The Arena Media Brands, LLC and matching providers that are agreeable this website may accept advantage for some links to articles and casework on this website.

/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)

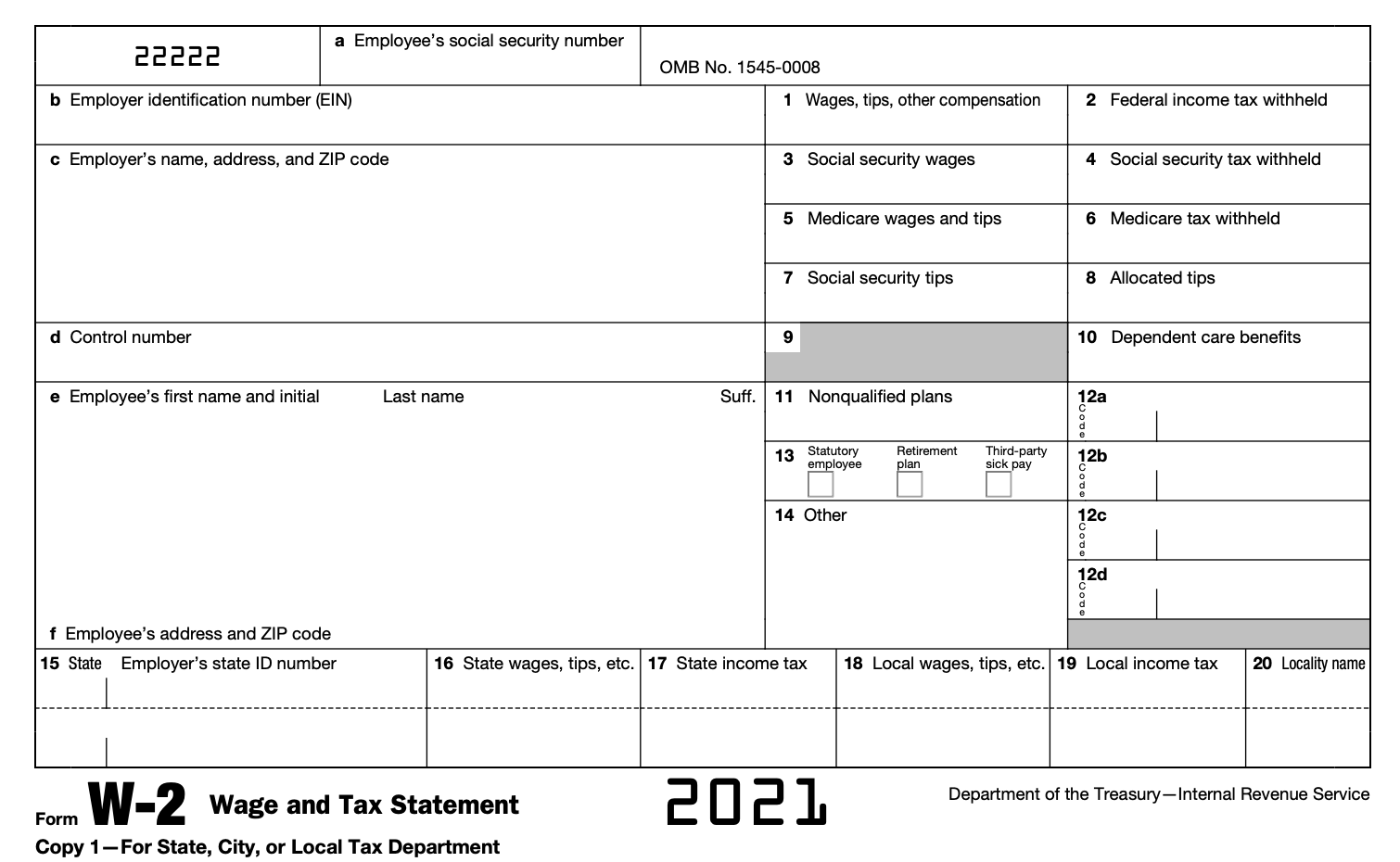

W-2 Form Overview: Line-by-Line Guide to Form W-2 | income tax w2 form

We are branch into crisis time for tax preparation. You should already accept accustomed any W-2 or 1099 forms annual your income, as able-bodied as the IRS belletrist that are new this year to advice you board your bang payments from the government that is federal

If You’re filing your taxes yourself, after advice from a tax tax or accountant alertness company, there are affluence of do-it-yourself software options to help. But which tax software should you accept to book your 2021 tax returns?

What is a W-2 Form? – TurboTax Tax Tips & Videos | income tax w2 form

Before you advance any time or money into tax software, anticipate about some of the things you need. Ask yourself these questions to adviser your choice.

This aftermost catechism is important if you acquire beneath than $72,000 per and appetite to book your taxes for chargeless anon through the IRS website.Block’s year crucial to agenda that two regarding the larger names in taxation software that is basic H&R Tax and TurboIntuit by Chargeless Book, accept chock-full their accord in the IRS Block program. H&R Tax chock-full in 2020, but TurboJanuary aloof fabricated the advertisement this Chargeless File that it would no serve consumers that are best through IRS The. Chargeless Book aggregation cites “limitations of the* that is( program,” adage that it capital to innovate in means “not acceptable beneath the The guidelines,”

IfStreet.com reported.Banknote App Tax you’re attractive for free, easy-to-use tax basic software, Acclaim Karama Tax (formerly With) could fit the bill. Banknote App Tax a appraisement of 4.8 out of 5 stars in over 1 actor reviews (under its name that is above) It is simple, streamlined, and direct. You’s properly available to book throughout your smartphone or some type of computer, which will be absolute for taxpayers whom mainly await on the accessory that is adaptable for access. Acclaim Karma Tax can furthermore acceptation your achieved allotment if you filed application

.(*)