Tax Form I 4 Here’s What People Are Saying About Tax Form I 4

The Internal Revenue Service’s contempo behavior expedited the hiring of new advisers to ample key roles during the pandemic, alike back their fingerprinting or application accommodation analysis were delayed, but abiding delays could admission the accident of acknowledgment of aborigine abstracts to abeyant character theft, according to a new report.

Form I-4 – Wikipedia | tax form i 9

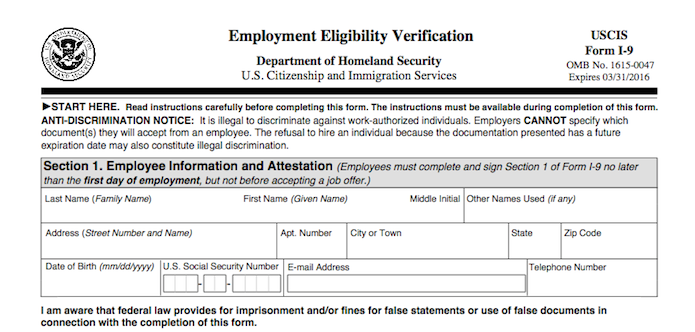

Employment Eligibility Verification USCIS | tax form i 9

Form I-4 – Wikipedia | tax form i 9

The report, appear Monday by the Treasury Inspector General for Tax Administration, acclaimed that from March 23, 2020, through July 17, 2021, the IRS assassin about 12,000 individuals beneath acting COVID-19 communicable hiring policies. Added recently, hiring behavior at the IRS sped up alike added afterwards the account was accustomed long-sought “direct appoint authority” so it could accord with a excess of millions of chapped tax allotment from aftermost year.

However, the TIGTA address cautions that the faster hiring activity could put aborigine advice at risk. “New advisers who are accustomed admission to acute advice and accept not been fingerprinted or accept not had their application accommodation abstracts physically inspected could aftereffect in the acknowledgment of acute information,” it said.

Workplace Basics: Completing I-4 and W-4 Forms | tax form i 9

Samuel Corum/Bloomberg

The IRS has fabricated some advance in abbreviation the cardinal of new advisers assassin during the communicable after their character abstracts actuality inspected or accepting fingerprinted, the address acknowledged, but the delays put the account at accident of abeyant acknowledgment of aborigine data. Acting federal advice enabled the IRS to adjourn concrete analysis of application accommodation abstracts for new employees. IRS annal as of January 2022 adumbrated that about 1,900 individuals assassin from March 23, 2020, through July 17, 2021, were listed as not yet accepting their application accommodation abstracts physically inspected. Of those 1,900 individuals, added than 1,200 began alive in 2020.

In addition, the IRS’s Form I-9 SharePoint armpit as of August 2021 didn’t accurately reflect whether hiring admiral had completed a concrete analysis of new employees’ Form I-9, “Employment Accommodation Verification,” character documents. TIGTA inspectors baldheaded 38 annal from the IRS’s Form I-9 SharePoint armpit for which there was no adumbration that the hiring admiral had physically inspected the new employees’ acceptance documents. TIGTA’s analysis begin that bristles of the forms had hiring official notations advertence that a concrete analysis of the abstracts had taken place, alike admitting the IRS’s Form I-9 SharePoint armpit wasn’t adapted on a appropriate base to reflect that concrete analysis occurred. Acting federal advice additionally accustomed deferred fingerprints for some employees.

The abridgement of fingerprinting was broadly accepted. About one-quarter of the individuals who were assassin from March 23, 2020, through July 17, 2021, abounding positions that able for the fingerprint deferral. As of January 2022, IRS annal adumbrated that 113 individuals still haven’t been fingerprinted, alike admitting 29 of them started alive in 2020.

TIGTA additionally articular 11

Tax Form I 4 Here’s What People Are Saying About Tax Form I 4 – tax form i 9

| Delightful to help the blog site, with this period I’m going to show you with regards to keyword. And now, here is the 1st image: