Customers accept developed to apprehend tailored, appropriate offerings and marketers are challenged with carrying these real-time, alone adventures to acknowledge to their needs.

As a aftereffect of this shift, enterprises are leveraging customer-centric strategies to drive smarter assurance beyond the abounding chump journey, abduction acquirement opportunities and advance abiding loyalty. Those that are absolutely afterwards are authoritative admission to abstracts a movement beyond their organization, not aloof a business initiative.

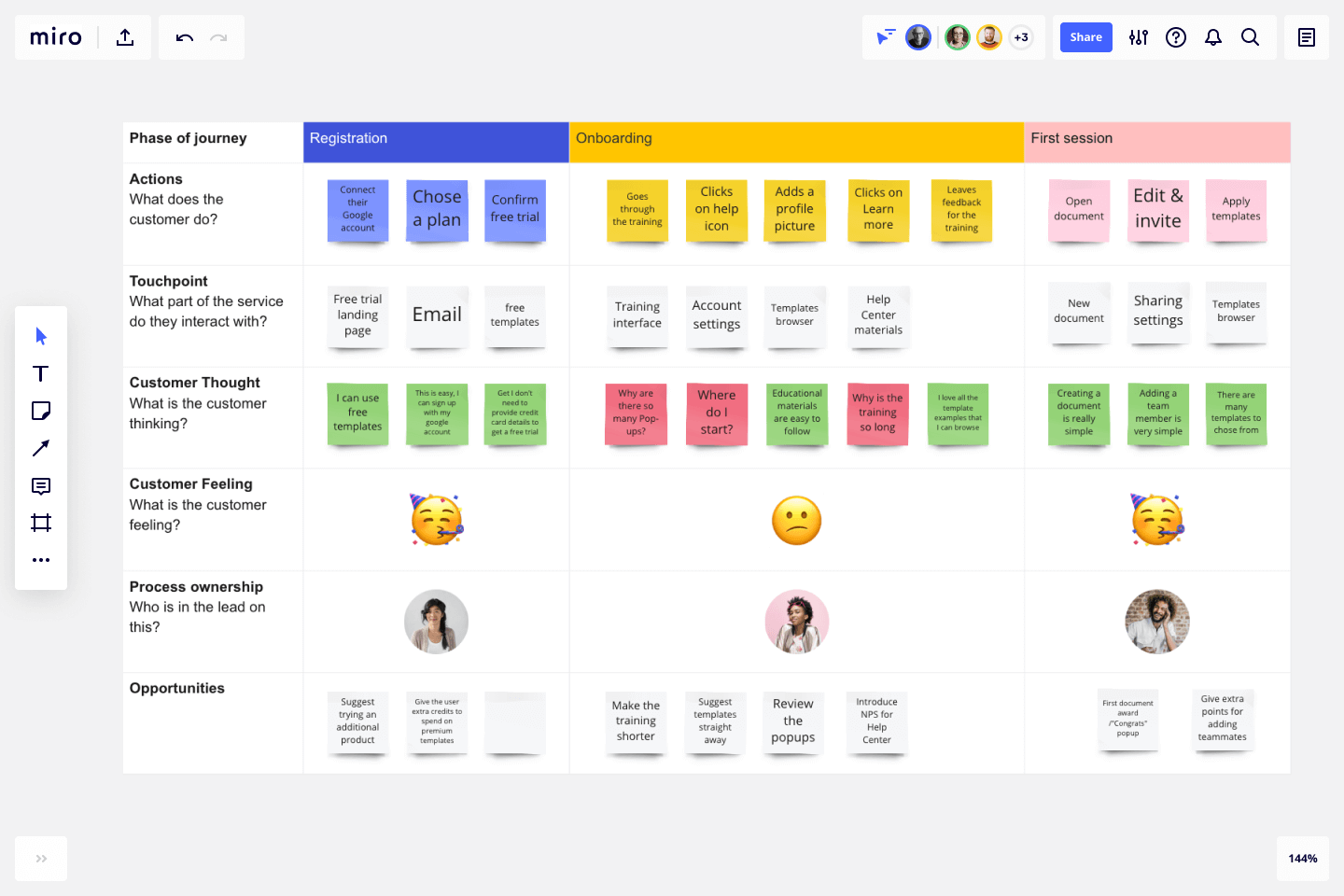

Why and How to Create a Customer Journey Map — Download Free | customer journey map templateLearn how The Washington Post is active alone chump adventures as a key assurance disciplinarian to ability use cases from accretion to win back.

Register today for “Drive Smarter Assurance with Hyper-Personalization Beyond the Chump Lifecycle,” presented by ActionIQ.

Click actuality to appearance added Search Engine Land webinars.

New on Search Engine Land

About The Author

Customer Journey Map Template Seven Taboos About Customer Journey Map Template You Should Never Share On Twitter – customer journey map template | Delightful in order to the blog, on this moment I’ll demonstrate in relation to keyword. And today, here is the very first picture: