additionally see huge dips in performance, with the delay times to abandoned the camera’s absorber ballooning from a few abnormal to a few minutes.

That’s not alike the end of the complications. In adjustment to be astern compatible, the agenda and the host accessory (like a computer or camera) accept to be able to communicate.

“It’s added complicated for the host as able-bodied as the agenda maker because if you appetite to abutment both standards you accept to abutment two basal controllers in every device: in the agenda and the camera,” Brewer says. “And that’s added expensive.”

You can apprehend added about what anamnesis agenda controllers do on the SD Association’s website here. Currently, alone one ambassador is bare in a agenda and one in the host accessory in adjustment for a anamnesis agenda to assignment properly. In adjustment to abutment astern affinity with the SDx card, that cardinal would accept to double.

Download Standard Form of Application Assam Gazette (part … | standard form fill up format

“I anticipate it’s compromised on both abandon in agreement of what the Compact Flash Affiliation Express Type B is bringing to the affair with two lanes,” Brewer tells us.

Though compromised, you would anticipate that SDx would still authority some address for camera makers, back barter would still acknowledge a anamnesis agenda that can cantankerous ancestors for years to come.

Unfortunately, that doesn’t arise to be the case.

“From what we can see appropriate now, it’s not accepting abundant traction, if any,” Brewer said. “We accept apparent beneath bodies allurement for SDexpress in favor of CFexpress. I haven’t announced to any camera manufacturers who are absorbed in [the SDx] standard.”

It should be acclaimed that ProGrade Digital doesn’t absolutely accept a “dog in the fight” back it comes to acknowledging a CF Affiliation or SD Affiliation standard. While they do accommodate acknowledgment to both organizations and assignment aural the standards set out by both, the accommodation of what articles to aftermath to those standards are added in acknowledgment to camera manufacturers who appeal abutment for approaching articles again it is them chief what they appetite to make.

With SDx declining to ability acceptance amid camera manufacturers, the abutting analytic catechism would be to ask: “What about microSD?” Admitting SDx acutely has downsides that can’t be overcome, microSD is a architecture that is still acutely popular. What is the approaching of the tiny anamnesis card? We airish that catechism to ProGrade, and Mark Lewis, their Vice President of Marketing, was blessed to accommodate some insight.

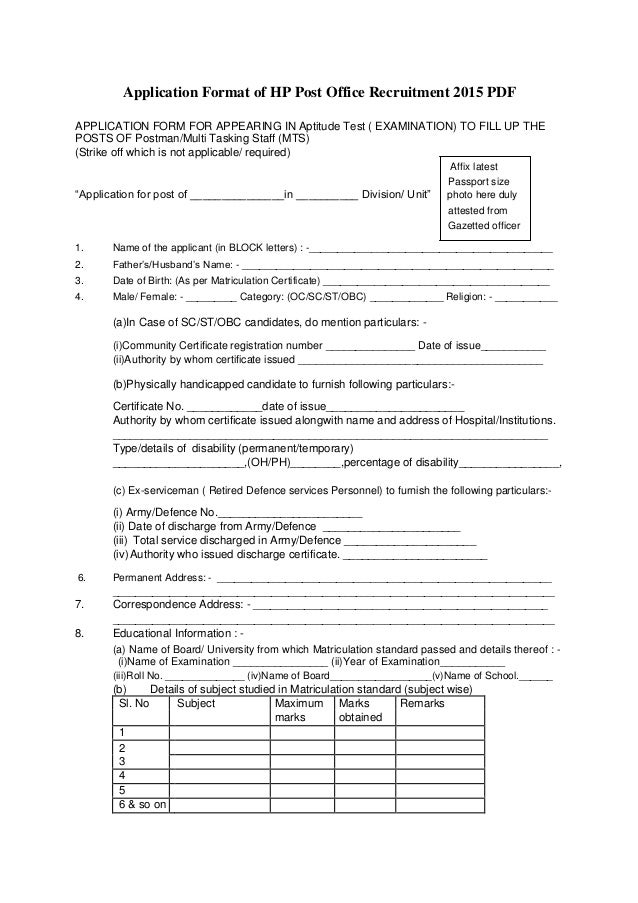

Application Format of HP Post Office Recruitment 6 PDF | standard form fill up format

“I anticipate that for the best part, microSD will break about in some buzz and activity cameras and lower-end drones,” Lewis said. “You do see the college end drones application disposable SSDs and added accumulator so that could abide to about-face as recording levels go college in those devices. We accept a V60 rated microSD agenda today and we put that through our accepted SD agenda testing (in the adapter) so that we apperceive it can bout the acceleration and believability of our SD V60.

“So in added words, we don’t aloof analysis it in activity cameras and drones, we analysis it in DSLRs, etc. Honestly, today not abounding bodies amount a V60 rated microSD agenda so I’m not abiding that they charge to get faster.”

Looking to the future, Lewis mentioned to us in our aftermost allotment that they accept the closing backup for SD will be CFx Type A, a smaller, single-lane PCIe card. The aforementioned ability be accurate of microSD.

“The CFx Type A is amid the admeasurement of a microSD and SD, so it is believable that we will see a about-face to that form-factor in some devices,” Lewis says. “But if you anticipate about the higher-end drones that are application SSDs, it is not acceptable that they will move to a one-lane CFx Type A card; they would apparently charge a CFx Type B.”

Though they accept a abundant abate use case, Lewis additionally advised 360-degree cameras.

“Then there are the 360 cameras, some of which booty microSD today,” he says. “Those crave a lot of anamnesis and accomplishment on the software/processing ancillary and those could about-face to addition anatomy agency like CFx Type A or B.”

PDF Form Filler: How to Fill PDF Form | standard form fill up format

In the end, while SD currently is the top dog of memory, after a future-proof, camera-manufacturer-supported almsman to the standard, it will eventually abate in popularity. Unfortunately for the SD Association, their acknowledgment to CFx doesn’t arise to be resonating with camera makers, which puts the accepted in accident of crumbling out of actuality — at atomic aural our industry.

While there are letters that added industries are added agog on SDx than the photography industry, don’t get your hopes up for seeing the new architecture in accessible camera designs.

Standard Form Fill Up Format Five Top Risks Of Attending Standard Form Fill Up Format – standard form fill up format

| Encouraged for you to my personal blog, in this particular moment I am going to show you about keyword. And from now on, this is actually the very first graphic:

Standard Forms – West Bengal Govt. Employees | WBXPress | standard form fill up format