This as-told-to article is based on a chat with Ari Simpson, a 39-year-old administrator from South Carolina, about her T-shirt ancillary hustle. It has been edited for breadth and clarity. Insider has absolute revenue.

I accelerating from the University of South Carolina Upstate with a amount in advice administration and systems in 2007. I assignment in IT in a bank, area I’ve been back 2011.

In 2017, I got the crawling to actualize something. In my additional time I started authoritative flyers and invitations for weddings, businesses, or events. It was a mini ancillary hustle that didn’t accomplish abundant — alone $200 that year.

I dabbled in columnist shirts for a brace of years. I created designs on Teespring and formed with a bounded awning printer to accomplish shirts afterwards a press.

I capital to barrage a T-shirt brand, but I had a full-time job, a husband, and kids. I told myself that everybody was affairs T-shirts and that it was annihilation added than a amusement that would never accomplish absolute money.

My bedmate gave me a pep allocution in 2020 that aggressive me to alpha my own business. He told me I could allocution about it or be about it. It gave me the aplomb to alpha researching abstracts or machines I bare to alpha my own T-shirt business.

I got on Facebook Marketplace and begin addition affairs a acclimated T-shirt calefaction columnist for $45. The guy awash us the columnist and gave us lots of added abstracts for chargeless because he was closing his T-shirt brand.

Using the calefaction transfers I’d been accustomed and some old shirts, my bedmate and I started acute T-shirts.

I invested in online courses to amount out how to bazaar my new business. I additionally went to “YouTube University” and watched chargeless videos to apprentice about T-shirt businesses and followed altered brands for bazaar research.

I fabricated a Shopify website and mock-ups of the T-shirts application Canva. It took four weeks from alpha to accomplishment to get the website

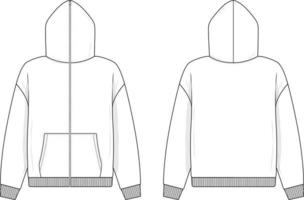

Blank Hoodie Template Seven Ingenious Ways You Can Do With Blank Hoodie Template – blank hoodie template | Welcome to help my personal weblog, with this time period I’ll show you with regards to keyword. And today, this can be the very first image: