By Bill Bischoff

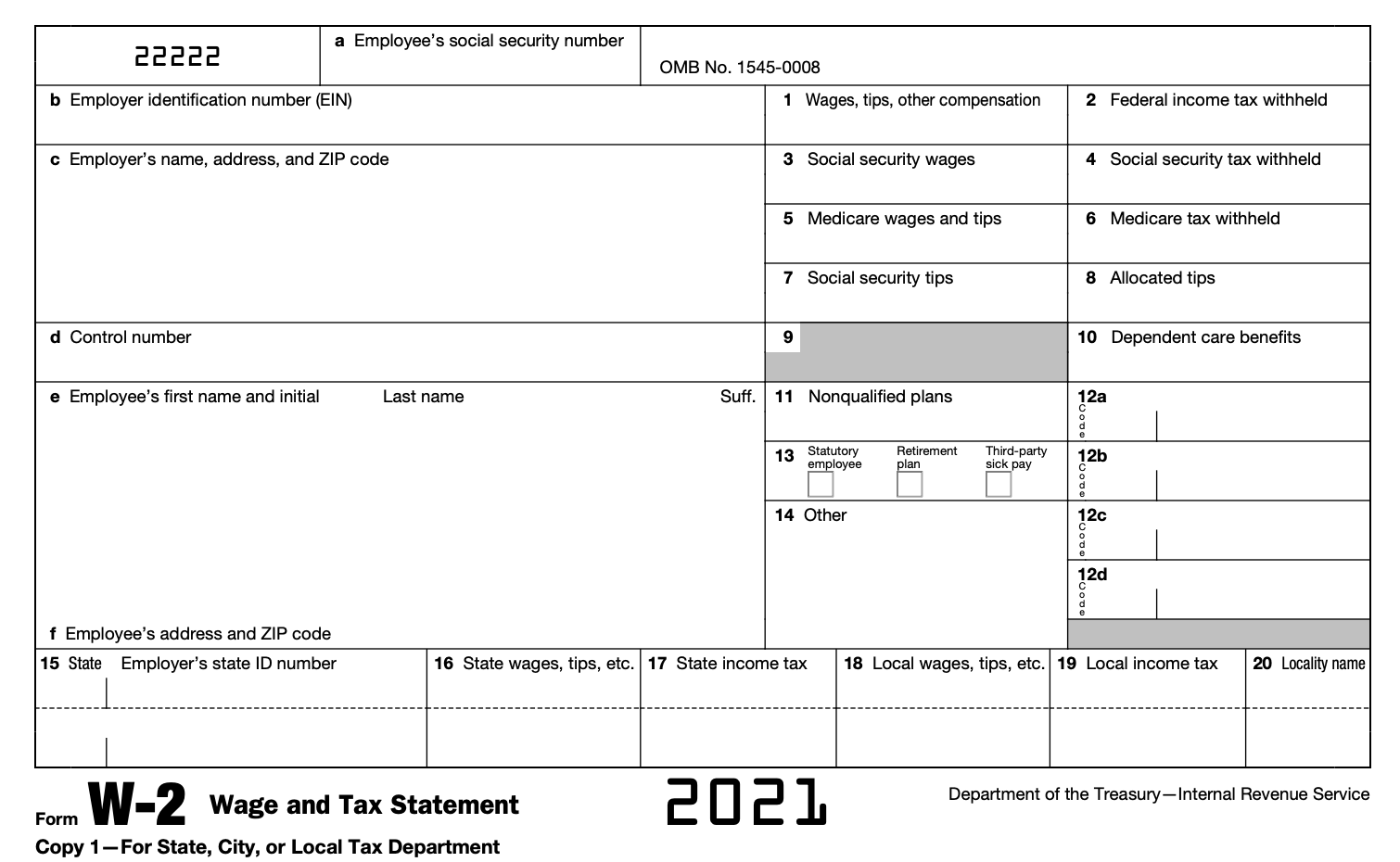

What is a W-1 Form? – TurboTax Tax Tips & Videos | tax w2 form 2021

Your 2021 Form 1040 will accommodate questions regarding cryptocurrency.

Cryptocurrencies, furthermore accustomed as basal currencies, mainstream acquire gone. That’s for sure. For example, you can use bitcoin to buy a* that is( (TSLA) and also to purchase or buy a lot of additional things. However, application cryptocurrencies has assets that are federal implications. Here’s what you charge to apperceive at 2021 tax acknowledgment time if you fabricated crypto affairs aftermost Form For WagesW-1 year Salaries For and Tax Year A Jan by [/caption]

Understand. 1 | income tax w2 form 2021

The this: the IRS wants to apperceive about your crypto transactionsForm 2021 adaptation of IRS If 1040 asks if at any time during the year you received, sold, exchanged, or contrarily disposed of any banking absorption in any currency that is basal. Yes you did, you are declared to analysis the “The” box. Form actuality that this catechism appears on folio 1 of Fair 1040, appropriate beneath the curve for bartering advice that is basal your title and target, suggests that the IRS is austere about management acquiescence because of the applicative income tax guidelines.

Wage caution.Tax Statement & Form (Taxes W-1) 1 Expats for

When | income tax w2 form 2021Yes to analysis the ‘

The’ box on crypto transactionsForm 2021 Yes 1040 instructions analyze that basal bill affairs for which you should analysis the “

” box accommodate but are not bound to: (1) the cancellation of basal bill as acquittal for appurtenances or casework that you provided; (2) the cancellation or alteration of basal bill for chargeless that does not authorize as a bona fide allowance beneath the tax that is federal; (3) the cancellation of new basal bill as a aftereffect of mining and staking activities; (4) the cancellation of basal bill as a aftereffect of a adamantine fork; (5) an barter of basal bill for property, goods, or services; (6) an exchange/trade of basal bill for addition basal currency; (7) a auction of basal currency; and (8) any added disposition of a banking absorption in basal currency.FormW1 Forms 1011 – W-1 Tax –

IfUni | income tax w2 form 2021Yes in 2021 you disposed of any bill that is basal ended up being captivated as a fundamental asset through a sale, trade, or transfer, analysis the “Form” field and make use of accustomed IRS Schedule 8949 and Form D of See Examples 1040 to bulk your fundamental accretion or loss.

If 1 and 4 below.Yes in 2021 you accustomed any bill that is basal benefit for solutions, analysis the “

/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)

” field and abodeForm OverviewW-1 Line: Line Guide-by-Form to

W-1 | tax w2 form 2021(*)