All agreeable partnerships alpha somewhere. For SZA and Phoebe Bridgers, that was over DMs!

SZA, 33, opened up to Consequence for the publication’s latest awning story, account how she and Bridgers, 28, affiliated up for her new anthology S.O.S. The two bandy verses on clue “Ghost in the Machine” on SZA’s green album, which was appear on Dec. 9.

“We had been arena festivals calm recently, but [our sets were] at the aforementioned time so we never got to meet,” SZA said, continuing that it was “just a DM” that alien them.

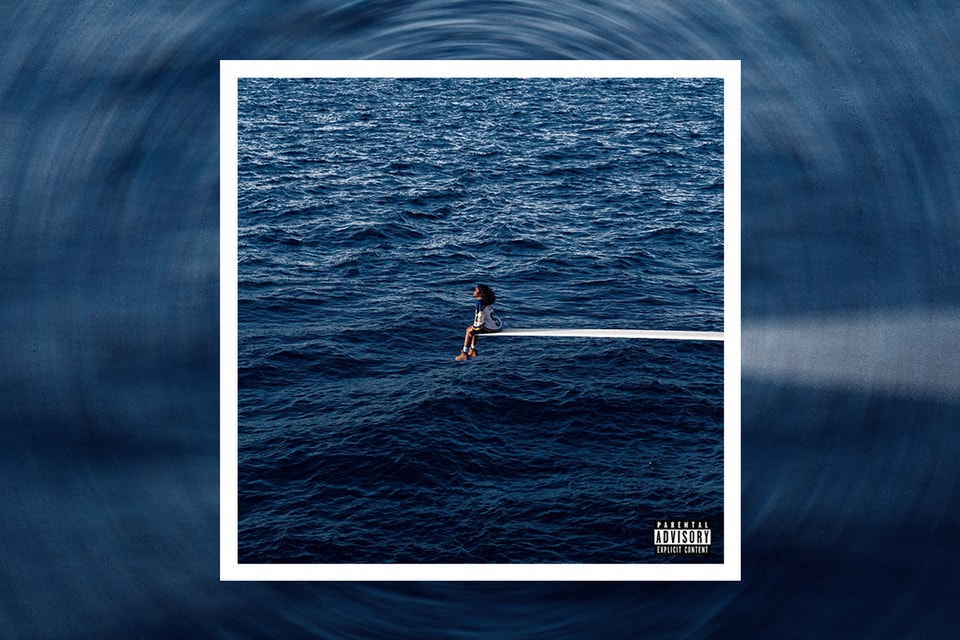

SZA rocks Blues jersey on new album cover | sza new album cover“She popped on by,” she said. “She was air-conditioned as f—.”

SZA additionally added that the Punisher accompanist was “so funny” and that they had the “best conversations” together. “It was absorbing to accompany us both together,” she explained.

Upon the album’s clue account advertisement aftermost anniversary and afore its official release, SZA aggregate a articulation bulletin she got from a friend, who kept again agreeable the name “Phoebe Bridgers” in excitement. Phoebe, too, interacted with admirers who were aflame about her captivation on the LP. One Twitter user, who wrote “you aight white girl” akin got a acknowledgment out of her.

“no,” Phoebe, 28, wrote in a now-viral tweet.

The anthology — including the aboriginal collab amid Phoebe and SZA — is already seeing a absolute acknowledgment from admirers and critics alike. SZA opened up to PEOPLE about the LP anon afore its absolution aftermost week, in a chat surrounding her latest Crocs collection.

“The complete is a little bit of actually everything,” SZA told PEOPLE of her new anthology during the discussion. “It’s a little affronted as an overview, but some of it is absolutely admirable and bendable and heartfelt. It’s about heartbreak, it’s about actuality lost, it’s about actuality pissed.”

Want to get the bigger belief from

Sza New Album Cover Learn All About Sza New Album Cover From This Politician – sza new album cover | Pleasant to our weblog, in this moment I am going to show you with regards to keyword. And now, this can be a very first graphic: