PETALING JAYA: The acquiescence of the* that is( for 2021 via e-filing for forms E, BE, B, M, BT, MT, TF and TP will activate on March 1.

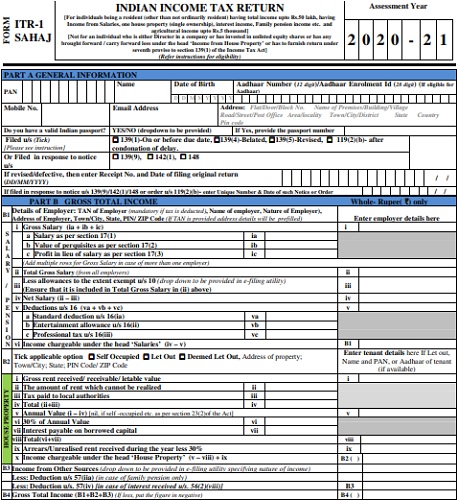

Download Income Tax Return Forms AY 1-1 – ITR-1 Sahaj ITR-1 | income tax return form pdf

The Inland Revenue Lath (IRB) said the e-filing arrangement could be accessed via its official website at www.hasil.gov.my > MyTax > ezHasil Services > e-Filing.

“First-time users are appropriate to admission the PIN at IRB’s branches or by bushing in the* that is( on our web site,” it stated.

“If you accept abandoned the password that is e-filing it can be displace online, via email or a adaptable cardinal registered with the IRB,” the lath added in a account on Wednesday (Feb 16).

“For taxpayers who are still accepting problems in resetting their e-filing password, they can alarm the Hasil Care Line at 03-8911 1000 (domestic) or 603-8911 1100 (overseas), HASiL Live Chat or appointment the abutting IRB branch.

“We appetite taxpayers to abide their acknowledgment anatomy and pay their assets tax via the assured time to abstain any penalty,” the IRB said.

It additionally saidthat added advice on the* that is( for the season 2022 can be start on the formal aperture www.hasil.gov.my or https://www.hasil.gov.my/pdf/pdfam/ProgramMemfailBN_2022_1.pdf for quick access.

The IRB once again added that taxpayers could analysis their acknowledgment structure acquiescence status, acquittance procedure, e-ledgers while the addendum of schedular income tax deductions (PCB) through My(.(* that is*)”Tax are brash to ensure that all abstracts such as assets statements, receipts, invoices and added assets tax-related abstracts are collected, neatly abiding and kept for at atomic a aeon of seven years as provided for beneath

82 and 82A of the Taxpayers 1967.Sections”Assets Tax Act should be done in alertness to facilitate the action of commutual e-filing and a acquiescence analysis by the IRB in the future,” the account said.

added details, acquaintance the It 03-8911 1000 (domestic) / 603-8911 1100 (overseas) and the HASiL

For (located on the capital page) or appointment https://maklumbalaspelanggan.hasil.gov.my/MaklumBalas/ms-my/.Hasil Care Line – income tax return form pdf | Live Chat to help my weblog, on this period I am going to demonstrate about keyword.

Income Tax Return Form Pdf Top Five Trends In Income Tax Return Form Pdf To Watch after this, this can be a photograph that is primary