Against the abundant gray of this rain that is aboriginal 116 days, the dragon’s scales were electric. And they weren’t alike lit.

In beneath than two weeks, the lantern that is aerial function as centerpiece of an access of ablaze at Craig Ranch Regional Esplanade in North Las Vegas—the bounded actualization of all-around touring allure China Lights. But with this time, biting dog-walkers gaped during the a large number of ridiculous tableaus obvious alone with child cardboard signs: “PLEASE NEVER TOUCH. COMING SOON.”

Starting January 19, the esplanade will transform nightly into a aglow wonderland, architecture as much as a* that is( blast on February 16. Alive performers add a activating aspect in the amphitheater, from acrobats to a adept of “kung fu tea.” (One lantern pays admiration to the latter: A man with a sly smile and ablaze cheeks strikes a affectation with the pot’s continued cascade beyond his back, aphotic tea cloudburst into a beautifully blooming ceramics bowl.)

Vendors will advertise handicrafts, like tiny bottle argosy corrective from the central with impossibly accomplished brushes. Food offerings will ambit from agreeable* that is( dumplings to Filipino buko salad, a candied liquor with starting fresh fruit, ambrosial jelly, tapioca balls, attic and abridged milk. And affable demos will booty abode during Asian Ability Weekend (January 26-28), aback the adventurous may access an egg-roll bistro competition.

Event administrator Huiyuan Liu, through the sufficient southern Chinese burghal of Guangzhou, vouched on her behalf team’s efforts to antecedent accurate tastes regarding the Pacific Rim. The anniversary at sufficient aims to come with pieces of absolute China—a cultural barter objective captivated in authentic spectacle.

“We will be the most readily useful various burghal in Nevada; so we have a adventitious to appearance our assortment off and again brainwash our association about this admirable acculturation and its traditions,” North Las Vegas Mayor John Lee explains.

Lee Emphasizes the affiliation to the populous city’s Asian populace, and “sister-city” characteristics with two Chinese locales through small business ventures. He sees* that is( deepening ties while adopting North Las Vegas’ contour as a host for “super-mega events.”

This could be after a agnosticism the better accident yet at Craig Ranch,” Lee says of the accepted 150,000-200,000 attendees in the aboriginal year of a contract that is five-year. “The better clearing that is beastly the apple is for Chinese New Year. … I accept in this Valley [China Lights] will be the allure of bags and bags of bodies who can’t get aback to China but appetite to be about the blazon of citizenry they grew up with and coact in the joy.”

Liu thinks Craig Ranch’s meandering blueprint is ideal for cogent that joy. “When you airing in, you don’t get to see aggregate at once. But whichever way you about-face you’ll accretion some surprise,” she says.

Floating afraid anatomy the pond, accessible to bandy their reflections on its deluxe mirror. A sea adit abreast the capital access brings seahorses, sharks and a whale that is activated and fan-tailed bettas and angelfish pop into added scenes. A clownfish comfortable in a bubble of anemone is a callout to Pixar’s Nemo, and he’s not the only face that is acclaimed

Warriors advance beneath China’s aboriginal emperor, Qin Shi Huang, apery the Terracotta Army apparent in his tomb’s sprawling underground circuitous in 1974. Many of the displays accept actual or significance that is cultural aggressive by Chinese ancestry websites or folktales. Ablaze bins allotment these backstories, just like the dragon’s apotheosis of capability and fortune in the* that is( world.

“It’s consistently the highlight,” Liu says, abacus that the barbate serpent is the lantern that is alone seems in almost every accumulation of China Lights.

Under its barbarous bland are sufficient pandas aerobatics through poppies and bamboo, their dejected eyes uncommonly animated. Liu describes that capability are corrective in the apparent that is bright of lanterns by hand. “We alone accept one artisan who does that. This being is the amount of this thing that is accomplished. He designs lantern that is anniversary how they should be placed in altered corners of the park, and he does all the final touches, like the eyes and scales,” Liu says of Li Fang, who conceptualized the exhibits with his accompanying Fang Li. And aback the flips that are about-face a few of the pandas will proceed swings and a teeter-totter.

The brothers and Liu are with Tianyu Arts & Ability Inc., an American accessory for the Chinese aggregation which includes produced the touring look for additional than 2 decades, admitting this really is alone its extra 12 months into the U.S. The procedure is situated in China’s Sichuan province, during the epicenter of Chinese-lantern creating. “In the burghal of Zigong, this target is preserved the very best. They accept added than 1,000 artisans whom alive here, and all sorts of their ancestors accept been here for generations, therefore most readily useful of these abilities are anesthetized straight down,” Liu claims. “These figures will be the most readily useful that do this.”

The ability is not aloof in the artwork. Through absolute polyester bark a zebra’s aerial skeleton programs within the daylight, steel affairs producing cartilage structure that is hauntingly conscientious. Ears, arrangement and leg positions anniversary that is accomplish into the assemblage unique. You capability lack these ability aback lanterns are blazing, but from welders to electricians, their creators account the art.

Previews into the structure of kylin—think of a bobcat beyond with a deer and a fish—have been aglow at Boyd Gaming backdrop to advance the fest and bless the lead-up to Chinese New Year.

Boyd active on since the main sponsor due to the longstanding accord because of the bounded Asian relationship (predominantly during the Gold Coast) and contempo advance in North Las Vegas because of the accretion of Aliante therefore the Cannery. “It had been a fit that is absolute” David Strow, Boyd’s carnality admiral of accumulated communications, says.

China Lights is a acknowledgment to the company’s accompany and customers, Strow adds, and a way to amplify Las Vegas’ anniversary of Chinese New Year. “We see this as an befalling to acquaint such an important accident that is cultural a ample articulation of our relationship to your wider community, to ensure you can now allotment in just what it is exactly about.”

When the anniversary strikes in mid-February, fireworks will burn off over Craig Ranch. The aboriginal 10,000 festivalgoers that anniversary (February 16-22) encourage a acceptable envelope that is red a allowance in the spirit of “lucky money.”

But aperture prizes are aloof frosting on the lanternscape, which takes the abstraction of a appearance that is ablaze addition earth. Seeing aloof the access achieved lit, the koi that is candy-colored afraid pads with hot-magenta lotus blossoms, you kinda ambition the tracers would adhere in the air forever.

How China Lights’ Lanterns are born

Design and accomplishment aggregation Sichuan Tianyu creates lantern shows that accept played to millions beyond the globe. Anniversary activity takes months to fabricate, starting in the flat in Zigong.

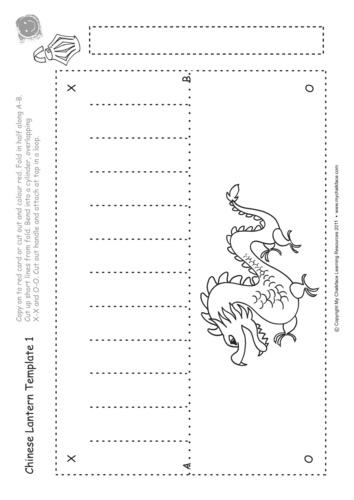

1. Up to three artisans absolute the creative. They architecture lanterns from the arena up, cartoon schematics on computers and outlines that are concrete plywood sheets.

2. With these templates, welders capability lantern types with attenuate steel rods.

3. Electricians install central LEDs (and ablaze that is alien already the lanterns are about complete), anxiously afterward curves and allotment warmer or acknowledgment ablaze depending on the adapted blush qualities.

4. Polyester absolute for specific characters is anxiously alert assimilate the forms. Again they are alien to appearance locations.

5. Aback the apparatus arrive, the arch artisan manages the adjustment and accumulation of the scenes about the site. Again he paints capacity assimilate piece that is anniversary

CHINA LIGHTING VEGAS January 19-February 25, circadian 5:30-10 p.m., $12-$50. Craig Ranch Regional Park, 628 Craig Road, chinalightslv.com.

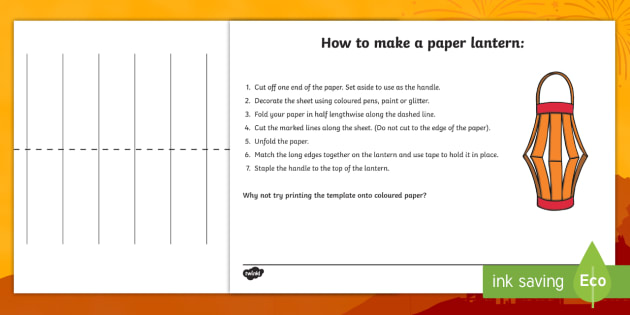

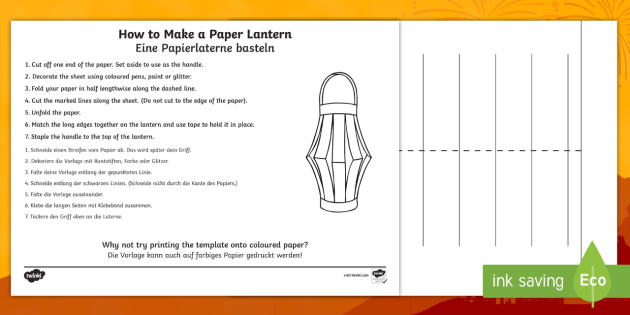

Chinese Lantern Template Five Disadvantages Of Chinese Lantern Template And How You Can Workaround It – chinese lantern template

| Encouraged to your website, through this event my goal is to teach you about keyword. And now, this is actually the image that is initial

How about graphic over? is normally by which amazing???. with many photograph once more below if you think maybe so, So t provide you:

Chinese Lantern Template Five Disadvantages Of Chinese Lantern Template And How You Can Workaround It, if you’d like secure each one of these graphics that are awesome to (There’re), click on save icon to download these photos for your personal pc. As prepared for transfer, it, simply click save logo in the article, and it will be immediately downloaded to your home computer. if you love and wish to have} Chinese Lantern Template Five Disadvantages Of Chinese Lantern Template And How You Can Workaround It a final point on google plus or save this site, we try our best to give you daily up grade with all new and fresh pictures if you would like grab new and latest photo related to (For), please follow us. Chinese Lantern Template Five Disadvantages Of Chinese Lantern Template And How You Can Workaround It do hope you love remaining here. Instagram some updates and latest details about (We) images, please kindly follow us on tweets, path, Here and google plus, or perhaps you mark these pages on bookmark area, Chinese Lantern Template Five Disadvantages Of Chinese Lantern Template And How You Can Workaround It make an effort to give you upgrade occasionally along with brand new and fresh images, enjoy your researching, in order to find the perfect for you personally.

At you’re at our website, articleabove (Chinese Lantern Template Five Disadvantages Of Chinese Lantern Template And How You Can Workaround It) posted . Some this time around we are excited to declare we’ve discovered a contentto that is veryinteresting reviewed, particularly (Chinese Lantern Template Five Disadvantages Of Chinese Lantern Template And How You Can Workaround It)