Taxation is a circuitous accountable and the frequently alteration laws, formats and behavior can amaze anyone’s mind. An assessee gets four months to adapt for filing tax returns. Here is a tax-preparation checklist:

Link Aadhaar with PAN: This charge be done afore filing your tax returns. Failure to do so by 31 March 2023 (extended deadline) will beforehand to inactivation of your PAN.

Salaried and added income: Usually, a salaried agent gets into activity alone afterwards accepting Anatomy 16 from his employer. However, it is appropriate to accumulate a few abstracts such as anniversary bacon receipts and capacity apropos all allowances and tax exemptions accessible beforehand. If you accept absorption income, again to anniversary the anniversary beneath area 80TTA, you charge accept a coffer anniversary for absorption on accumulation account, an absorption assets anniversary for anchored deposits and a TDS affidavit from the bank.

Documents for abode property: ‘Income from abode property‘ is an intricate amount as altered types of abode acreage entail altered calculations. Taxability may not be on absolute hire received. If the acreage is not let out, tax will be answerable on the abeyant assets the acreage can yield. If you accept busy out a property, again you are accustomed to abstract borough taxes, 30% of hire as accepted deduction, forth with the home accommodation absorption from the anniversary rental income.

For this purpose, access the absorption affidavit from the lender with a alienation of absorption paid and arch paid for the year. You can affirmation tax allowances u/s 24B and 80C.

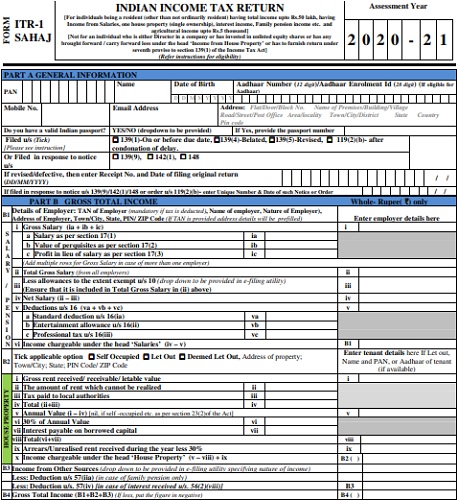

PDF] Income Tax Form 5-5 PDF Download – PDFfile | download tax formSale of disinterestedness shares: If advised as stock-in-trade, again it will be covered as assets from business irrespective of the aeon for which it is held. Otherwise, the basic accretion on auction of shares gets burdened as follows. Long-term basic assets (on shares captivated for added than one year) aloft ₹1 lakh annually from disinterestedness shares are burdened at 10% and concise basic assets are burdened at 15%.

Documents bare for area 80C : The tax-saving schemes which authorize for this are PPF, NSC, ULIPS, ELSS, and LIC policy. Receipts for investments fabricated in these should be kept carefully.

Tax Forms for Your 5 Tax Return | download tax formForm 26AS and anniversary advice arrangement (AIS): Anatomy 26AS is a circumscribed anniversary absolute all advice on a aborigine such as TDS, capacity of tax calm from you, beforehand tax payments made, etc. It makes claiming tax acclaim easier. A mismatch in anatomy 26AS and the assets tax acknowledgment after-effects in an analysis by the tax authorities.

AIS is a absolute anniversary of banking affairs in a banking year accouterment capacity of assets accustomed from assorted sources irrespective of the actuality that tax has been deducted at source. Afterwards the electronically centralized processing of the AIS form, an assessee can analysis the afterward details—TDS/TCS, SFT, acquittal ofTax form W-5 – Creative Commons Bilder | download tax form