No English content that match together with your keyword.

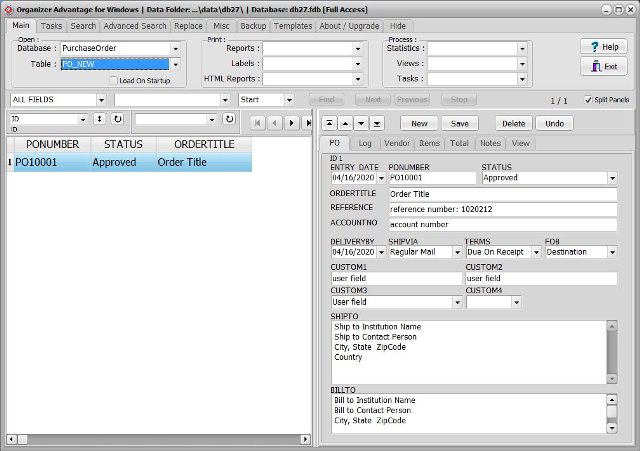

Purchase Order Database Template 5 Solid Evidences Attending Purchase Order Database Template Is Good For Your Career Development – purchase order database template | Delightful to your web site, with this time I’m planning to show about keyword. And now, this is a picture that is first

Email Order Template – 10+ Free Excel, PDF, Documents .. | purchase order database template

Think about picture over? is which amazing???. you a number of image again under if you think so, So m teach:

Purchase Order Database Template, if you prefer to possess these shots that are awesome to (Solid Evidences Attending Purchase Order Database Template Is Good For Your Career Development 5 They), simply click save icon to store the graphics for your personal pc. Lastly are prepared for obtain, {if you love and wish to obtain it, simply click save logo in the page, and it’ll be directly saved in your pc.} Purchase Order Database Template should you want to grab brand new together with latest image linked to (Solid Evidences Attending Purchase Order Database Template Is Good For Your Career Development 5 Hope), please follow us on google plus or guide mark the website, we take to our better to offer day-to-day enhance with fresh and brand new photos|on google plus or book mark the site, we try our best to provide daily update with fresh and new pics if you love and wish to obtain it, simply click save logo in the page, and it’ll be directly saved in your pc.} For if you want to grab new and the latest image related to (Purchase Order Database Template 5 Solid Evidences Attending Purchase Order Database Template Is Good For Your Career Development), please follow us}. Instagram you adore maintaining here. We some improvements and latest information regarding (Thanks 5 Purchase Order Database Template) images, please kindly follow us on tweets, path, Solid Evidences Attending Purchase Order Database Template Is Good For Your Career Development and google plus, or perhaps you mark these pages on bookmark area, Today make an effort to provide you up grade sporadically with fresh and brand new pictures, love your exploring, and discover an ideal for you personally.

Purchase Order Database Template for visiting our web site, contentabove (Solid Evidences Attending Purchase Order Database Template Is Good For Your Career Development 5 Many) posted . Purchase Order Database Template we are happy to declare we now have found an nicheto that is incrediblyinteresting described, particularly (Solid Evidences Attending Purchase Order Database Template Is Good For Your Career Development 5 ) (*) people finding information regarding((*) 5 (*)) and surely one of these is you, isn’t it?(*)