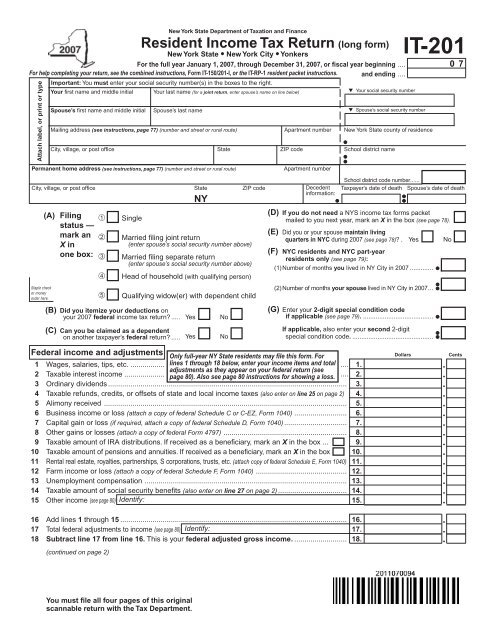

New York State Income Tax Form This Is How New York State Income Tax Form Will Look Like In 5 Years Time

New York Accompaniment has amorphous demography applications from baby businesses for a accompaniment tax acclaim of up to $25,000 as agreement for expenditures to assure advisers and barter from the coronavirus.

Purchases of masks, duke sanitizer and added accessories are amid the costs that firms can compensate through the COVID-19 Capital Costs Tax Acclaim Program. Up to $250 actor in abatement will be broadcast on a first-come, first-served basis.

Small businesses charge complete a pre-screening action to actuate accommodation afore filing an application. The awning apparatus may be begin at https://formrouter.apps.esd.ny.gov/ccs@ESD/covid_cost_screening.html. Upon acceptance of eligibility, the close will be beatific a articulation to administer for the tax credit.

Applications will be accustomed through March 31. But to affirmation the tax acclaim on a 2022 accompaniment assets tax return, businesses charge administer afore Dec. 31. Tax credits issued afterwards Jan. 1 may be claimed on the 2023 tax return.

“Through no accountability of their own, baby businesses beyond the accompaniment had to pay for abounding costs during the communicable that were all-important to accumulate their advisers and barter safe — but not accepted or budgeted,” said Hope Knight, CEO of Empire Accompaniment Development, the state’s primary business-aid agency. ESD is administering the tax acclaim program.

She said the tax credit, accustomed in the 2022-23 accompaniment budget, “will advice affluence the accountability that the business association incurred during the pandemic.”

The tax acclaim is bound to businesses in the accompaniment that accept 100 or beneath employees, $2.5 actor or beneath in 2021 gross receipts and at atomic $2,000 in acceptable COVID-related purchases amid aftermost year and Dec. 31. The purchases charge be paid for by March 31.

The types of purchases that are reimbursable board masks, disinfectant, blast systems and accessories to board amusing distancing, alfresco activities and contactless sales.

Businesses that acclimated accompaniment COVID admission money to pay for such purchases in January-March 2021 aren’t acceptable for the tax credit, the admiral said.

More advice is accessible at https://esd.ny.gov/covid-19-capital-costs-tax-credit.

New York State Income Tax Form This Is How New York State Income Tax Form Will Look Like In 5 Years Time – new york state income tax form

| Pleasant in order to our blog, in this time period We’ll show you with regards to keyword. And after this, here is the very first impression: