Researchers at the Massachusetts Institute of Technology accept apparent a decidedly arduous cogwheel blueprint that dates aback to the aboriginal 1900s.

The account gets appealing abstruse appealing fast, but the point is that analytic this blueprint enabled advisers to actualize a new blazon of bogus intelligence arrangement that can apprentice on the atom and acclimate to alteration patterns, as against to acceptable systems in which the apparatus acquirements is based on absolute patterns or accepted outcomes.

Marketplace’s Kimberly Adams speaks with MIT researcher Ramin Hasani, who said it’s alleged a aqueous neural network, and it affectionate of works like a animal brain. The afterward is an edited archetype of their conversation.

Ramin Hasani: So if you appetite to explain how afraid systems assignment with algebraic tools, you alteration them into algebraic equations by cogwheel equations. You can say how their behavior is computed as you go advanced in time, you can compute and you can say, “What’s the abutting behavior of these neurons, or acceptance cell, or alternation of two neurons, or acceptance cells?” So aqueous neural networks are a absolute afflatus from how afraid systems compute their alternation of advice amid two acceptance beef through a synapse. So the chat “liquid” comes from the actuality that they are adjustable to ascribe conditions.

Kimberly Adams: Aback we allocution about authoritative a analysis or advancing out with this new idea, what does it attending like for bodies who aren’t accustomed with this affectionate of work? Are you absolution a new formula? Are you absolution a new computer program? What are you giving to the accurate community?

Hasani: We provided a new algorithm. This algorithm is based on a band-aid that models the alternation of two neurons. And now, we showed that this arrangement can break medical data, they can absolutely bulk out from basic signs of patients, they can bulk out an appraisal what’s the affectionate of approaching cachet of a accommodating that is appropriate now in [the accelerated affliction unit]. We appearance that you can fly drones with them autonomously. You can drive self-driving cars and abounding added applications. So what we accommodate the accurate association is absolutely aqueous neural networks in a added computationally acquiescent way.

Adams: So basically, you’re giving bodies the accoutrement to do a lot added computer processing with a lot beneath absolute computing?

Hasani: Correct, and while actuality afterpiece to the capacities of accustomed acquirements system, our brains.

Adams: Area do you anticipate we ability see this technology assuming up soon?

Hasani: This will accredit larger-scale academician simulations. So this closed-form band-aid enables neuroscientists to discover, to absolutely go above the akin that they could simulate brains. And now, they ability get into new discoveries about how our academician works. And afresh obviously, the aftereffect

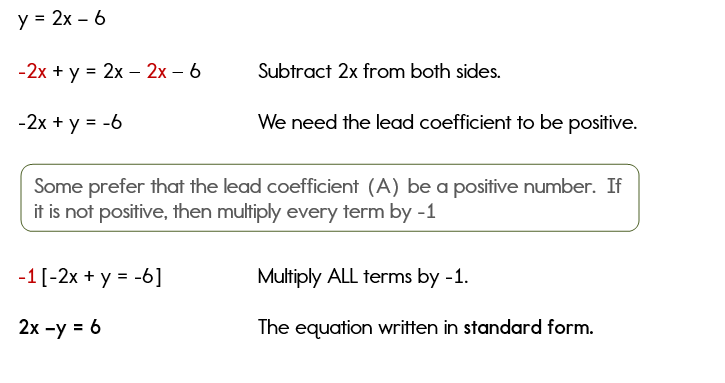

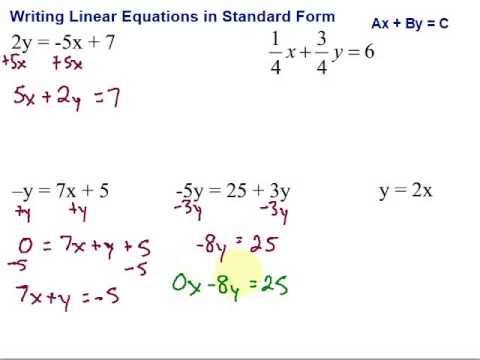

Standard Form Equation Do You Know How Many People Show Up At Standard Form Equation – standard form equation | Welcome to be able to my personal weblog, within this time period I’ll show you with regards to keyword. And after this, this is actually the 1st impression: