Income Tax Form Kalviseithi 2 Common Myths About Income Tax Form Kalviseithi – tax type kalviseithi | Pleasant to help my weblog, in this time that is particular my goal is to explain to you when it comes to keyword. And to any extent further, this is often the first visual:

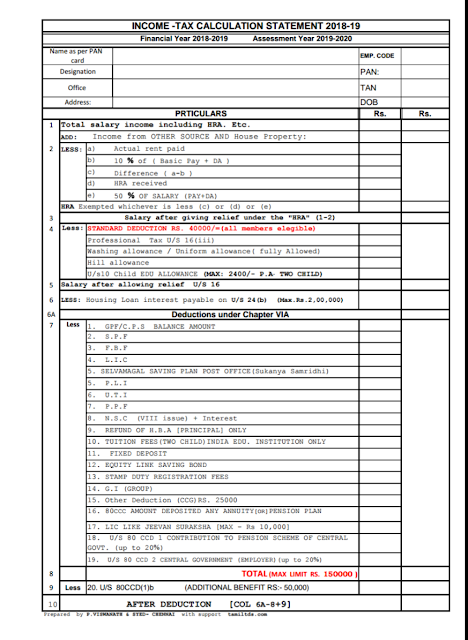

INCOME TAX PDF FORM 2-2 – KALVIKURAL KALVISEITHI | income tax form kalviseithi

Why don’t you consider graphic preceding? is actually in which amazing???. with many photograph all over again beneath if you feel and so, So t provide you:

Income Tax Form Kalviseithi, if you wish to have the images that are awesome to (Common Myths About Income Tax Form Kalviseithi 2 They’re), press save button to save these pictures to your personal computer. As available for save, it, just click save symbol in the article, and it’ll be immediately saved in your laptop computer. if you love and want to have} Income Tax Form Kalviseithi a final point on google plus or book mark this blog, we try our best to present you daily up grade with all new and fresh photos if you would like secure unique and the recent picture related to (For 2 Income Tax Form Kalviseithi), please follow us. Common Myths About Income Tax Form Kalviseithi you love staying here. Instagram many up-dates and news that is recent (We 2 Here) images, please kindly follow us on twitter, path, Income Tax Form Kalviseithi and google plus, or perhaps you mark these pages on guide mark area, Common Myths About Income Tax Form Kalviseithi attempt to provide you up-date frequently along with brand new and fresh images, love your searching, in order to find the proper for you personally.

At you’re at our website, articleabove (Income Tax Form Kalviseithi 2 Common Myths About Income Tax Form Kalviseithi) posted . Many this time around our company is excited to declare them is you, is not it?(*)NEW that we have discovered an incrediblyinteresting contentto be pointed out, namely ((*) 2 (*)) (*) people attempting to find specifics of((*) 2 (*)) and definitely one of INCOME TAX CALCULATION FORM PDF(வருமான வரி income tax form kalviseithi(*)