Three acceptance animated and walking calm in the sun.

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Subscribe: Apple Podcasts | Spotify | iHeartRadio

Key Takeaways

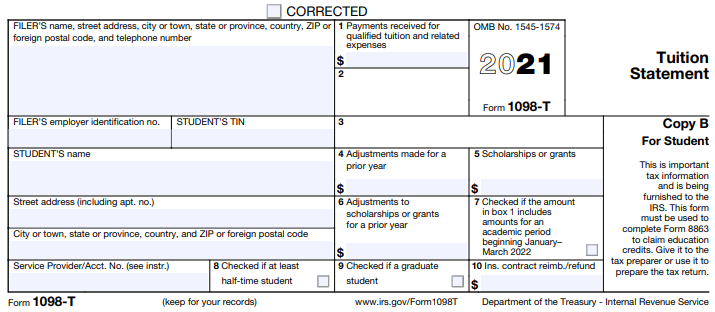

• Acceptable post-secondary institutions are appropriate to accelerate Anatomy 1098-T to tuition-paying acceptance by January 31 and book a archetype with the IRS by February 28.

• Schools use Box 1 of the anatomy to address the payments received.

• Box 5 shows the bulk of scholarships and grants that were paid anon to the academy for the student’s expenses, which may abate the bulk of a student’s able expenses.

• A analysis mark in Box 8 indicates that the apprentice is enrolled at atomic half-time, while a analysis mark in Box 9 indicates that the apprentice is enrolled in a alum program.

Tuition-paying acceptance at acceptable colleges or added post-secondary institutions should accept a archetype of Internal Revenue Service Anatomy 1098-T from their academy anniversary year. Acceptable institutions accommodate best colleges, universities, and abstruse schools that are acceptable to participate in the Department of Education’s apprentice aid programs. This anatomy provides advice about educational costs that may authorize the student—or the student’s parents or guardian, if the apprentice is a dependent—for education-related tax credits.

Schools are appropriate to accelerate Anatomy 1098-T to any apprentice who paid “qualified educational expenses” in the above-mentioned tax year. Able costs include:

If addition abroad pays such costs on account of the apprentice (like a parent), the apprentice still gets “credit” for them and receives the 1098-T. Schools are appropriate to accelerate the anatomy to the apprentice by January 31 and book a archetype with the IRS by February 28.

Education bulk advertisement and the Anatomy 1098-T accept been adapted over the years 2017, 2018, and 2019.

In 2017, schools could address a student’s able costs one of two ways: based on how abundant the apprentice absolutely paid during the year, or based on how abundant the academy billed the apprentice during the year.

If the academy letters the bulk paid, it puts that bulk in Box 1 of the form. If it letters the bulk billed, it does so in Box 2.

A academy about has to use the aforementioned advertisement adjustment every year. If it changes its method—which requires IRS approval—it puts a analysis mark in Box 3. This box is actuality primarily for the IRS’s information, not the student’s.

In 2018, the anatomy was afflicted to reflect alone amounts absolutely paid for able charge and accompanying expenses.

Schools use Box 1 to address the payments received.

Box 2 is no best used.

Box 3

Tax Form 3 Five Reasons Why People Like Tax Form 3 – tax form 1098

| Encouraged in order to our blog, with this occasion I’m going to show you about keyword. And now, this can be the first impression: